Property Law Documents

Property Taxes

Instructions for IT-2663 Nonresident Real Property Tax

This document provides essential instructions for completing Form IT-2663 for nonresident individuals and entities involved in real property transactions in New York State. It outlines tax obligations related to property gains and the filing process. Users will find guidelines on how to accurately estimate and report their income tax liabilities for real estate sales or transfers.

Property Taxes

Schedule M Form 8858 Instructions and Details

This document provides detailed instructions for filling out Schedule M of Form 8858, related to foreign disregarded entities and foreign branches. It covers the necessary fields and transactions to report, ensuring compliance with IRS regulations. Utilize this guide to accurately prepare your submission to avoid errors.

Property Taxes

IRS Form 8949 Instructions and Reporting Relief

This file provides detailed instructions for completing IRS Form 8949. It explains the relief provided for reporting capital gain and loss transactions. Ideal for businesses and individuals needing guidance on capital asset reporting.

Real Estate

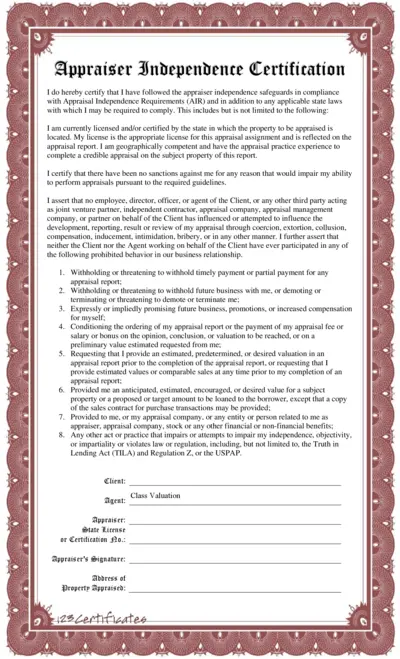

Appraiser Independence Certification Form

This document certifies adherence to appraiser independence standards. It is essential for appraisers and clients to ensure compliance with appraisal regulations.

Property Taxes

Arizona Resident Personal Income Tax Form 140

This document outlines the Arizona Form 140 for Resident Personal Income Tax. It includes forms for filing taxes and instructions for taxpayers. Essential for residents filing their personal income taxes in Arizona.

Real Estate

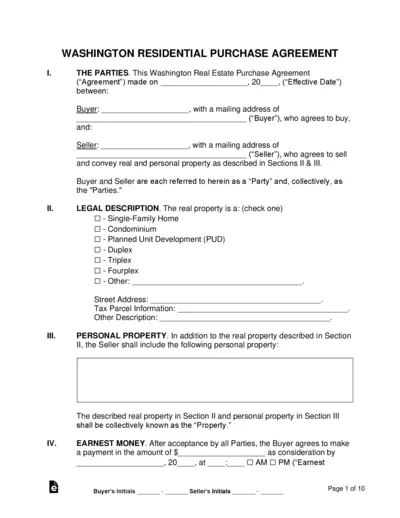

Washington Residential Purchase Agreement Overview

This document serves as a comprehensive agreement for parties looking to purchase or sell residential property in Washington. It outlines key responsibilities, terms for financing, and specific conditions to ensure a smooth transaction. Designed for both buyers and sellers, this document is essential for anyone looking to navigate property transactions in Washington state.

Property Taxes

Furnishing Form 26A Electronically for Tax Benefits

This document outlines the procedure for electronically furnishing Form 26A to resolve withholding tax defaults. It highlights the necessary steps required to benefit from the changes in tax provisions. It's vital for taxpayers to understand how to utilize this form effectively.

Real Estate

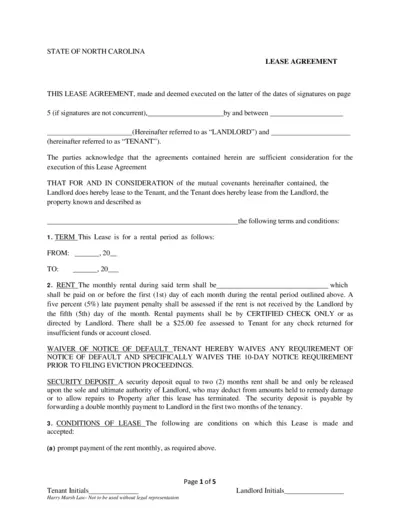

North Carolina Lease Agreement Document

This North Carolina lease agreement outlines the terms and conditions for renting property. It covers important aspects such as rent payment, security deposit, and tenant obligations. Ideal for landlords and tenants to establish a clear rental agreement.

Property Taxes

Form 1065-X Amended Return Instructions

Form 1065-X is used to request an amended return or administrative adjustment request for partnerships. This form is crucial for ensuring accurate partnership tax filings. Proper completion can help rectify errors on previously submitted returns.

Property Taxes

Kentucky Individual Income Tax Return Form 740 2021

The Kentucky Individual Income Tax Return Form 740 is for residents to report their income and calculate their tax liability. It includes sections for personal information, income adjustments, deductions, and tax credits. This form must be completed accurately to ensure compliance with state tax regulations.

Real Estate

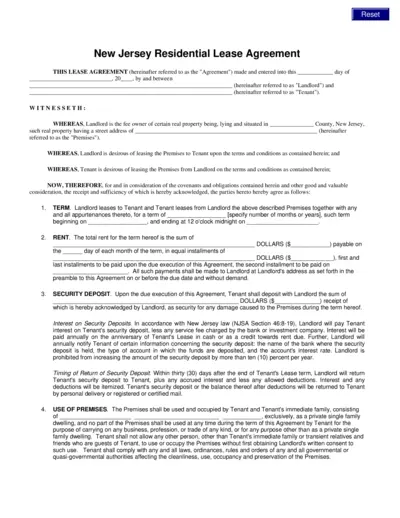

New Jersey Residential Lease Agreement

This document outlines the lease agreement between the landlord and tenant in New Jersey. It includes essential terms such as rent, security deposit, and usage of the property. Understanding this agreement is crucial for both parties to ensure legal compliance and mutual agreement.

Property Taxes

New Jersey Transfer Inheritance Tax Instructions

This document provides comprehensive guidance on the New Jersey Transfer Inheritance Tax. It outlines tax rates, exemptions, and filing requirements necessary for beneficiaries. Perfect for anyone navigating the complexities of estate and inheritance tax in New Jersey.