Property Law Documents

Property Law

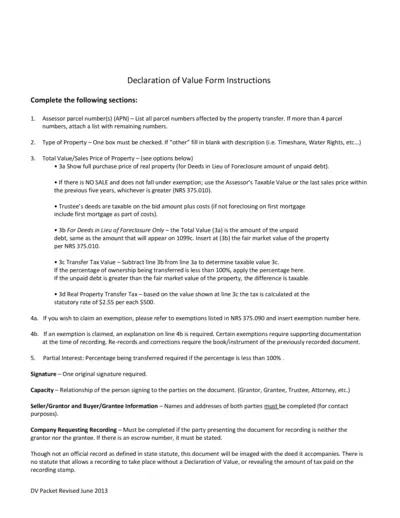

Declaration of Value Form Instructions

This file provides essential instructions for completing the Declaration of Value Form. It outlines the necessary information and sections required for property transfer documentation. Users can easily follow these guidelines to ensure accurate submissions.

Property Law

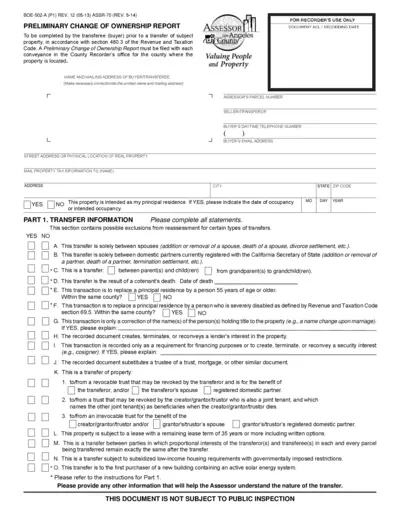

Preliminary Change of Ownership Report Fillable Form

The Preliminary Change of Ownership Report is a form required by the County Recorder's office for each property transfer. It helps to track ownership changes and assess property taxes efficiently. Ensure to complete the report accurately to avoid additional fees.

Real Estate

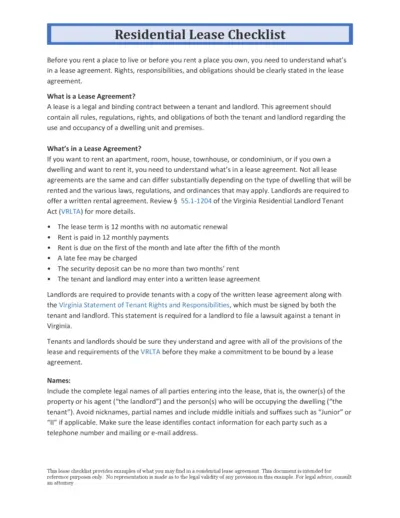

Residential Lease Agreement Checklist for Tenants and Landlords

This document provides a detailed checklist of what both tenants and landlords need to know and include in a residential lease agreement. It covers key elements such as lease terms, rent payment schedules, and maintenance responsibilities. Use this guide to ensure all rights and obligations are clearly outlined in your lease agreement.

Real Estate

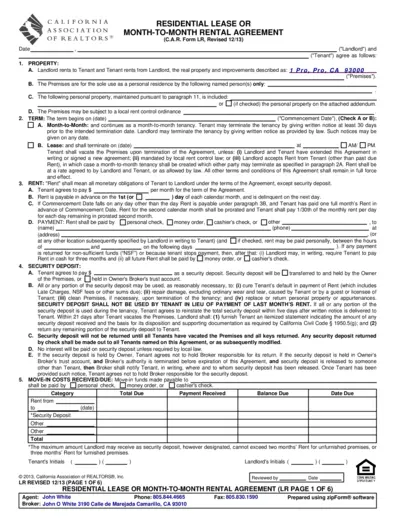

Residential Lease or Month-to-Month Rental Agreement

This file contains a comprehensive residential lease or month-to-month rental agreement used in California. It provides details on terms, obligations, and conditions for both landlords and tenants. Perfect for those seeking a standardized rental agreement form.

Property Taxes

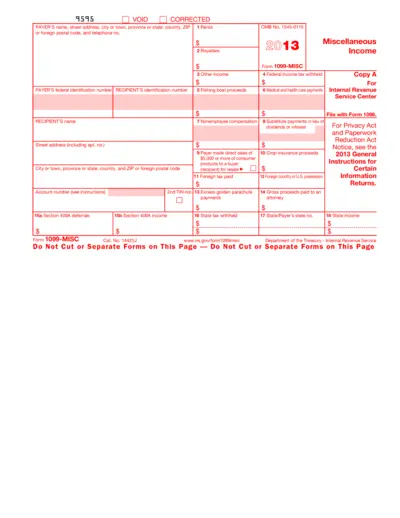

Form 1099-MISC: Miscellaneous Income for 2013

This file is a 2013 version of the IRS Form 1099-MISC used to report miscellaneous income. It includes fields for reporting various types of payments made to individuals or entities. The form is typically filed by payers to report income paid to recipients.

Property Taxes

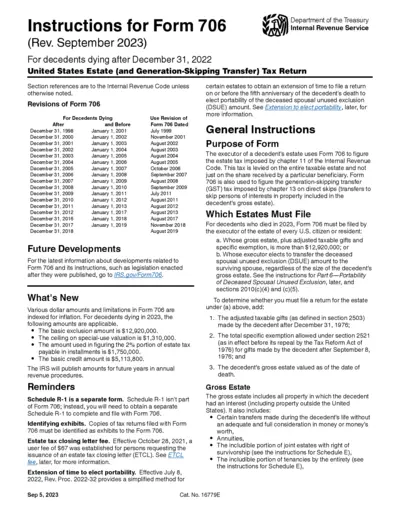

Instructions for Form 706 (Rev. September 2023)

This document provides detailed instructions for completing Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return for decedents dying after December 31, 2022. It includes information on revisions, general instructions, and specific filing requirements. The instructions also cover important updates and reminders related to the form.

Property Taxes

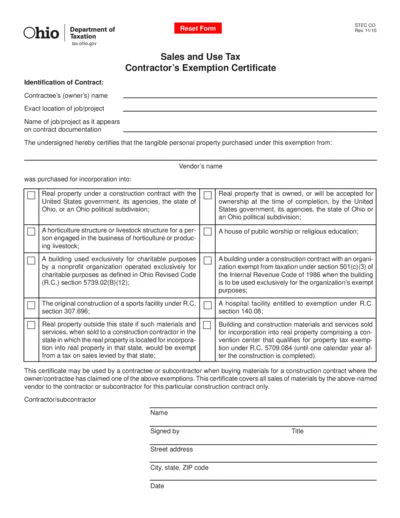

Ohio Sales and Use Tax Contractor's Exemption Certificate

This document is the Ohio Sales and Use Tax Contractor's Exemption Certificate. Contractors use this form to claim exemptions on certain taxable goods for specified exempt uses. It's crucial for contractors working with tax-exempt entities or on tax-exempt projects.

Property Taxes

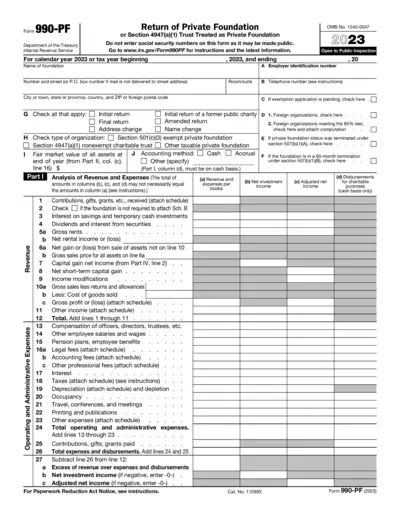

Return of Private Foundation Form 990-PF 2023

Form 990-PF is a return for private foundations required by the IRS. It includes information on revenue, expenses, and other financial details. Avoid entering social security numbers on this form.

Property Taxes

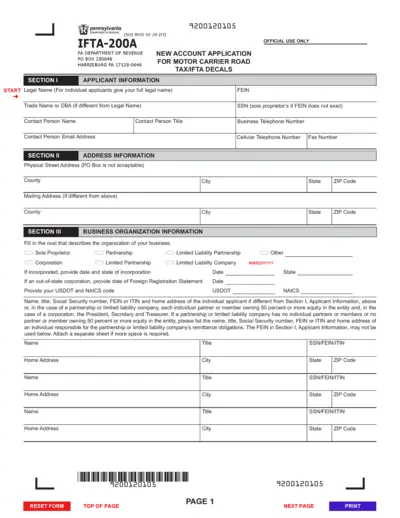

Pennsylvania Motor Carrier Road Tax/IFTA Decals Application

This file is the application form for new accounts needing Pennsylvania Motor Carrier Road Tax (MCRT) and/or International Fuel Tax Agreement (IFTA) decals. It captures applicant, business organization, address and tax reporting service information, along with exemptions, decal requests and certifications. This form must be filled out completely and accurately to ensure proper processing and issuance of the decals.

Property Taxes

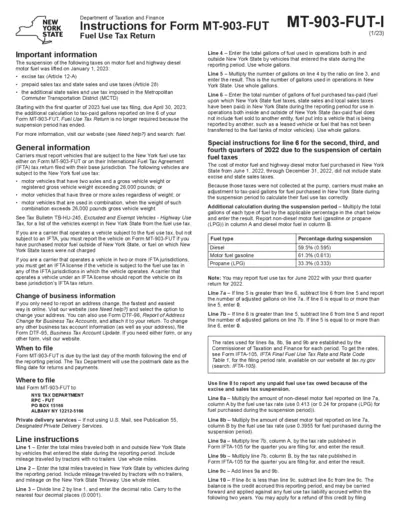

New York State Fuel Use Tax Return Instructions

Instructions for completing the New York State Form MT-903-FUT, including details on fuel use tax, reporting requirements, and filing deadlines.

Property Taxes

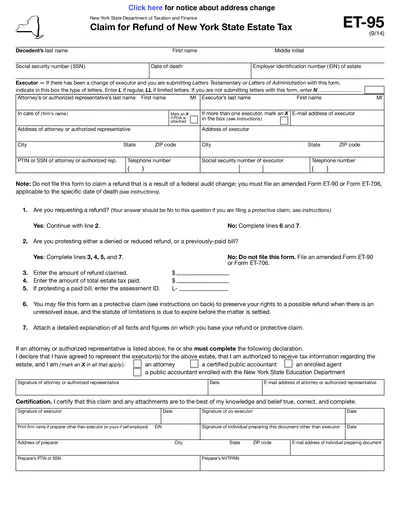

Claim for Refund of New York State Estate Tax - ET-95 Form

The ET-95 form is used to claim a refund of New York State estate tax for protested denied refunds, protective claims, and protested paid bills. This form must be filled accurately to ensure the claim is processed correctly. Learn how to fill, edit, and submit this form using our PDF editor.

Real Estate

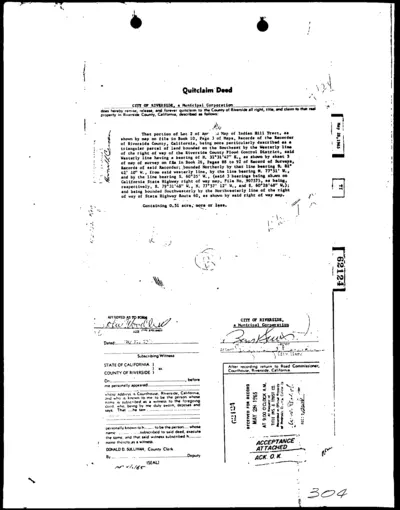

Quitclaim Deed - Riverside County Property

This document is a Quitclaim Deed from the City of Riverside to the County of Riverside. It provides details about the property in Riverside County, California. This file includes legal descriptions and boundaries of the property.