Property Law Documents

Real Estate

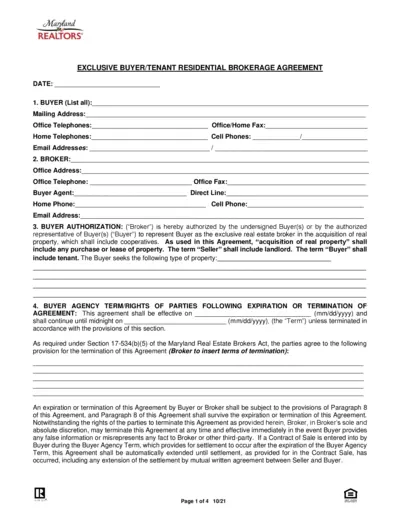

Exclusive Buyer/Tenant Representation Agreement for Maryland REALTORS

This file is an exclusive buyer/tenant residential brokerage agreement for Maryland REALTORS. It includes the terms and conditions, responsibilities of the buyer and broker, and compensation details. The document also addresses fair housing laws, limitations, and flood disclosure notices.

Zoning Regulations

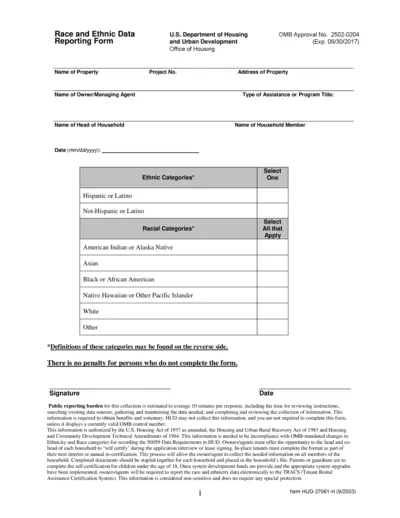

Race and Ethnic Data Reporting Form - HUD

This file is the Race and Ethnic Data Reporting Form from the U.S. Department of Housing and Urban Development. It includes sections for recording ethnic and racial categories. Completing this form is required for compliance with HUD regulations.

Property Taxes

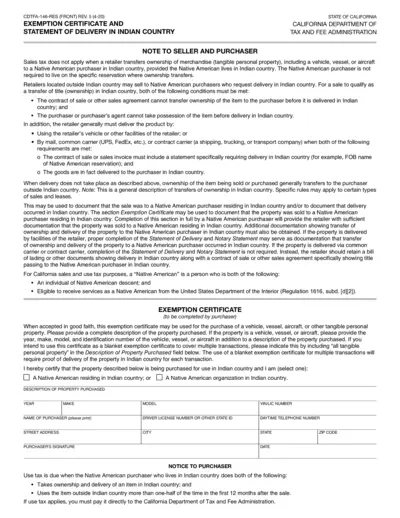

Exemption Certificate and Delivery Statement in Indian Country

This file is used to document sales of tangible personal property to Native Americans in Indian country. It includes an Exemption Certificate and Statement of Delivery. Completion of this form assists in determining sales tax applicability.

Real Estate

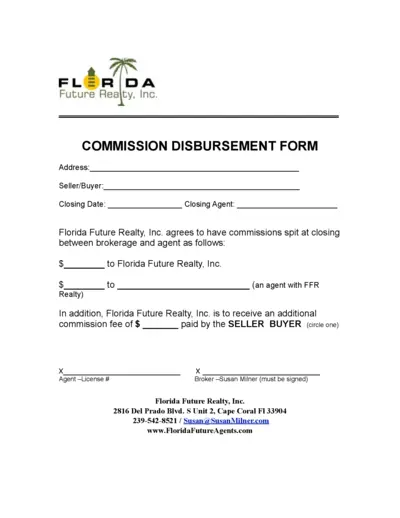

Commission Disbursement Form - Florida Future Realty, Inc.

This Commission Disbursement Form from Florida Future Realty, Inc. outlines the details for splitting commissions between the brokerage and the agent at closing. It includes sections for specifying the amounts to be received by both parties, as well as additional commission fees to be paid by the seller or buyer. The form must be signed by both the agent and broker.

Property Taxes

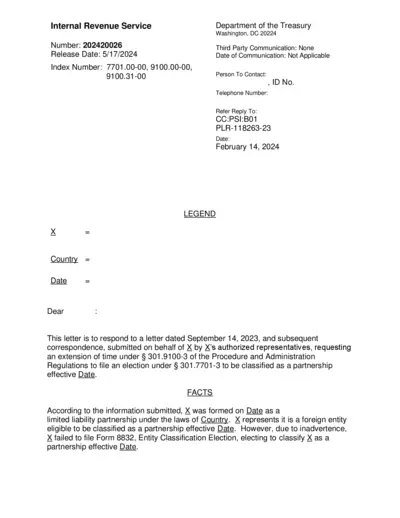

IRS Private Letter Ruling on Foreign Partnership Election

This document is a private letter ruling from the IRS about a foreign partnership's classification election. It includes the legal background, analysis, and conclusion. The ruling grants an extension of time to file Form 8832.

Property Taxes

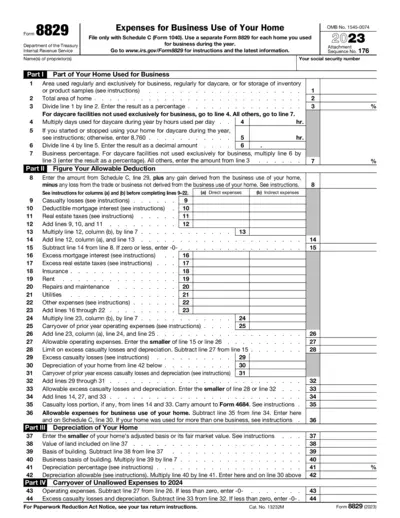

Form 8829: Expenses for Business Use of Your Home

IRS Form 8829 is used to claim expenses for the business use of your home. It includes sections on calculating the allowable deduction, depreciation, and carryover of unallowed expenses. Be sure to follow the instructions to ensure accuracy.

Property Taxes

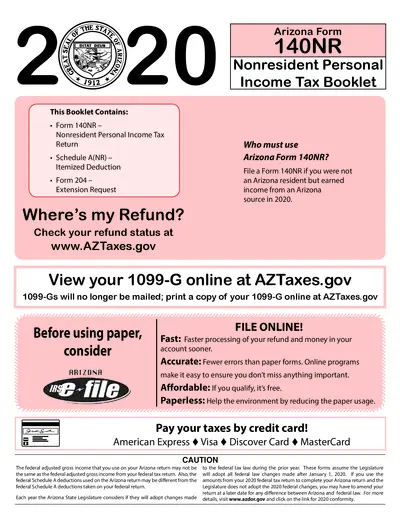

Arizona Form 140NR Nonresident Personal Income Tax Booklet 2020

This document contains the Arizona Form 140NR for nonresident personal income tax filing for the year 2020. It includes details on itemized deductions, extension requests, and instructions on how to file and submit the form. It is essential for nonresidents who earned income from an Arizona source in 2020.

Property Taxes

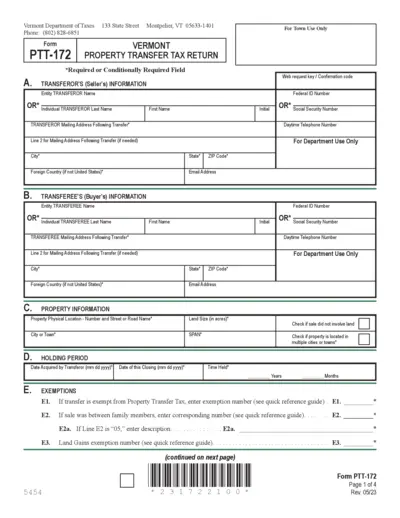

Vermont Property Transfer Tax Return Form PTT-172

This form is used for reporting the transfer of property in Vermont and calculating the property transfer tax due. Included are sections for both the transferor's and transferee's information, property details, exemptions, transfer information, and tax calculation. It is essential for buyers and sellers to complete this form accurately to comply with Vermont tax laws.

Property Taxes

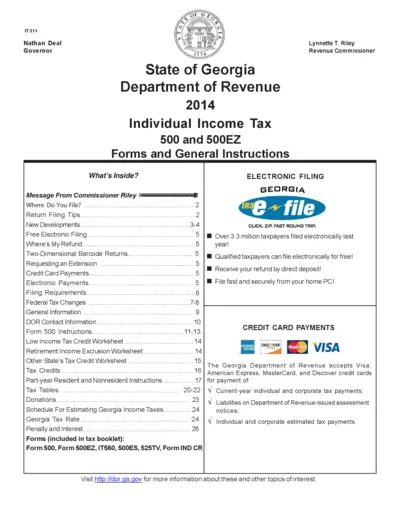

Georgia Individual Income Tax Forms and Instructions 2024

This document provides detailed instructions and forms for filing Georgia individual income tax for the year 2024. It includes information about electronic filing, payment methods, and tax credits. The guide also highlights new developments and offers tips for filing your tax return accurately.

Property Taxes

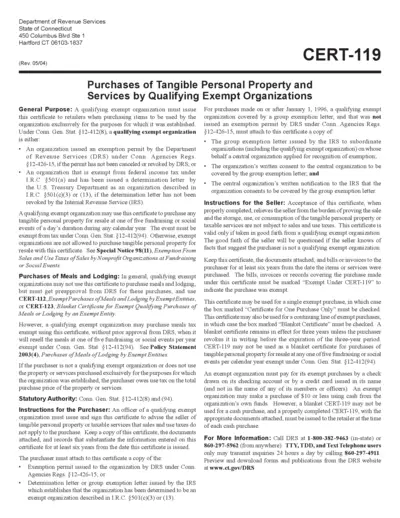

Connecticut CERT-119: Exempt Purchases by Qualifying Organizations

This document is Connecticut's CERT-119 form for exempt purchases by qualifying organizations. It provides guidelines for organizations on how to issue this certificate when purchasing items. It also includes instructions for both the purchaser and the seller.

Property Taxes

Form 8863: Education Credits - IRS 2023

Form 8863 is used to claim education credits, including the American Opportunity and Lifetime Learning Credits. It's essential for taxpayers seeking education-related tax benefits. This guide helps you understand how to fill it out.

Property Taxes

TRACES PDF Converter V1.3L Light e-Tutorial

This e-tutorial provides guidance on using the TRACES PDF Converter V1.3L Light. It is intended for users who need to manage their TDS/TCS accounts. All information is for informational purposes only.