Property Law Documents

Property Taxes

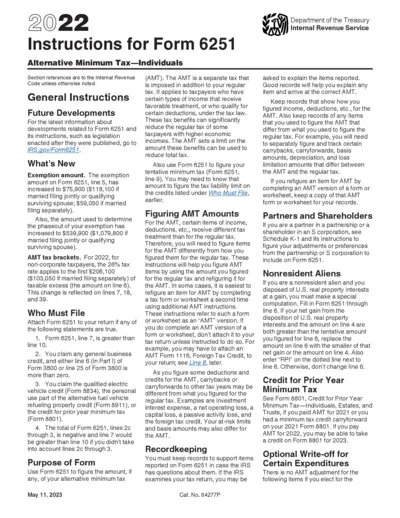

Instructions for Form 6251: Alternative Minimum Tax

This file provides essential instructions for filling out Form 6251 for the Alternative Minimum Tax. It outlines important guidelines, exemptions, and who must file. Understanding this form is crucial for correct tax reporting.

Property Taxes

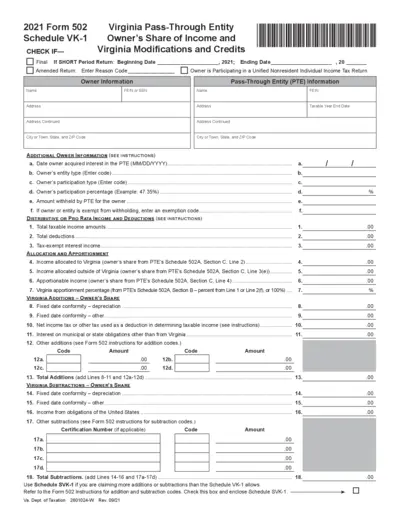

2021 Virginia Schedule VK-1 Owner's Share Income

This file provides details about the Owner's Share of Income for Virginia's Pass-Through Entities. It includes instructions for completing the form and information about Virginia tax credits. Ideal for business owners and tax professionals dealing with Virginia taxation.

Property Taxes

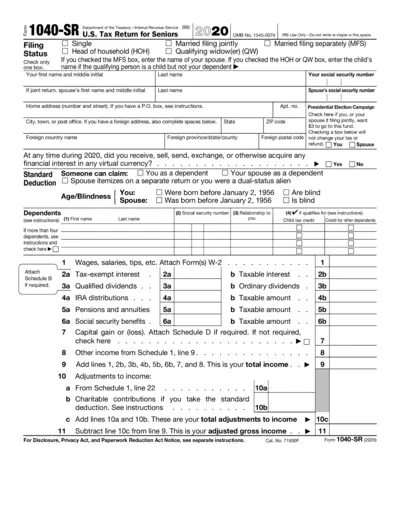

U.S. Tax Return for Seniors 2020 - Form 1040-SR

The 1040-SR form is designed for seniors to file their taxes. It simplifies the tax filing process with clear instructions. Use this form to report your income and claim deductions effectively.

Real Estate

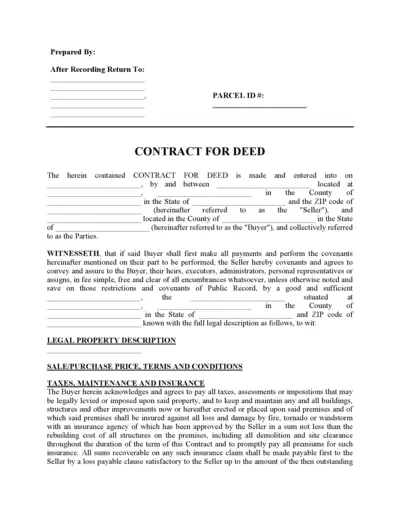

Contract for Deed Property Agreement Document

This document outlines the terms and conditions of a Contract for Deed between a Seller and Buyer. It provides guidance on payment, property maintenance, and legal responsibilities. Ideal for both personal and commercial real estate transactions.

Property Taxes

Client Tax Return Disclosure Consent Form

This document outlines the rules for disclosing your tax return information. It ensures you understand your rights regarding your tax data. Please read carefully to know how your information is handled.

Property Taxes

IRS Form W-4V Voluntary Withholding Request

Form W-4V enables individuals receiving specific government payments to request federal income tax withholding. This file contains vital information for tax purposes. Ensure proper withholding by following the instructions carefully.

Property Taxes

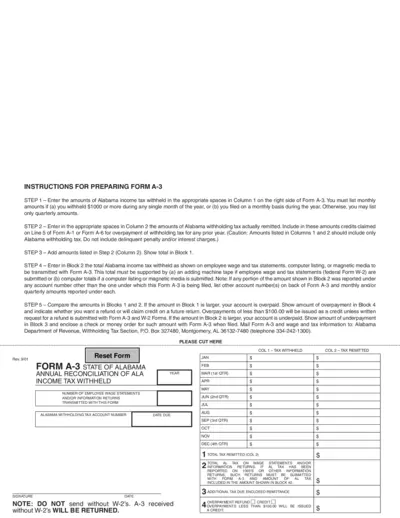

Alabama Form A-3 Annual Reconciliation Instructions

This file contains detailed instructions for completing Form A-3 for Alabama income tax withholding. It guides users through the necessary steps to accurately report tax withheld and remitted. Users can refer to these instructions to ensure compliance with state tax regulations.

Real Estate

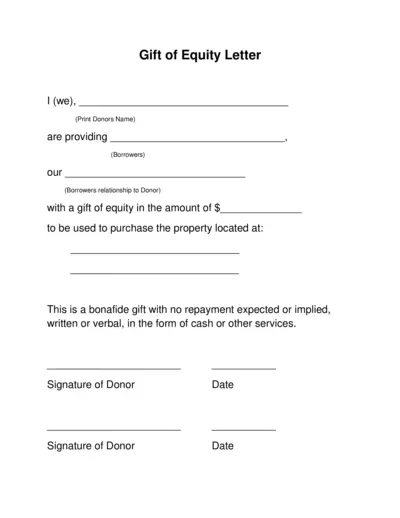

Gift of Equity Letter Template for Real Estate Use

This Gift of Equity Letter template provides a formal document for donors to give equity towards a property purchase. It outlines clear instructions and requirements to ensure proper legal documentation of the gift. Utilize this resource for straightforward drafting and completion.

Property Taxes

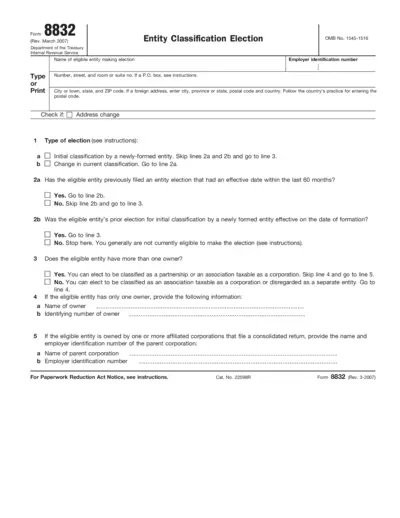

Form 8832 Entity Classification Election Instructions

Form 8832 is used for electing the classification of eligible entities for federal tax purposes. This file provides step-by-step instructions for properly completing the form. It is essential for business entities aiming for the correct classification with the IRS.

Real Estate

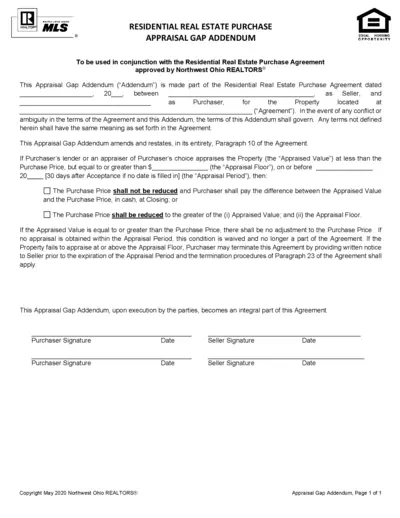

Appraisal Gap Addendum for Residential Real Estate

This document is an Appraisal Gap Addendum that modifies the terms of the Residential Real Estate Purchase Agreement. It provides clarity on how appraised values impact purchase prices. Essential for buyers and sellers in real estate transactions.

Property Taxes

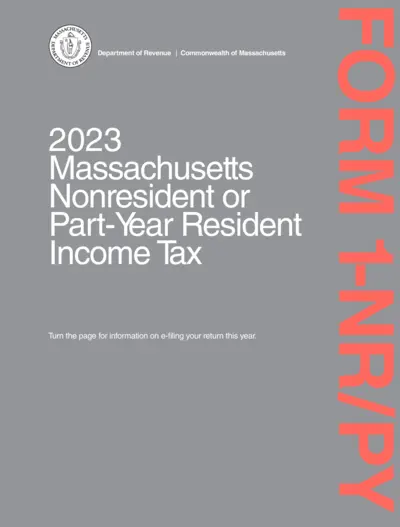

Massachusetts Nonresident Part-Year Resident Income Tax

This file provides comprehensive instructions for filing the Massachusetts Form 1-NR/PY for nonresidents and part-year residents. It offers important information about eligibility, filing requirements, and due dates. Utilize this file to ensure accurate and timely submission of your tax return.

Property Taxes

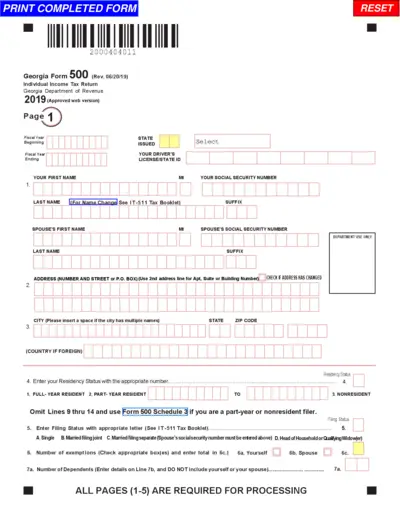

Georgia Form 500 Individual Income Tax Return

Georgia Form 500 is an important document used for filing individual income tax returns in the state of Georgia. This form provides essential details required for accurate tax reporting and ensures compliance with state tax regulations. It is crucial for residents and part-year residents who need to report their income and calculate their tax liabilities.