Property Law Documents

Property Taxes

Ohio State Sales Tax Return Form

The Ohio State Sales Tax Return Form is used by vendors to report sales tax collected within the specified filing period. This form requires a one-time registration with the Ohio Department of Taxation. It should be submitted according to the filing frequency specified for the vendor.

Property Taxes

Massachusetts Form 3M: Income Tax Return for Non-Profit Organizations

Form 3M is the Massachusetts Income Tax Return for Clubs and other Organizations not involved in profit-making activities. This form must be filed for the calendar year 2022 or the respective taxable period. Detailed instructions for specific income calculations and tax computations are provided within the form.

Property Taxes

Instructions for Form 8871, Political Organization Notice of Section 527 Status

Form 8871 is used by political organizations to notify the IRS that the organization is to be treated as a tax-exempt section 527 organization. The form also reports any material changes or terminations of the organization. Failure to file this form on time may result in the organization not being treated as tax-exempt for the period before filing.

Property Taxes

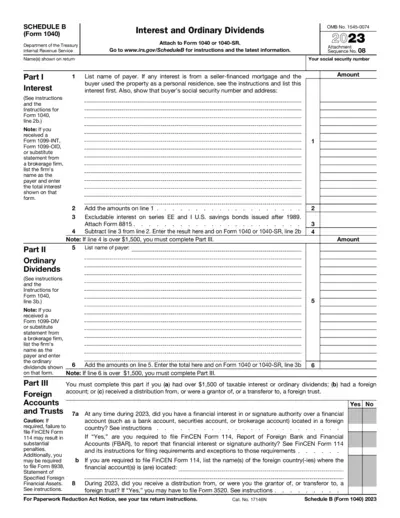

Schedule B (Form 1040) Instructions & Information

Schedule B (Form 1040) is used to report interest and ordinary dividends. Attach it to Form 1040 or 1040-SR. Ensure you complete Part III if necessary.

Property Taxes

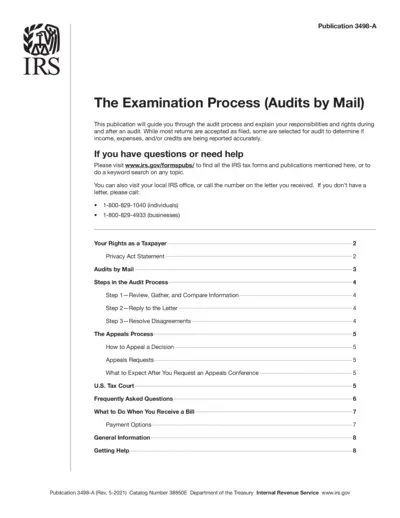

IRS Publication 3498-A: The Examination Process Guide

This guide provides detailed information on the IRS audit process, taxpayer rights, and steps to resolve disagreements. It helps understand the appeals process, payment options, and how to get help with tax-related issues. Essential for taxpayers undergoing an audit.

Property Taxes

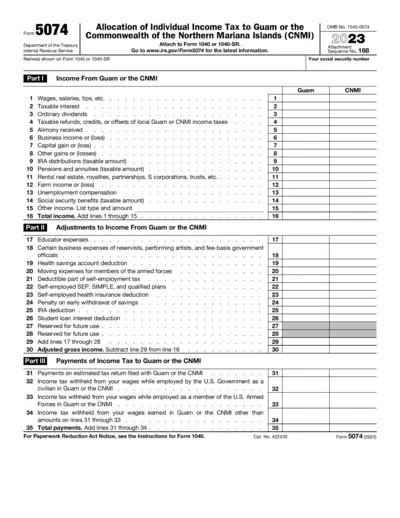

Form 5074 Instructions for Guam and CNMI Tax Reporting

Form 5074 is used by U.S. citizens and resident aliens for Guam or CNMI tax reporting. This form assists in determining individual income tax obligations. Complete this form alongside your 1040 or 1040-SR for accurate income allocation.

Property Taxes

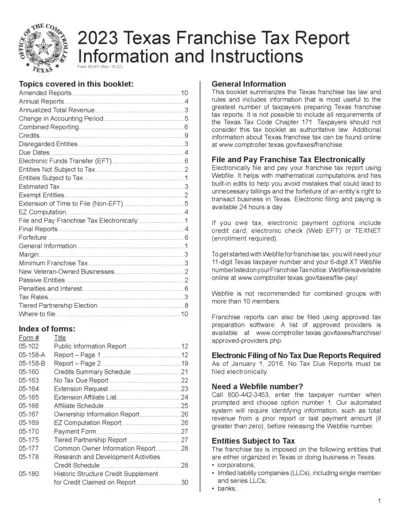

2023 Texas Franchise Tax Report: Information and Instructions

This file provides detailed information and instructions for businesses to file the Texas Franchise Tax Report for the year 2023. It includes guidelines on electronic filing, entities subject to tax, and specific tax rates. This document is essential for understanding compliance requirements under Texas Tax Code Chapter 171.

Real Estate

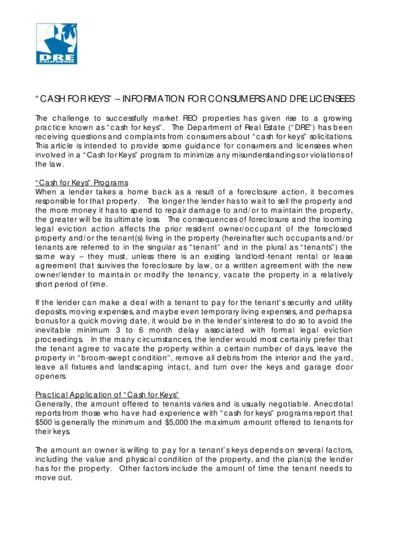

Cash For Keys Information for California Consumers

This document provides essential information regarding the 'Cash for Keys' program in California. It aims to help consumers and DRE licensees understand their rights and responsibilities. The file outlines the process and legal aspects surrounding foreclosures and tenant protections.

Property Taxes

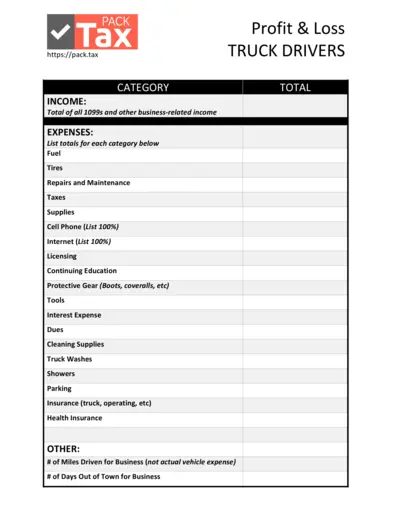

Tax Form for Truck Drivers: Income and Expenses

This file is essential for truck drivers to accurately track their income and expenses for tax purposes. It provides detailed categories for reporting all relevant financial data. Using this document can simplify your tax filing process significantly.

Property Taxes

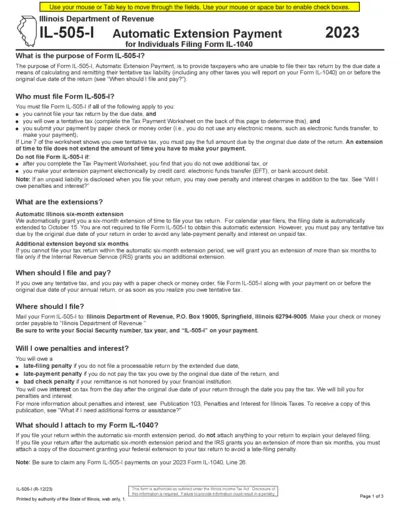

IL-505-I Automatic Extension Payment Filing Instructions

This document outlines the instructions for filing Form IL-505-I, the Automatic Extension Payment for individuals. It provides information on who must file, how to calculate tentatives taxes and where to submit the payment. Understanding this form ensures you meet your Illinois tax obligations timely.

Property Taxes

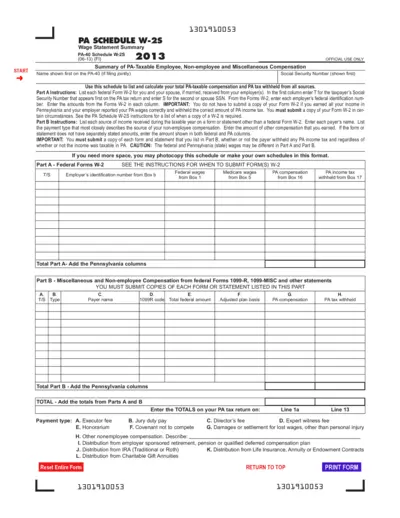

PA W-2S Schedule: Wage Statement Summary

The PA W-2S form assists users in listing and calculating their total Pennsylvania taxable compensation. It provides essential instructions for reporting income from various sources. Perfect for employees and self-employed individuals in Pennsylvania.

Property Taxes

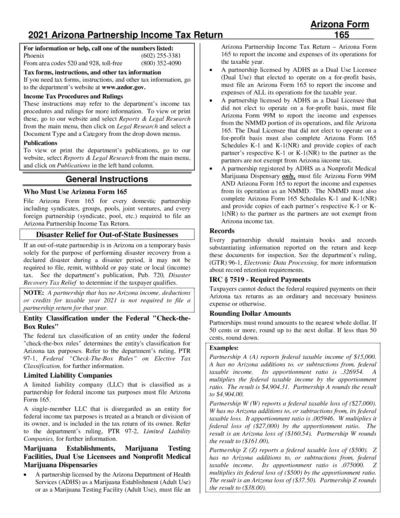

2021 Arizona Partnership Income Tax Return Form 165

This document provides detailed information about the 2021 Arizona Partnership Income Tax Return (Form 165). It includes instructions for filling out the form and essential guidelines for partnerships operating in Arizona. Make sure to follow the guidelines provided to ensure timely and accurate tax submissions.