Property Law Documents

Property Taxes

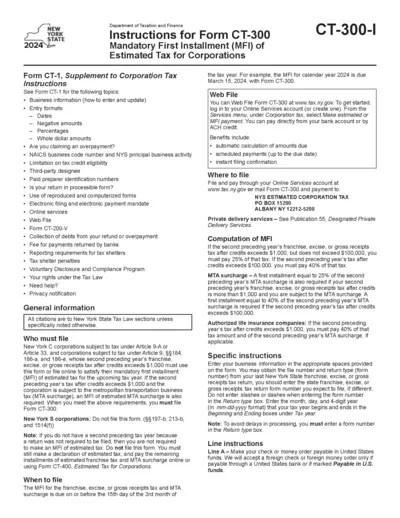

CT-300-I Instructions for Form CT-300 2024

This file provides detailed instructions for the CT-300 form, which is necessary for Corporate Estimated Tax payments in New York. It covers essential filing information, eligibility requirements, and computation methods for the Mandatory First Installment (MFI) of estimated taxes. Corporations must follow these guidelines to ensure compliance with New York State tax laws.

Property Taxes

Instructions for Form 5329 Additional Taxes

This document provides detailed instructions for Form 5329, which reports additional taxes related to qualified retirement plans. It outlines who must file, how to complete the form, and important information regarding penalties. This is essential for taxpayers managing IRAs and retirement distributions.

Real Estate

Working with a REALTOR® Form 810 for Ontario

This document outlines the relationship between consumers and REALTORS® in Ontario. It explains client and customer relationships, obligations of REALTORS®, and legal requirements. Users can learn about filling out the form for personal educational purposes.

Property Taxes

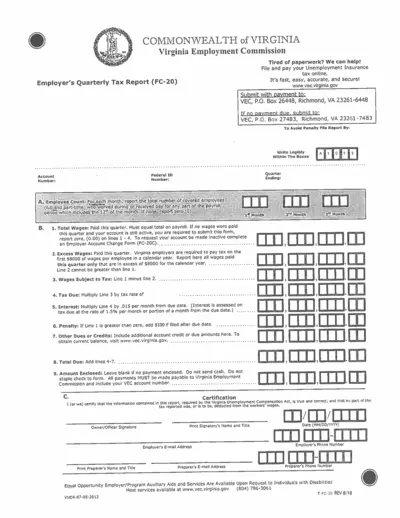

Virginia Employment Commission Quarterly Tax Report

The Virginia Employment Commission's Employer's Quarterly Tax Report (FC-20) is essential for reporting unemployment insurance taxes. This form helps employers accurately file and pay their taxes online. Ensure compliance and avoid penalties by submitting the report on time.

Property Taxes

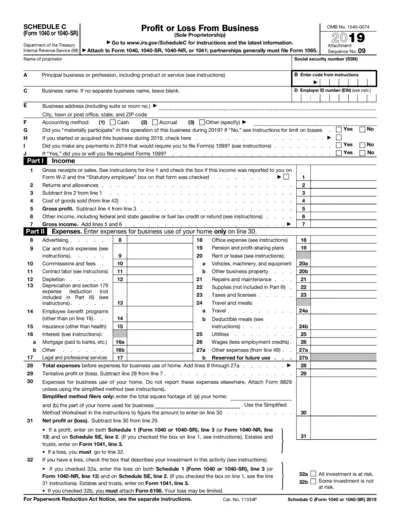

Schedule C Form 1040 or 1040-SR Profit and Loss

Schedule C (Form 1040 or 1040-SR) is used to report income or loss from a business operated as a sole proprietorship. It provides the IRS with information about your business's financial performance. Accurate completion of this form is vital for your tax return.

Property Taxes

South Carolina ST-3 Sales and Use Tax Return

The South Carolina ST-3 Sales and Use Tax Return is essential for businesses to report their sales tax. It must be filed even if no tax is due during the period. Filing guidance and details are provided to ensure compliance with state regulations.

Property Taxes

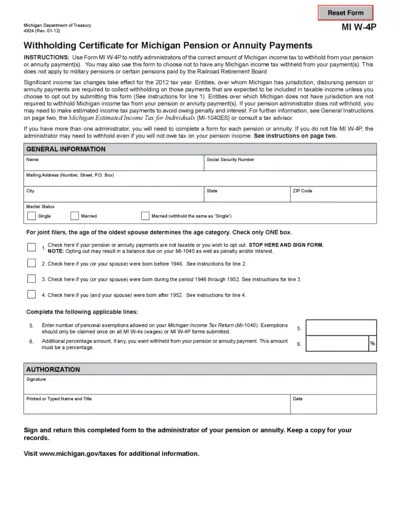

MI W-4P Withholding Certificate for Pension Payments

This form allows Michigan residents to manage their income tax withholding from pension or annuity payments. Users can opt out of withholding or specify exemptions. Essential for ensuring correct tax handling on annuity income.

Property Taxes

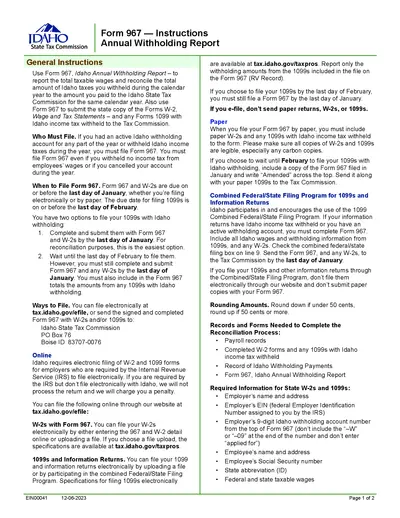

Idaho Annual Withholding Report Form 967 Instructions

This document includes detailed instructions for completing the Idaho Annual Withholding Report (Form 967). It is essential for employers to report taxable wages and taxes withheld. Learn how to submit your forms accurately to comply with Idaho tax regulations.

Land Use

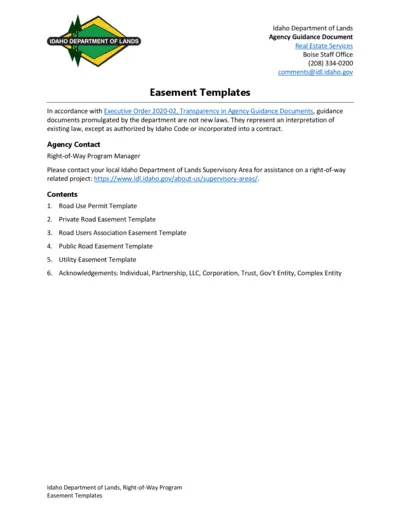

Idaho Department of Lands Easement Templates

This document contains essential easement templates for various land use scenarios in Idaho. It is a critical resource for navigating right-of-way projects. Users can find templates for road use permits, public road easements, and more.

Property Taxes

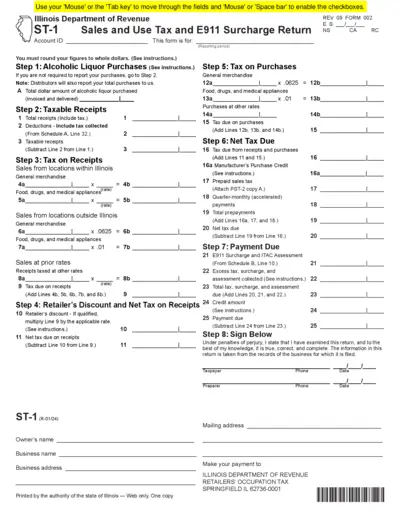

Illinois Sales and Use Tax Return Instructions

This document provides users with detailed instructions on how to fill out the Illinois ST-1 Sales and Use Tax Return. It includes guidance on various steps and calculations required for compliance. Perfect for business owners in Illinois who need to file their taxes accurately.

Property Taxes

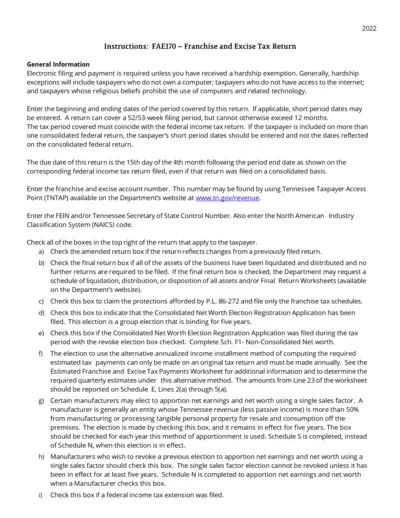

Franchise and Excise Tax Return Instructions

This document contains detailed instructions on how to complete the Franchise and Excise Tax Return. It is essential for businesses operating in Tennessee to ensure compliance. The instructions include filing requirements, tax computations, and important timelines.

Property Taxes

Engagement Letter for Tax Form Preparation

This document outlines the engagement terms for tax form preparation. It specifies responsibilities of both the CPA firm and the client. Essential for ensuring compliance and understanding the structure of the engagement.