Property Law Documents

Property Taxes

Massachusetts DOR Form M-2848 Power of Attorney

Form M-2848, Power of Attorney and Declaration of Representative, is used for taxpayers to authorize individuals to represent them before the Massachusetts Department of Revenue. This form ensures the confidentiality of tax records by granting authority to designated representatives. It can be used for various tax matters within the Commonwealth.

Property Taxes

2023 NJ-1040X Form Instructions

This file provides detailed instructions for filling out the 2023 NJ-1040X form, which is used to amend a previously filed New Jersey Income Tax return. It includes guidance on providing supporting documents, calculating taxes, and submitting the amended return.

Property Taxes

Sales and Use Tax Filing Instructions for Form ST-103

This file provides detailed instructions on how to complete the sales and use tax filing form ST-103. It covers total sales, exempt sales, taxable sales, and more. Learn the step-by-step process to accurately fill out and submit your tax information.

Property Taxes

2023 New Jersey CBT-100U Instructions for Corporation Business Tax Unitary Return

This document provides instructions for filing the 2023 New Jersey Corporation Business Tax Unitary Return, Form CBT-100U. It includes information on electronic filing mandates, managerial member responsibilities, and specific requirements for different types of corporations. Understanding the combined return filing methods and mandatory combined reporting is emphasized.

Property Taxes

Form 4562 - Depreciation and Amortization Instructions

Form 4562 is used by businesses to claim deductions for depreciation and amortization. It attaches to your tax return. Detailed instructions are available on the IRS website.

Property Taxes

2023 Paid Preparer's Due Diligence Checklist - Form 8867

This file is a checklist designed to assist paid tax preparers with their due diligence requirements for various tax credits and the head of household filing status. It includes specific actions to be performed and documented to avoid penalties. The checklist references Form 8867 and IRS Publication 4687 for additional guidance.

Property Taxes

HMRC Starter Checklist for Employers and Employees

The HMRC Starter Checklist is crucial for employers to gather employee information before the first payday and ensure the correct tax code is used. This form includes employee details, bank information, and necessary identification numbers. Do not send this form to HMRC.

Property Taxes

Form 8962 Instructions for 2022 Tax Year

This file provides instructions for filling out Form 8962, which is used for Premium Tax Credit (PTC). It includes a detailed table for calculating amounts. The instructions are vital for accurate tax filing.

Property Taxes

Missouri Department of Revenue Sales Tax Return Form

This file is a Sales Tax Return Form (53-1) issued by the Missouri Department of Revenue. It includes various fields for reporting sales tax collected, adjustments, and deductions. Instructions for completing and submitting the form are also provided.

Property Taxes

2023 S Corporation Instructions for Schedules K-2 and K-3

The 2023 S Corporation Instructions for Schedules K-2 and K-3 provide detailed guidance on completing these forms, which report items of international tax relevance. Learn who must file, how to fill out the schedules, and when and where to file them. This document is essential for S Corporations with international tax obligations.

Property Taxes

Delaware Division of Revenue Wholesale Exemption Certificate

Form 373 is used to substantiate exempt sales to out of state purchasers who pick up goods in Delaware. This form ensures sales tax exemption and must be filled out accurately. Ensure all required fields are filled and signed by authorized individuals.

Real Estate

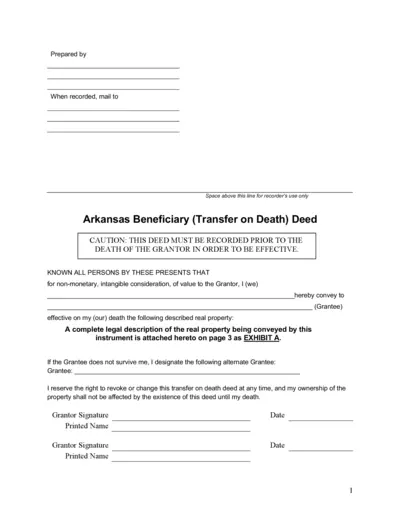

Arkansas Beneficiary (Transfer on Death) Deed

This document is used to convey real property in Arkansas upon the death of the Grantor. It includes spaces for all necessary details, notary acknowledgment, and legal description of the property. The document must be recorded before the Grantor's death for it to be effective.