Property Law Documents

Property Taxes

Form 3520-A Instructions 2023

Form 3520-A is the annual information return of a foreign trust with a U.S. owner. This file provides details on form requirements and filing instructions. It also explains penalties for non-compliance and exemptions.

Real Estate

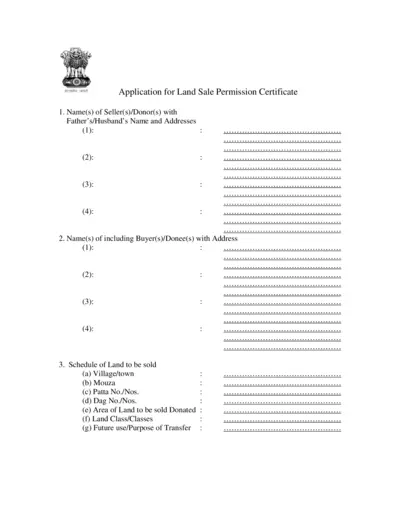

Application for Land Sale Permission Certificate

This is an application form used for obtaining permission to sell land. It requires the details of the seller, buyer, and the land being sold. Fill out all required fields accurately to avoid any delays.

Real Estate

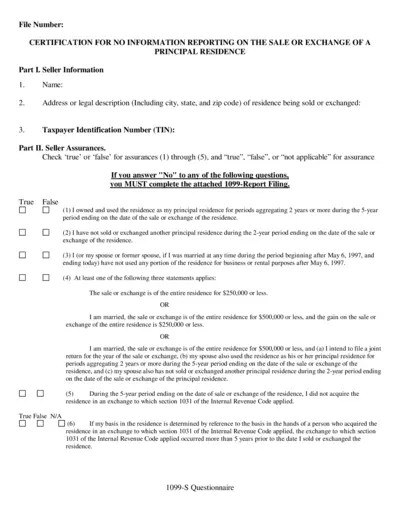

Form 1099-S Certification for No Information Reporting

This form is used to report certain information on real estate transactions. It must be completed if you answered 'No' to any questions on the attached questionnaire. A copy of the form is furnished to the IRS.

Real Estate

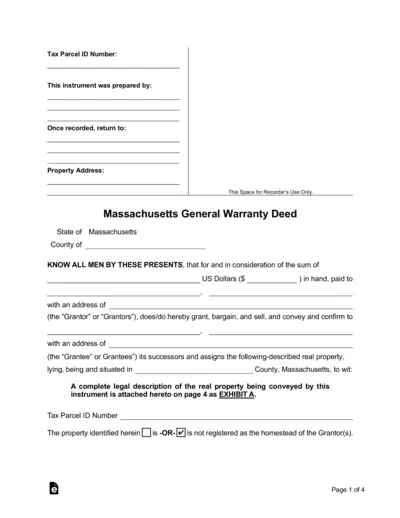

Massachusetts General Warranty Deed

This file is a Massachusetts General Warranty Deed containing all necessary information for the Grantor and Grantee. It includes sections for property details, notary acknowledgment, and exhibits. The document ensures legal transfer of property ownership, including warranties.

Property Taxes

Schedule F Form 1040 - Profit or Loss From Farming

Schedule F (Form 1040) is used by farmers to report their farming income and expenses. It must be attached to Form 1040, 1040-SR, 1040-SS, 1040-NR, 1041, or 1065. For detailed instructions, visit the IRS website.

Property Taxes

Illinois MFUT-15 IFTA Quarterly Return Instructions

The Illinois MFUT-15 Form is essential for Illinois-based motor carriers to report qualified vehicle operations under the International Fuel Tax Agreement quarterly. The instructions provide detailed steps on how to complete the form accurately and on time. Ensure to follow the outlined deadlines for each quarter to avoid penalties.

Property Taxes

Arkansas Sales and Use Tax Exemption Certificate

This form is used by nonresident purchasers or authorized representatives to claim sales and use tax exemption in Arkansas. It verifies that the purchaser holds a valid permit and outlines the conditions for maintaining exemption status. The document also provides necessary information for sellers to comply with Arkansas tax laws.

Property Taxes

Taxable and Nontaxable Income: IRS Pub 525

Publication 525 explains various types of income and whether they're taxable or nontaxable. It covers employee wages, fringe benefits, and other compensation. It also includes information on disability pensions and public assistance benefits.

Property Taxes

Kansas Department of Revenue Religious Exemption Certificate

This file is a religious organization exemption certificate from the Kansas Department of Revenue. It allows religious organizations to certify that their purchases are exempt from Kansas sales and compensating use tax. This exemption is applicable to organizations that are exempt under section 501(c)(3) of the federal internal revenue code.

Real Estate

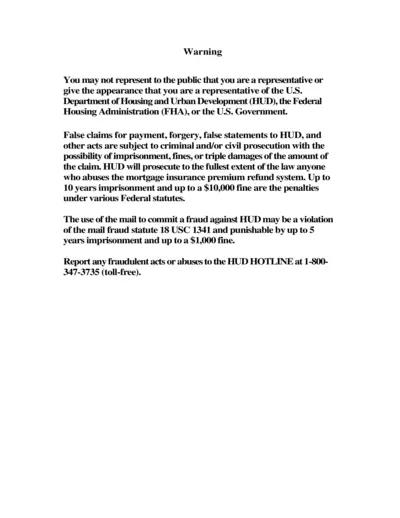

HUD Mortgage Insurance Premium Refund Guide

This file provides instructions and procedures for claiming a premium refund or distributive share payment from the HUD Mutual Mortgage Insurance Fund. It includes guidelines for third-party tracers and claimants. The form and documents required are outlined in detail.

Real Estate

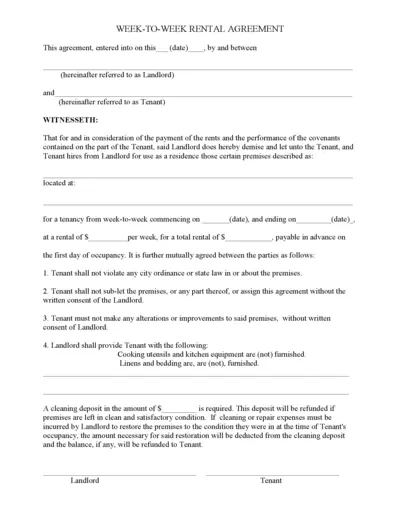

Week-to-Week Rental Agreement Template

This file is a Week-to-Week Rental Agreement, which outlines terms between a landlord and a tenant. It includes provisions for rent, sub-leasing, alterations, and deposits. The agreement ensures a clear understanding for both parties.

Property Taxes

Cherokee Nation Tax Commission Lien Entry Form

This document is the Lien Entry Form issued by the Cherokee Nation Tax Commission. It must be filled out by lenders to cover vehicle lien information. Proper completion ensures legal compliance for notifying debtors of their obligations.