Property Law Documents

Property Taxes

IRS Form 8582: Passive Activity Loss Limitations 2022

IRS Form 8582 is used to calculate passive activity loss limitations for tax purposes. This form is essential for those with rental real estate or other passive activities. Attach this form to Form 1040, 1040-SR, or 1041 when filing taxes.

Property Taxes

Florida Documentary Stamp Tax Return for Nonregistered Taxpayers

This document is the Florida Department of Revenue Documentary Stamp Tax Return Form (DR-228) for nonregistered taxpayers. It is used to report stamp tax on unrecorded documents and is due by the 20th of the month following execution. Please follow the instructions and guidelines provided.

Property Taxes

California Schedule K-1 (100S) 2023 - Shareholder's Share of Income, Deductions, Credits

This file is for California Schedule K-1 (100S) for the 2023 taxable year. It is used by S corporations and their shareholders to report shares of income, deductions, and credits. Detailed instructions for filling out this form are included within.

Real Estate

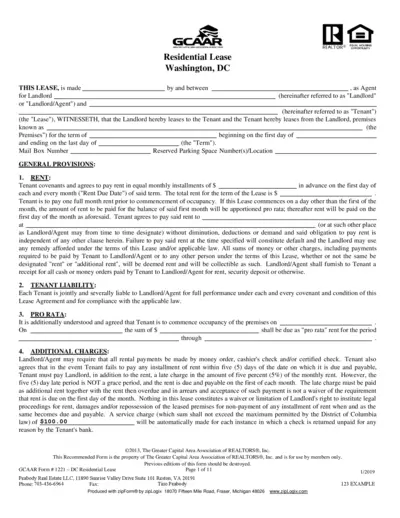

Residential Lease Agreement for Washington, DC

This residential lease agreement outlines the terms and conditions for renting a property in Washington, DC. It includes provisions for rent payment, tenant liability, security deposits, and authorized occupants. The document ensures compliance with local housing regulations and sets the rules for maintaining the premises.

Real Estate

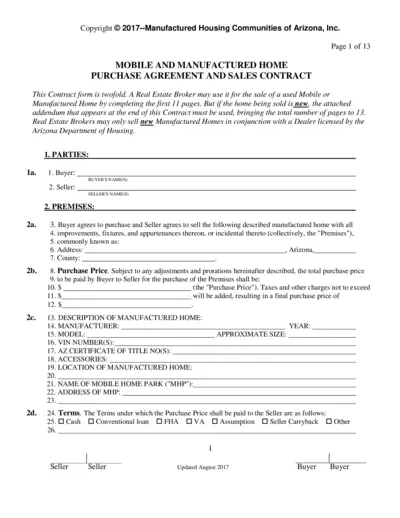

Mobile and Manufactured Home Purchase Agreement and Sales Contract

This document serves as a comprehensive purchase agreement and sales contract for mobile and manufactured homes. Real Estate Brokers can use it for new or used home sales with detailed provisions for both scenarios. It includes terms of sale, escrow details, and required addenda.

Property Taxes

Form 1099-R Instructions and Details

Form 1099-R is used to report distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. This form is essential for both the payer and recipient to report distributions accurately to the IRS. Review the details and instructions to ensure compliance.

Property Taxes

Connecticut Pass-Through Entity Tax Return Instructions 2022

This document provides comprehensive instructions for completing the Connecticut Pass-Through Entity Tax Return for 2022. It guides entities through the forms and schedules required for accurate filing. Additionally, it explains the available elections and how to complete various schedules.

Property Taxes

Hawaii State General Excise/Use Tax Filing Instructions

This file provides instructions for filing General Excise/Use Tax returns in the State of Hawaii. It includes details on activity classifications, step-by-step instructions for completing various forms, and filing requirements. It is essential for taxpayers engaged in business within Hawaii.

Real Estate

Nevada Deed Upon Death Form - Transfer Real Estate Without Probate

The Nevada Deed Upon Death form allows property owners to transfer real estate to beneficiaries without probate. It ensures ownership control during the owner's lifetime and seamless transfer upon their death. Completing this form protects properties from the lengthy probate process.

Real Estate

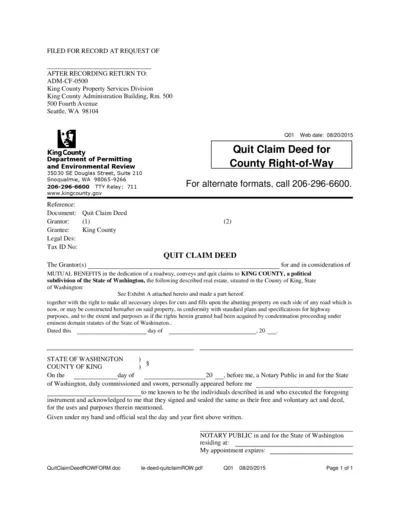

King County Quit Claim Deed for Right-of-Way

This document is a Quit Claim Deed for King County Right-of-Way. It details the transfer of property to King County for roadway purposes. It includes form fields for grantor, legal description, and notary acknowledgment.

Property Taxes

Instructions for Form 2210: Underpayment of Estimated Tax

This file contains detailed instructions for Form 2210, which helps individuals, estates, and trusts determine if they owe a penalty for underpaying their estimated tax. It also provides information on exemptions, special rules, and waivers.

Real Estate

Michigan Motor Vehicle Repair Facility Registration

This file provides instructions for registering a motor vehicle repair facility in Michigan. It is mandatory to obtain this registration before performing repairs for compensation. Includes important information about the Repair Facility Manual, required certifications, and submission instructions.