Property Law Documents

Property Taxes

American Samoa Wage and Tax Statement (Form W-2AS)

The American Samoa Wage and Tax Statement (Form W-2AS) is used by employers in American Samoa to report wages paid and taxes withheld. It provides detailed information about an employee's earnings and tax withholdings for the year. This form must be filed with the American Samoa Tax Return.

Property Taxes

Form 7004 Application for Extension of Time 2023

Form 7004 is used for requesting an automatic extension for filing certain business income tax returns. This form helps businesses and practitioners file for time extensions for tax submissions. Ensure to submit by the return’s due date.

Property Taxes

Illinois Department of Revenue Equipment Exemption Certificate

This file is the Equipment Exemption Certificate (ST-587) provided by the Illinois Department of Revenue. It is used to certify that specific equipment purchases are exempt from tax. Filling out this form correctly is essential for taking advantage of the tax exemption.

Property Taxes

IRS Requirement for Kiwanis 501(c)(4) Form 8976

This document provides information about the IRS requirement for newly-formed 501(c)(4) organizations to file Form 8976. It includes instructions on who needs to file, when to file, and how to complete the form. Additionally, it provides contact information for further assistance and clarifications.

Property Taxes

Form 8379: Injured Spouse Allocation Instructions

Form 8379 helps an injured spouse claim their share of a joint tax refund that was applied to their spouse's past-due obligations. Follow the detailed instructions to fill out this form accurately. Ensure you meet eligibility criteria before filing.

Property Taxes

Discretionary Sales Surtax Information for Calendar Year 2024

This file provides detailed information on discretionary sales surtax rates for various counties in Florida for the calendar year 2024. It includes data on new, revised, extended, and expiring surtaxes. The document also contains important dates and contact information for further inquiries.

Property Taxes

Louisiana L-3 Transmittal of Withholding Tax Statements 2021

Form L-3 is used to transmit copies of Information Returns (W-2, W-2G, 1099) to Louisiana Department of Revenue. It must be filed if a business terminates during the year or at the end of the year. The form is due on or before January 31st.

Property Taxes

2021 Instructions for Schedule SE Self-Employment Tax

This file provides detailed instructions on how to fill out Schedule SE for self-employment tax. It includes information on who must file, tax rates, exemptions, and special cases. Useful for self-employed individuals, ministers, and certain church employees.

Property Taxes

2015 Instructions for Form 8960 - Net Investment Income Tax

Instructions for individuals, estates, and trusts on how to file Form 8960 to report Net Investment Income Tax (NIIT). Includes definitions, filing requirements, and special rules.

Real Estate

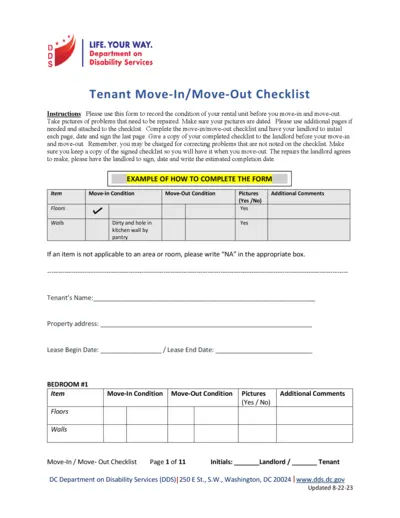

Tenant Move-In/Move-Out Checklist by DDS

This Tenant Move-In/Move-Out Checklist helps record the condition of a rental unit before moving in and out. It includes sections for different rooms and items, ensuring all potential issues are documented. Completion and landlord's signatures are required for validation.

Tenant-Landlord

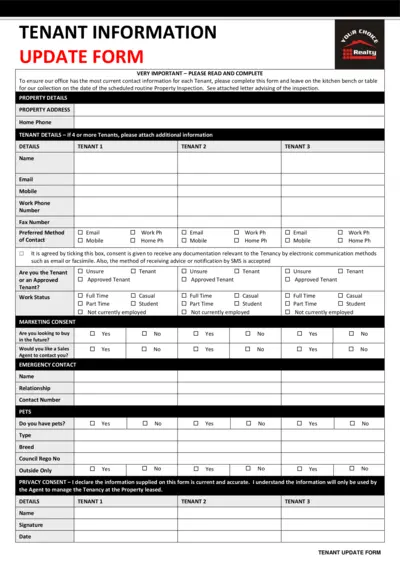

Tenant Information Update Form - Realty

This form is used to update tenant information for our database. Tenants are required to fill out this form before the scheduled property inspection. It includes sections for property details, tenant details, marketing consent, emergency contact, and more.

Property Taxes

Renewable Electricity Production Credit Form 8835 (2023)

Form 8835 is used to claim the renewable electricity production credit. It applies to electricity produced from qualified energy resources. Review instructions and eligibility requirements before completing the form.