Property Law Documents

Real Estate

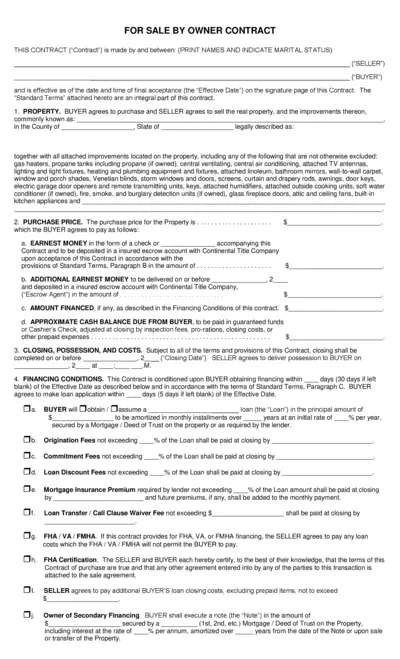

For Sale By Owner Residential Contract Template

This file contains a standard contract for a residential property sale between a seller and a buyer. It outlines the terms, conditions, and responsibilities associated with the transaction. Utilize this contract to ensure a smooth real estate transaction when buying or selling property.

Property Taxes

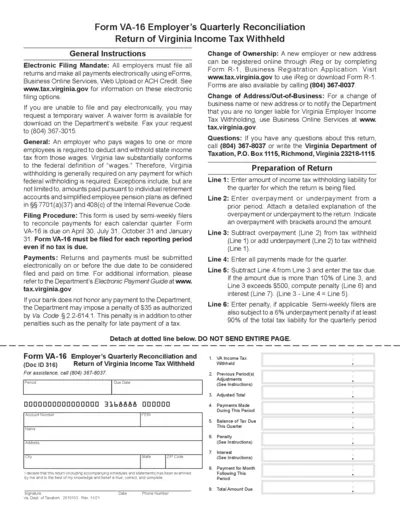

VA-16 Employer's Quarterly Reconciliation Form

The VA-16 form is used by employers for quarterly income tax reconciliation in Virginia. It details the income tax withheld and payments made during the quarter. Employers must file electronically to comply with Virginia law.

Property Taxes

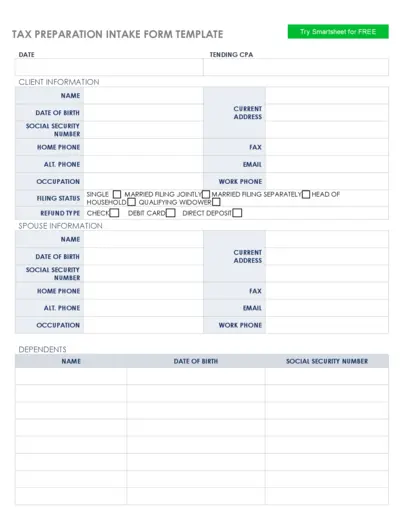

Tax Preparation Intake Form Template

The Tax Preparation Intake Form Template is essential for efficiently gathering client information and income details. This form streamlines the tax preparation process, ensuring all necessary data is collected. Ideal for both individuals and businesses seeking structured tax documentation.

Property Taxes

Instructions for Hawaii Form N-848 Power of Attorney

Form N-848 allows individuals to grant authority to a representative for tax matters in Hawaii. This form is essential for taxpayers needing assistance with confidential tax information. Follow the guidelines carefully to ensure proper submission and representation.

Property Taxes

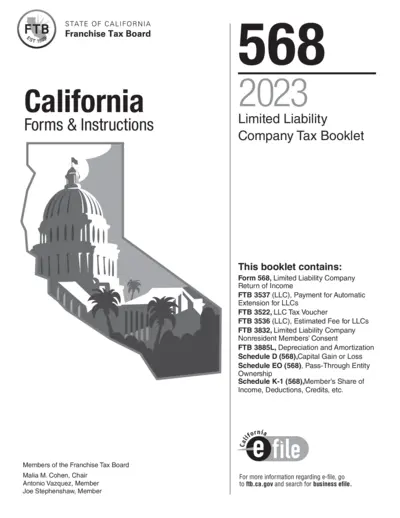

California Franchise Tax Board Form 568 Instructions

This document provides comprehensive instructions for completing Form 568, the Limited Liability Company Return of Income in California. It includes vital reporting requirements, important deadlines, and guidance on how to navigate the form. Suitable for LLCs in California and their tax preparers.

Property Taxes

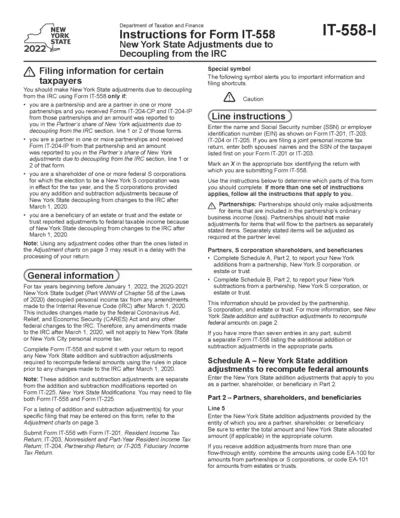

Instructions for Form IT-558 New York State Adjustments

This document provides essential instructions for completing Form IT-558, which is used by taxpayers in New York State to report adjustments due to decoupling from the Internal Revenue Code. It outlines the necessary requirements for partnerships, S corporations, and beneficiaries of estates or trusts. Understanding these instructions is crucial for proper tax filing compliance.

Property Taxes

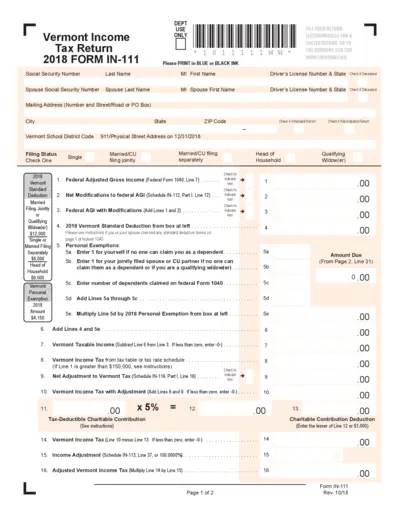

Vermont Income Tax Return Form IN-111 Instructions

This file contains the complete Vermont Income Tax Return Form IN-111 for the year 2018. It includes detailed filing instructions, essential forms, and the information needed to accurately complete your tax return. A must-have for Vermont residents filing their income taxes.

Real Estate

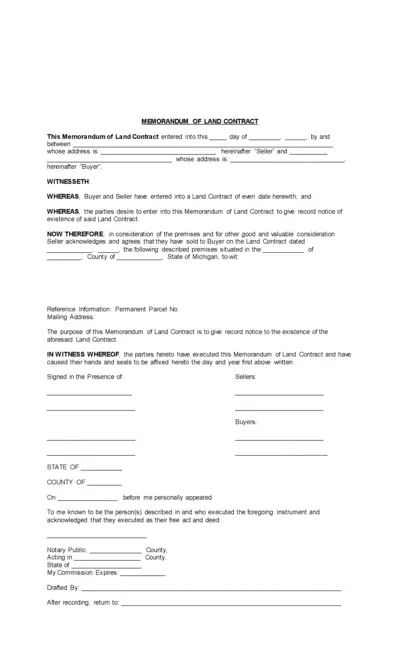

Memorandum of Land Contract for Buyers and Sellers

This Memorandum of Land Contract serves as a formal record of agreement between the buyer and seller regarding land sale. It outlines the terms under which the property is sold and provides vital information for both parties. Essential for legal and financial clarity, this document is crucial for property transactions.

Property Taxes

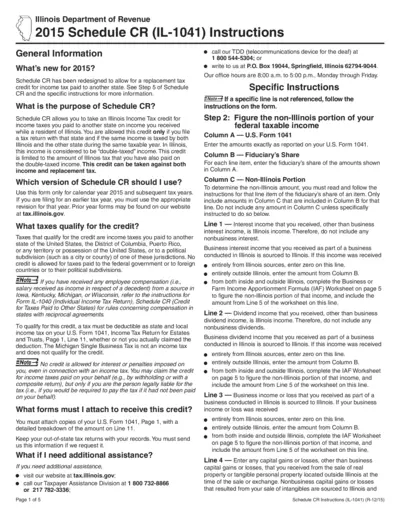

Illinois Schedule CR (IL-1041) Tax Credit Instructions

This file contains detailed instructions for completing Schedule CR used in Illinois tax filings. It outlines the process for claiming income tax credits for taxes paid to other states. Essential for residents who have income taxed by both Illinois and another state.

Real Estate

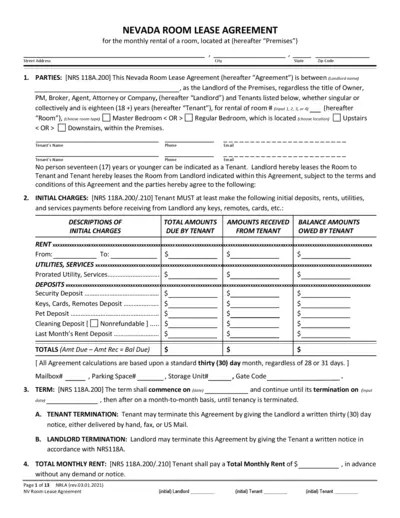

Nevada Room Lease Agreement for Rental of Room

This Nevada Room Lease Agreement outlines the terms and conditions for renting a room. It includes detailed information on initial charges, monthly rent, and tenant responsibilities. This document serves as a legal binding between the landlord and the tenant.

Real Estate

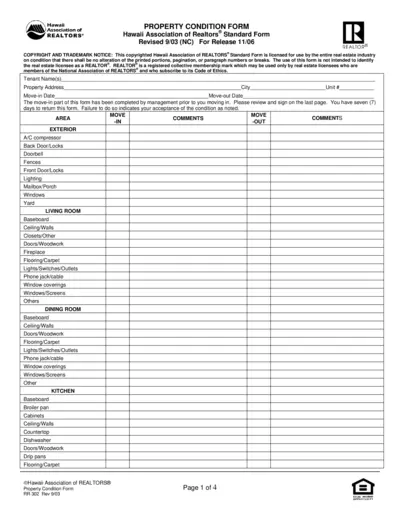

Hawaii Property Condition Form for REALTORS

The Hawaii Property Condition Form is essential for documenting the condition of rental properties. This form enables both landlords and tenants to have a clear understanding of the property’s state. Users can fill, edit, and sign this form easily through PrintFriendly.

Property Taxes

IRS Instructions for Form 1041 for Estates and Trusts

This document provides essential instructions for filing Form 1041, which is used for U.S. Income Tax Return for Estates and Trusts. It outlines the requirements, deadlines, and important filing information necessary for compliance with IRS regulations.