Property Law Documents

Real Estate

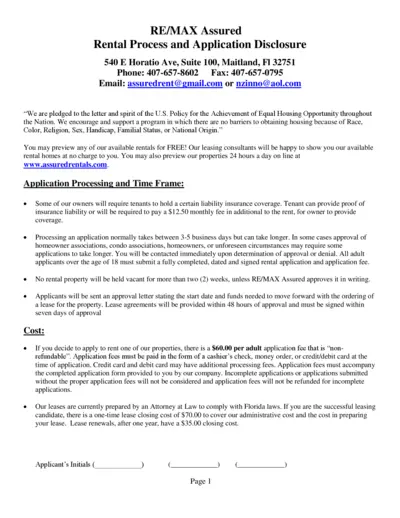

REMAX Assured Rental Process and Application Disclosure

This file outlines the rental process and application requirements for RE/MAX Assured. It provides essential guidelines for prospective tenants. Understanding this document is crucial for smooth approval and compliance.

Property Taxes

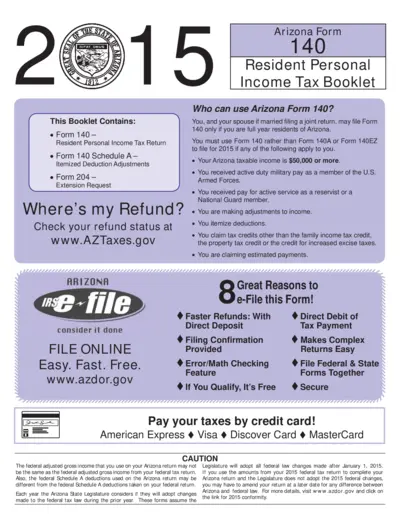

Arizona Form 140 Instructions and Information

This file contains important information and instructions for filling out Arizona Form 140. It covers eligibility, filing process, and updates for 2015 taxes. Ideal for Arizona residents seeking to file their income tax returns accurately.

Real Estate

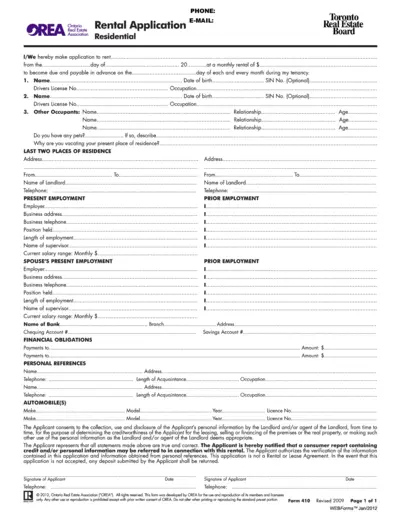

Residential Rental Application Form for Ontario

This Residential Rental Application is essential for tenants looking to rent a property in Ontario. It collects necessary personal and financial information to assess creditworthiness. Ensure to fill it out completely for a smooth application process.

Property Taxes

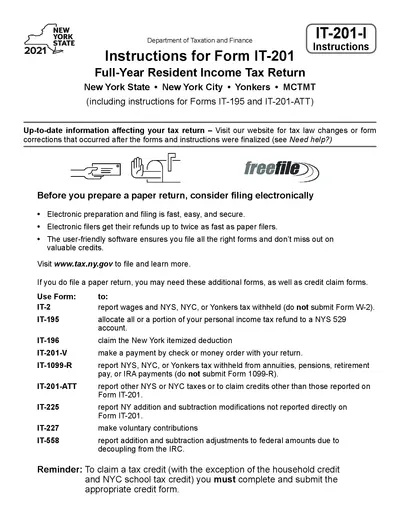

New York State IT-201 Instructions for 2021

This document provides detailed instructions for completing the New York State IT-201 Full-Year Resident Income Tax Return for 2021. It includes essential guidelines for filing taxes in New York State, New York City, and Yonkers, as well as important credit and payment information. Users will find valuable resources and links for e-filing and tax law updates.

Property Taxes

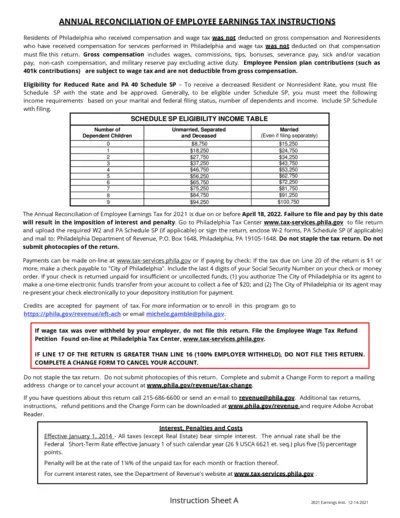

Annual Reconciliation Employee Earnings Tax Instructions

This file provides essential instructions for residents and non-residents of Philadelphia regarding the filing of the Annual Reconciliation of Employee Earnings Tax. It outlines eligibility criteria, submission guidelines, and important deadlines to ensure compliance with local tax regulations.

Tenant-Landlord

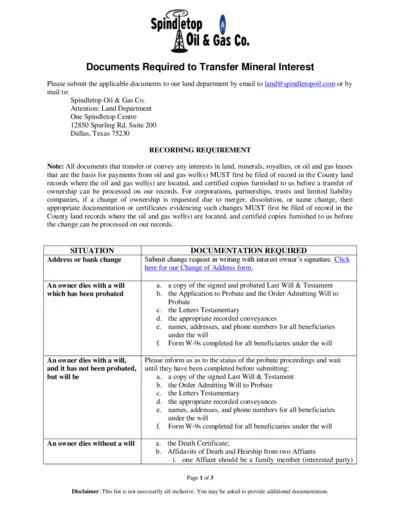

Transfer of Mineral Interest Documentation

This document outlines the requirements for transferring mineral interest ownership. It details necessary documentation and submission processes. Essential for both individuals and entities engaged in mineral interest transactions.

Property Taxes

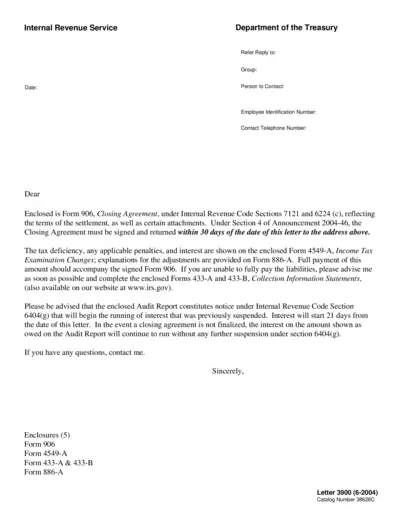

IRS Form 906 Closing Agreement Instructions

This document provides essential instructions for Form 906, a Closing Agreement under the Internal Revenue Code. It includes details about submission deadlines and related forms. Understanding this form is crucial for taxpayers facing a tax deficiency.

Property Taxes

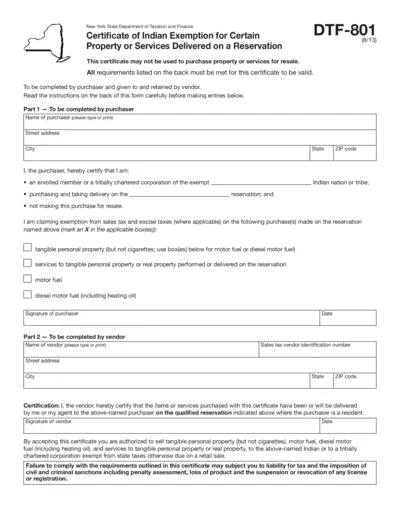

Certificate of Indian Exemption for Property Services

This form certifies Indian exemption from sales and excise taxes for property or services on a qualified reservation in New York. It must be completed by the purchaser and retained by the vendor. Ensure to follow the guidelines and instructions on the reverse side for valid use.

Property Taxes

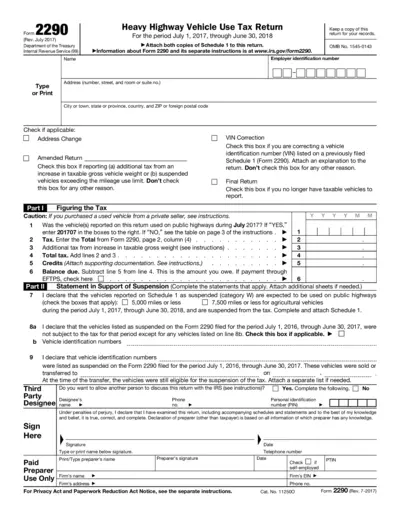

Form 2290 - Heavy Highway Vehicle Use Tax Return

Form 2290 is used for reporting the Heavy Highway Vehicle Use Tax to the IRS. It is essential for vehicle owners who operate heavy vehicles on public highways. This form helps facilitate tax compliance for the fiscal year ending June 30, 2018.

Real Estate

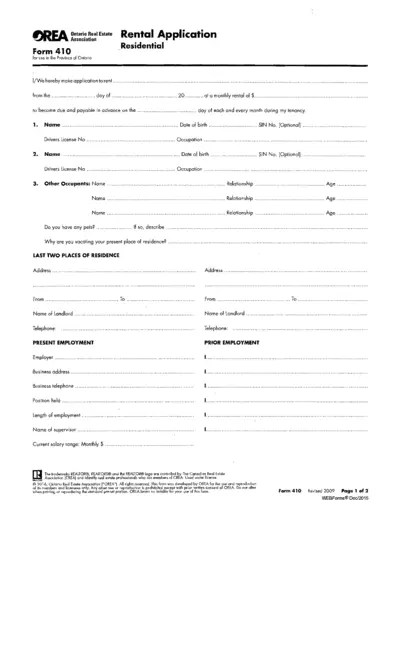

OREA Ontario Real Estate Rental Application Form 410

The OREA Form 410 is a standardized rental application used in Ontario for residential properties. This form collects important information from prospective tenants, including employment and financial details. It ensures a clear evaluation process for landlords.

Property Taxes

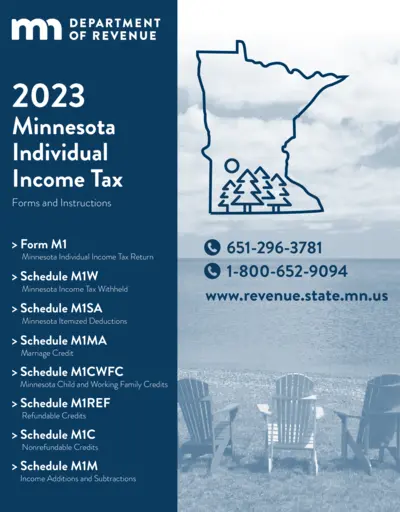

Minnesota Individual Income Tax Forms and Instructions

This file provides comprehensive instructions for the Minnesota Individual Income Tax Return and other related forms. It includes essential guidelines for filing, available credits, and important deadlines. Ideal for Minnesota taxpayers looking for guidance on their income tax return process.

Real Estate

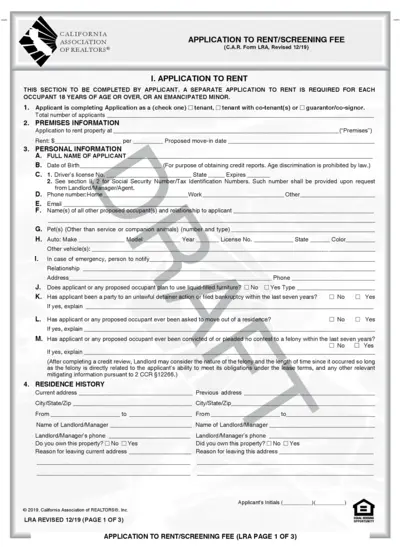

Application to Rent Screening Fee Form California

This file contains the Application to Rent and screening fee instructions. It's essential for tenants applying for rental properties in California. Ensure to fill out all required sections for a successful application.