Property Law Documents

Real Estate

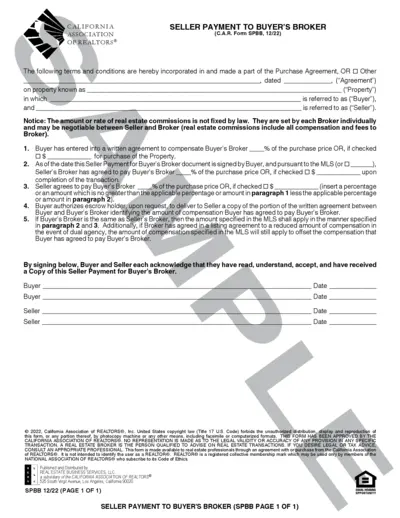

Seller Payment to Buyer's Broker Agreement

This document outlines the terms and conditions for the Seller Payment to Buyer's Broker. It is essential for real estate transactions in California. Use this form to specify the compensation agreed upon between the Seller and Buyer's Broker.

Property Taxes

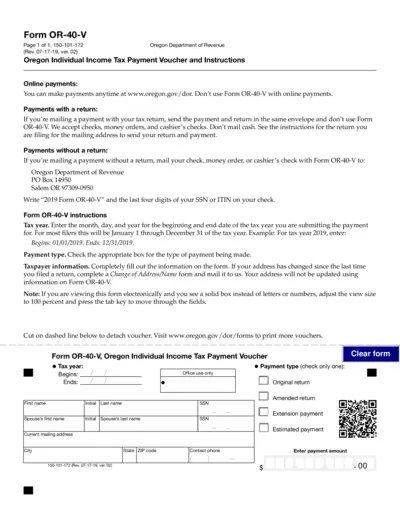

Oregon Individual Income Tax Payment Voucher Instructions

The Oregon Individual Income Tax Payment Voucher is a form required for submitting individual income tax payments in Oregon. It includes detailed instructions for filling out the form, submitting payments, and necessary tax year information. Use this form to ensure your tax payments are processed correctly.

Property Taxes

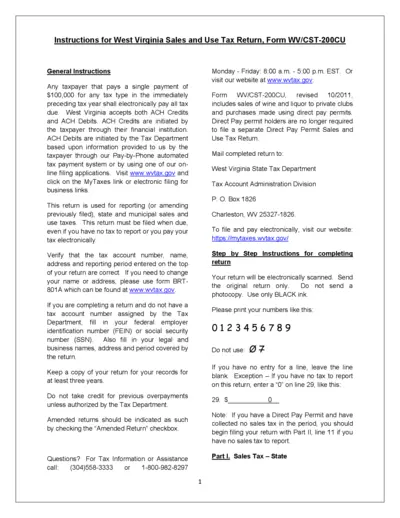

West Virginia Sales and Use Tax Return Instructions

This file contains detailed instructions for the West Virginia Sales and Use Tax Return, Form WV/CST-200CU. It includes guidelines for submission, exemptions, and payment methods applicable to sales and use taxes in West Virginia. Designed for both taxpayers and businesses, this document simplifies the reporting process.

Real Estate

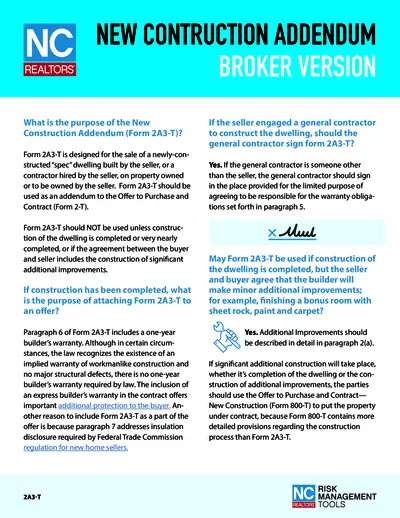

New Construction Addendum Form 2A3-T Details

The New Construction Addendum (Form 2A3-T) is essential for buyers and sellers involved in newly constructed homes. This document provides important details regarding warranties, construction improvements, and obligations. It ensures that all parties are protected during the real estate transaction.

Property Taxes

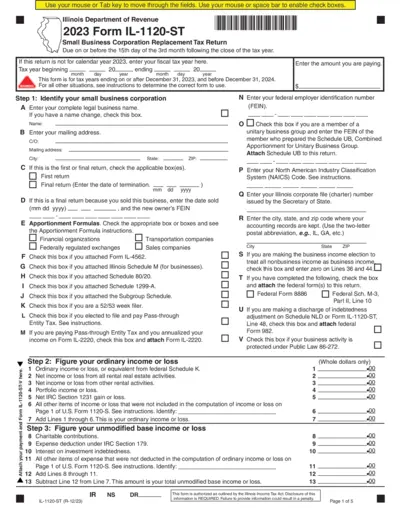

Illinois Form IL-1120-ST Small Business Tax Return

The Illinois Form IL-1120-ST is a tax return for small business corporations. It must be submitted by the 15th day of the third month following the tax year end. This form is essential for businesses operating in Illinois to report their taxes accurately.

Property Taxes

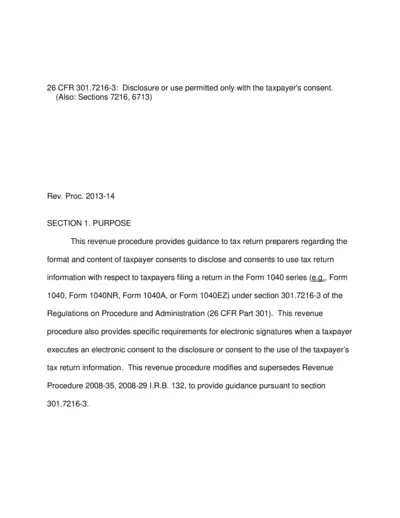

Guidance on Taxpayer Consent for Information Disclosure

This revenue procedure offers essential guidance for tax return preparers on taxpayer consent for disclosing or using tax return information. It outlines specific requirements for consents related to Tax Form 1040 and provides clarity on electronic signatures. Understanding these consents is crucial for compliance with regulations under section 301.7216-3.

Property Taxes

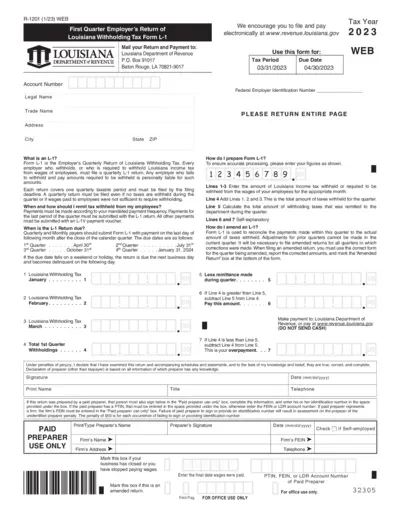

Louisiana Withholding Tax Employer's Return Form L-1

Form L-1 is the Employer's Quarterly Return of Louisiana Withholding Tax. It is mandatory for all employers who withhold Louisiana income tax to file this form quarterly. This document provides important information necessary for proper tax reporting.

Property Taxes

Schedule O Form 1120 Instructions for Controlled Groups

This document provides essential instructions for completing Schedule O for Form 1120, required for corporations within controlled groups. It outlines consent plans, apportionment schedules, and compliance requirements. Ensure accurate submission by following detailed guidance provided in this file.

Real Estate

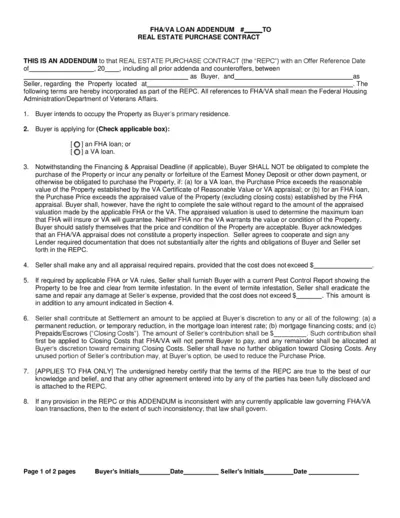

FHA VA Loan Addendum Real Estate Purchase Contract

This FHA/VA Loan Addendum outlines the terms regarding loans from the Federal Housing Administration and Department of Veterans Affairs. It is an essential document for buyers seeking FHA or VA loans for real estate purchases. Buyers should carefully review the stipulations of this addendum before proceeding with the purchase.

Real Estate

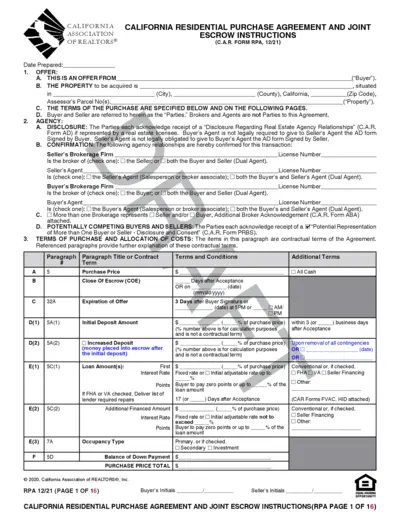

California Residential Purchase Agreement Instructions

This file contains the California Residential Purchase Agreement and Joint Escrow Instructions. It's a guide for both buyers and sellers in California real estate transactions. Clear terms and detailed instructions ensure smooth escrow processes.

Property Taxes

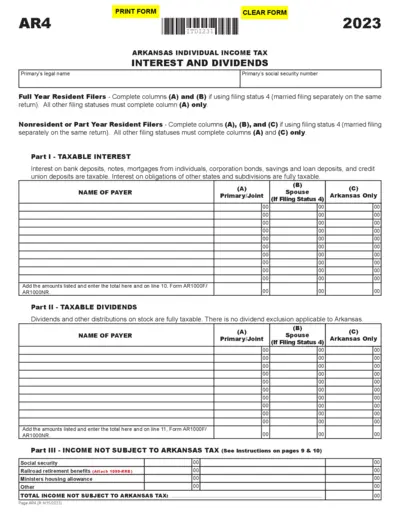

Arkansas Individual Income Tax Filing Instructions

This file provides essential details on how to file Arkansas individual income tax. It outlines the instructions for filling out interest and dividends disclosures. Use this form if you are a resident or a part-year resident of Arkansas.

Property Taxes

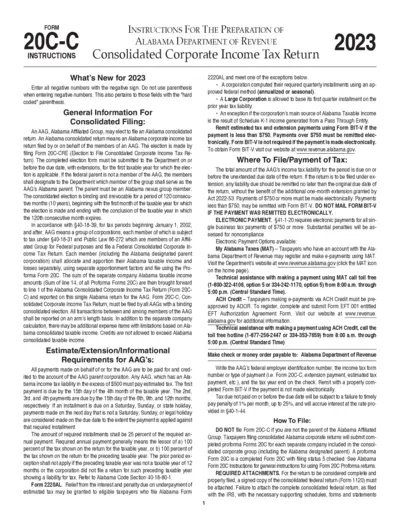

Alabama Corporate Income Tax Return Instructions

This document provides comprehensive instructions for filing the Alabama Consolidated Corporate Income Tax Return. It includes details on eligibility, filing requirements, and important deadlines. Businesses must understand these instructions to ensure compliance with Alabama tax laws.