Property Law Documents

Real Estate

Florida Real Estate Company Application Form DBPR RE 7

The Florida Real Estate Company Application Form DBPR RE 7 is essential for businesses seeking to obtain a real estate license. This form outlines the necessary steps and requirements for applicants. Ensure all documentation and fees are submitted for a smooth application process.

Property Taxes

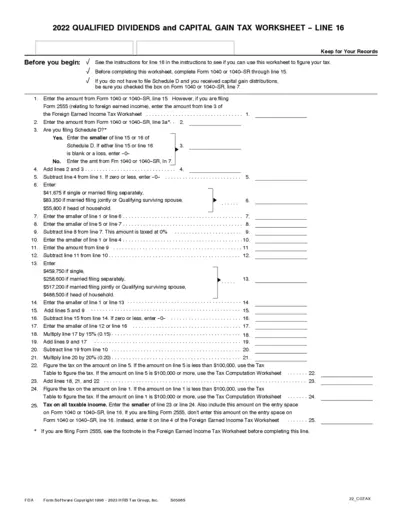

2022 Qualified Dividends and Capital Gain Tax Worksheet

This worksheet helps you determine the tax on your qualified dividends and capital gains. Complete Form 1040 or 1040-SR before using this worksheet. For accurate tax calculation, follow the outlined instructions carefully.

Real Estate

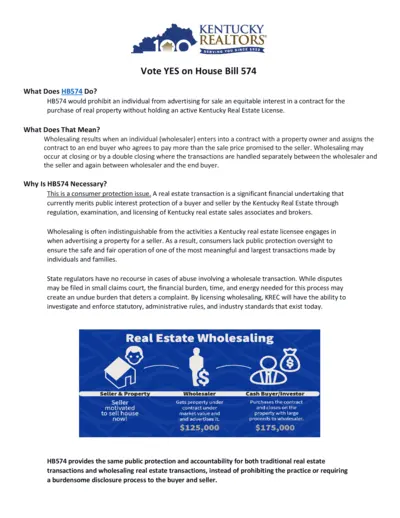

Kentucky House Bill 574 Wholesaling Guidelines

This document provides essential information about House Bill 574 regarding real estate wholesaling in Kentucky. It outlines the implications of the bill and the necessary licensing for wholesalers. Ideal for real estate professionals and consumers involved in property transactions.

Property Taxes

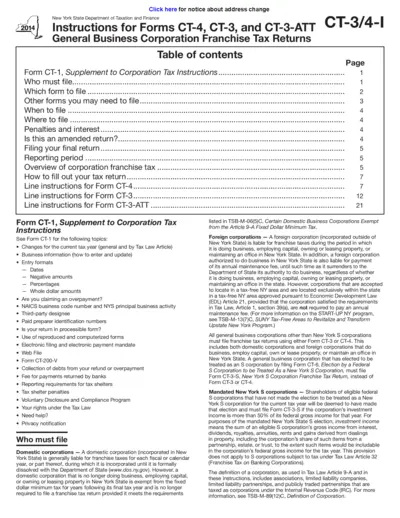

Instructions for New York State Tax Forms CT-4 and CT-3

This file provides necessary instructions and forms for filing New York State franchise tax returns. It covers details on who must file, what forms to use, and line-by-line filing instructions. Business owners and corporations will benefit from following these guidelines to ensure compliance.

Property Taxes

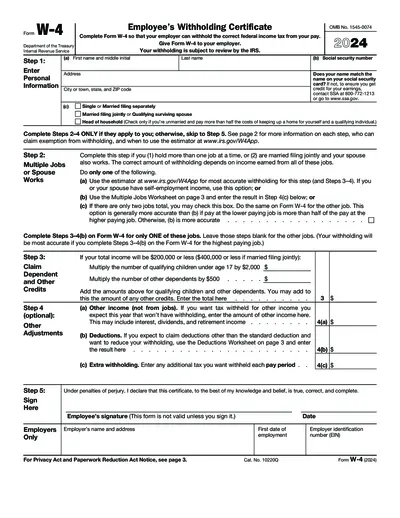

Employee's Withholding Certificate - Form W-4 (2024)

The W-4 form is essential for employees to determine federal income tax withholding from their pay. It helps ensure the right amount is deducted to avoid penalties or large refunds. Complete the form accurately to reflect your tax situation.

Property Taxes

IRS Non-Filing Verification Tax Form

This file is a verification of non-filing for Form 1040. It contains information regarding the taxpayer's status and instructions from the IRS. Essential for taxpayers needing proof of non-filing, especially for specific tax periods.

Real Estate

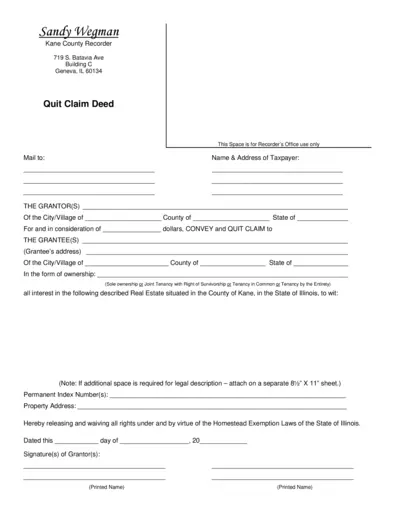

Kane County Quit Claim Deed Form Instructions

This file provides essential information about the Quit Claim Deed used in Kane County, Illinois. It outlines the necessary components required for filling out the form. Use this guide to ensure accurate completion of the deed, safeguarding your property interests.

Property Taxes

Filing Guidelines for IRS Form 8806 Submission

This document outlines the necessary instructions for submitting IRS Form 8806, Information Return for Acquisition of Control or Substantial Change in Capital Structure. It details the requirements and processes for corporations involved in significant ownership changes. Ensure compliance to avoid penalties by submitting via fax.

Property Taxes

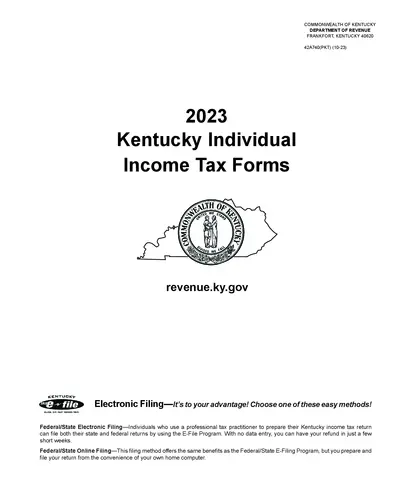

Kentucky Individual Income Tax Forms 2023

This file provides essential instructions and information for filing your individual income tax in Kentucky for the year 2023. It includes various filing options, taxpayer assistance details, and guidelines for various tax credits. Perfect for individuals and families preparing their tax returns.

Real Estate

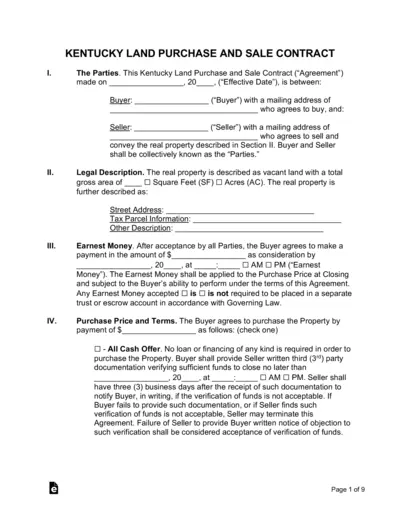

Kentucky Land Purchase and Sale Contract

This Kentucky Land Purchase and Sale Contract serves as a formal agreement between the buyer and seller for the sale of real estate. It includes important details such as the sale price, legal description, and closing terms. This file is essential for any real estate transaction involving Kentucky land.

Real Estate

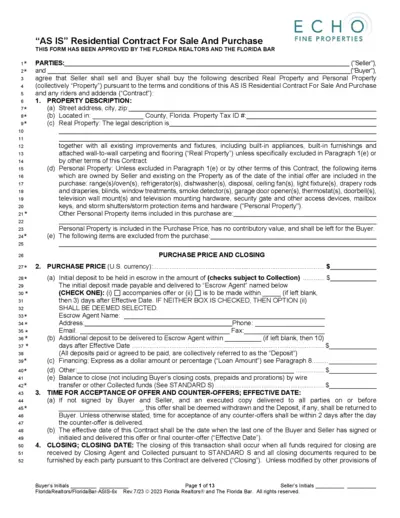

AS IS Residential Contract For Sale and Purchase

This AS IS residential contract serves as a comprehensive guide for the sale and purchase of real and personal property in Florida. It outlines the terms, conditions, and pertinent details required for both the seller and buyer to achieve a successful transaction. This document is essential for real estate transactions ensuring all legal aspects are clearly defined.

Real Estate

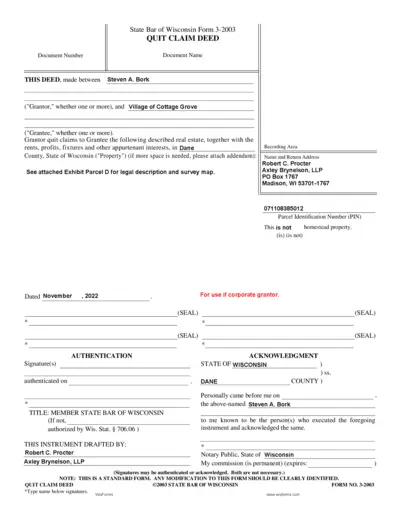

QUIT CLAIM DEED - State Bar of Wisconsin Form

This file contains the Quit Claim Deed form required for transferring property rights in Wisconsin. It provides a legal framework for property transactions between grantors and grantees. Ideal for individuals and entities engaged in real estate transactions.