Property Law Documents

Property Taxes

Filing Taxes for Employee Stock Purchase Plan (Qualified)

This guide provides information on filing taxes for a qualified Employee Stock Purchase Plan (ESPP), including necessary documents, tax treatment, and reporting guidelines. It helps you understand the tax implications of ESPP stock sales and how to report ordinary income and capital gains/losses. Ensure you're enrolled in a qualified ESPP and use this guide to accurately file your taxes.

Property Taxes

2023 Oklahoma Resident Individual Income Tax Forms & Instructions

This file contains the 2023 Oklahoma Resident Individual Income Tax Return Form 511, instructions, and supporting schedules. It includes information about residence status, due dates, extensions, refunds, and amended returns. Also provides helpful hints and new tax credits for the year.

Property Taxes

New York State Department of Taxation and Finance - Other Tax Credits and Taxes Form 2023

This document is a form issued by the New York State Department of Taxation and Finance for reporting other tax credits and taxes. It functions as an attachment to Form IT-201 and details nonrefundable and refundable credits, as well as additional New York City and Yonkers taxes. Users must submit this form alongside Form IT-201.

Property Taxes

Instructions for Form NYC-210, New York City School Tax Credit

This file provides detailed instructions on how to fill out Form NYC-210 to claim the New York City School Tax Credit for the year 2014. It includes eligibility criteria, instructions for filling out the form, and submission details. The file is essential for individuals seeking to claim this tax credit.

Property Taxes

Maryland 500 Corporation Income Tax Return 2021 – Form Guide

Maryland 500 Corporation Income Tax Return 2021 is a tax form for corporations to report income. Ensure to fill accurately to comply with state requirements. This form assists in calculating the taxes owed or refunds.

Property Taxes

Federal Insurance Contributions Act (FICA) Tip Credit Guide

This document provides guidance on the FICA Tip Credit, including the tax treatment of tip income, how the credit works, and the history, rationale, and criticism of the credit.

Property Taxes

2023 Oklahoma Partnership Income Tax Forms and Instructions

This file provides the 2023 Oklahoma Partnership Income Tax Forms and Instructions. It includes details on completing Form 514 and relevant supplemental schedules. It is essential for partnerships with Oklahoma source income.

Property Taxes

IRS Form 8995-A: Qualified Business Income Deduction

IRS Form 8995-A is used to calculate the Qualified Business Income Deduction for taxpayers with income above specific thresholds. This form includes sections for trade, business, or aggregation information, and detailed calculations. Make sure to follow the latest instructions from the IRS.

Property Taxes

FORM NO. 12C for Income Details under Section 192(2B)

Form No. 12C is used for sending particulars of income under section 192(2B) for a financial year. It includes details of income other than salaries and tax deducted at source. This form is verified and signed by the employee.

Real Estate

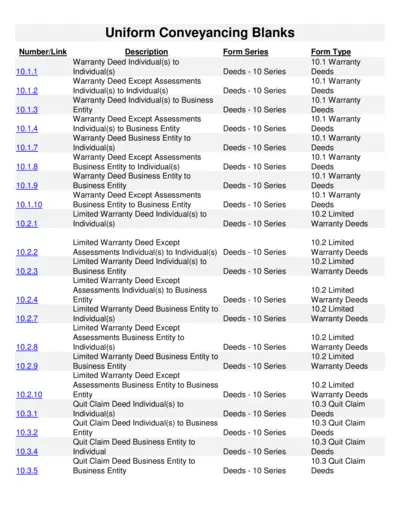

Uniform Conveyancing Blanks Deeds and Mortgages Forms

This file contains uniform conveyancing blanks, specifically deed and mortgage forms, organized by series and type. The forms serve various purposes from transferring property ownership to amending existing mortgages. Ideal for property transactions and legal documentations.

Property Taxes

North Carolina 2020 Individual Income Tax Return Form D-400

This is the North Carolina 2020 Individual Income Tax Return Form D-400. It provides the necessary fields and instructions to complete and submit your tax return. Ensure you follow all guidelines and fill out the form accurately.

Property Taxes

Instructions for New York Resident Income Tax Form IT-201, 2022

This file provides detailed instructions for filling out the New York State Full-Year Resident Income Tax Return (Form IT-201) for the year 2022. It includes guidelines for electronic filing, making payments, and protecting against identity theft. Additionally, it provides information on filing requirements for full-year residents, part-year residents, and nonresidents.