Property Law Documents

Real Estate

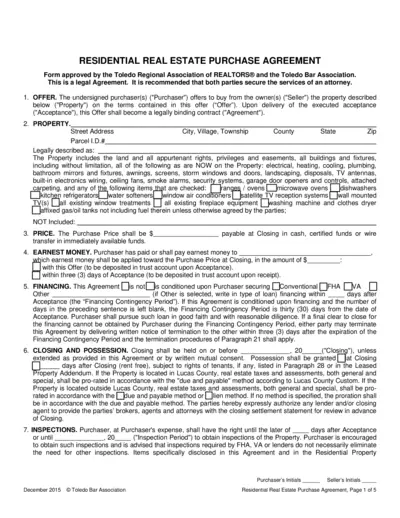

Residential Real Estate Purchase Agreement - Toledo

This file is a Residential Real Estate Purchase Agreement form approved by the Toledo Regional Association of REALTORS® and the Toledo Bar Association. It contains important terms and conditions for the purchase and sale of residential property. Both parties are advised to secure the services of an attorney to ensure all legal aspects are covered.

Property Taxes

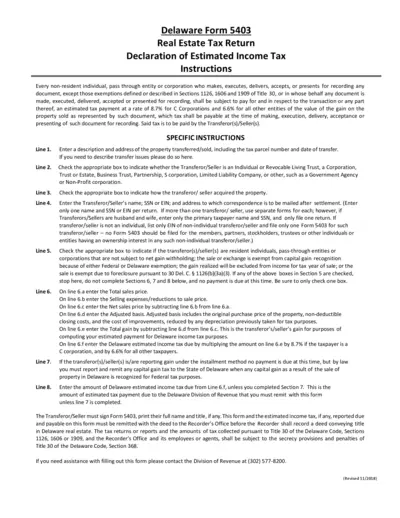

Delaware Form 5403 Real Estate Tax Return

Delaware Form 5403 is required for non-resident individuals and entities who transfer real estate in Delaware. This form ensures proper declaration and payment of estimated income tax on the gain from the sale. Specific instructions guide the seller through the completion of the form.

Property Taxes

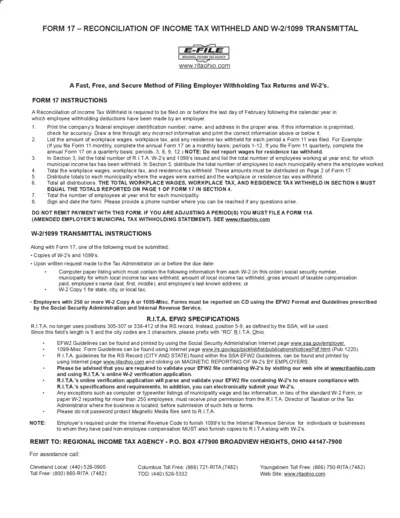

FORM 17 - Reconciliation of Income Tax Withheld and W-2/1099 Transmittal

This file contains the instructions and details needed to reconcile income taxes withheld and W-2/1099 transmittal for the Regional Income Tax Agency (R.I.T.A.). It provides guidelines on filling the form, submitting the required documents, and distributing taxes to appropriate municipalities. It's crucial for employers to complete this form accurately to ensure compliance with local tax regulations.

Property Taxes

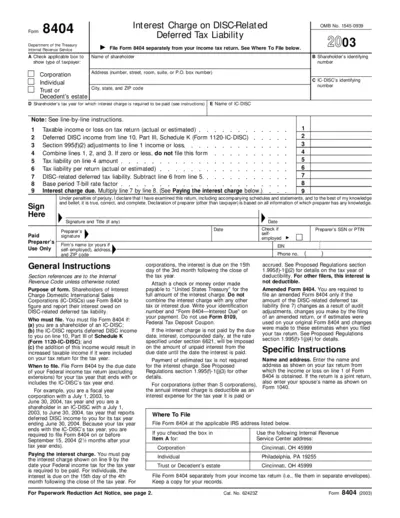

Form 8404 - Interest Charge on DISC-Related Deferred Tax Liability

Form 8404 is used by shareholders of Interest Charge Domestic International Sales Corporations (IC-DISCs) to calculate and report interest owed on DISC-related deferred tax liability. Instructions include who must file, when to file, paying the interest charge, and other computation rules. It also explains how to enter necessary information such as taxpayer details and identifying numbers.

Real Estate

Zillow Rental Application Process Guide

This file provides a comprehensive guide on how to use Zillow's online rental application and screening tool. It includes steps for enabling applications, inviting applicants, reviewing information, managing applicants, and creating lease agreements. The guide is useful for landlords looking to streamline their tenant application process.

Property Taxes

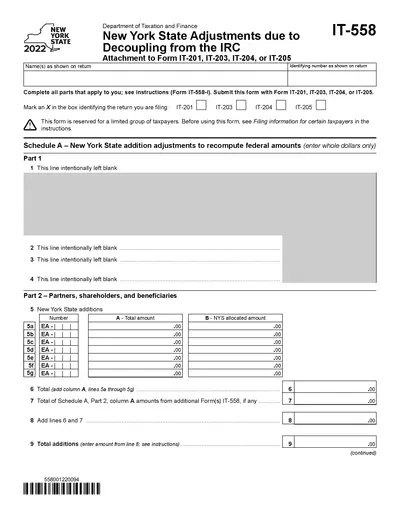

New York State 2022 Adjustments Due to Decoupling from the IRC

This file contains the New York State Adjustments due to Decoupling from the IRC for the year 2022. It is used as an attachment to Form IT-201, IT-203, IT-204, or IT-205. Complete all relevant parts and submit it with the appropriate form.

Property Taxes

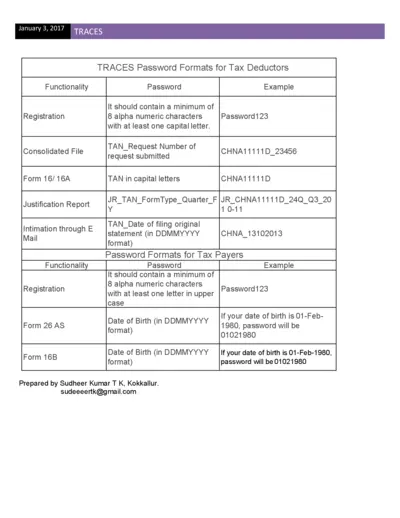

TRACES Password Formats and Functionality Guide for Tax Deductors and Tax Payers

This document provides guidance on TRACES password formats for tax deductors and tax payers. It includes detailed examples and instructions for various forms such as Form 16/16A and Form 26AS. Users will find step-by-step guidance on how to register and create passwords.

Property Taxes

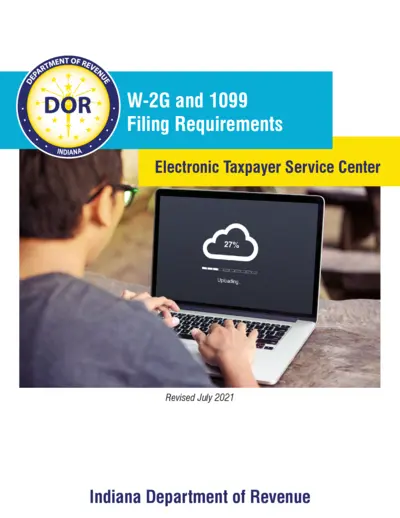

Indiana W-2G and 1099 Filing Requirements Guide

This file provides detailed instructions and requirements for filing W-2G and 1099 forms in Indiana. It includes guidelines for electronic filing, sequence of records, and specific IRS format. The document also covers administrative highlights and important information for taxpayers.

Property Taxes

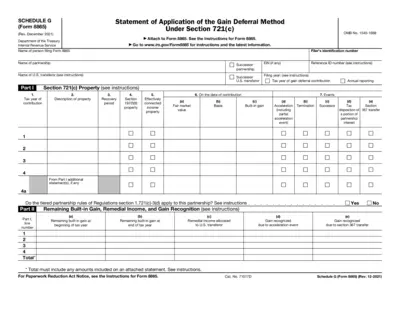

Schedule G (Form 8865) Instructions and Details

Schedule G (Form 8865) is used for the Statement of Application of the Gain Deferral Method under Section 721(c). It must be attached to Form 8865. This document provides instructions and required details for filing Schedule G.

Property Taxes

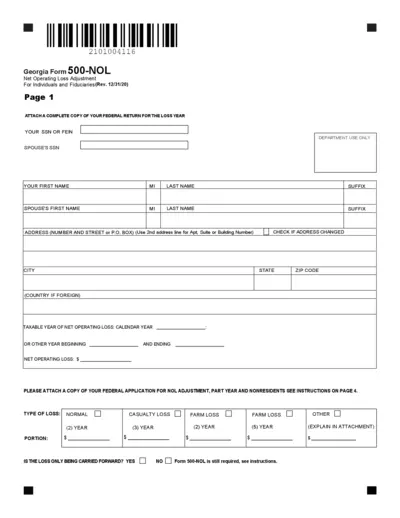

Georgia Form 500-NOL: Net Operating Loss Adjustment

This document is the Georgia Form 500-NOL, used for adjusting net operating losses for individuals and fiduciaries. It includes fields for personal information, loss types, and detailed income adjustments. The form must be filled out accurately and a complete copy of your federal return is required.

Property Taxes

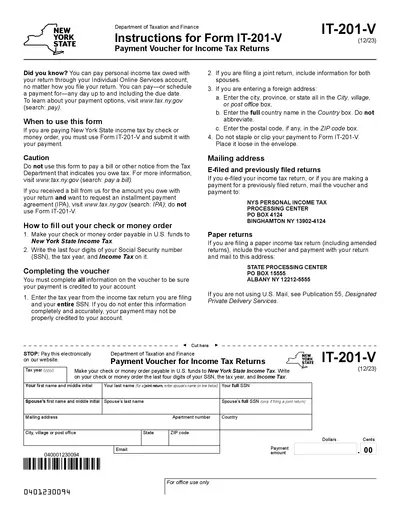

Instructions for Form IT-201-V Payment Voucher

This document provides instructions for filling out Form IT-201-V, which is used to submit payments for New York State income taxes by check or money order. It details when to use the form, how to complete it accurately, and where to mail it. The file also includes important contact information and privacy notices.

Property Taxes

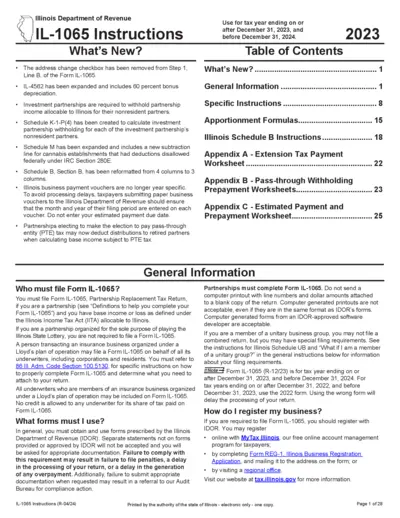

Illinois Department of Revenue IL-1065 Instructions 2023-2024

This document provides instructions for completing the IL-1065 form for the Illinois Department of Revenue. It includes new updates, general information, and specific instructions for the 2023-2024 tax year. Ensure accuracy by following the detailed guidelines.