Property Law Documents

Real Estate

Warranty Deed Document for Michigan Real Estate

This file is a Warranty Deed template for Michigan real estate transactions. It includes all necessary fields for property conveyance and warranty. Use this template to ensure compliance with Michigan recording statutes.

Real Estate

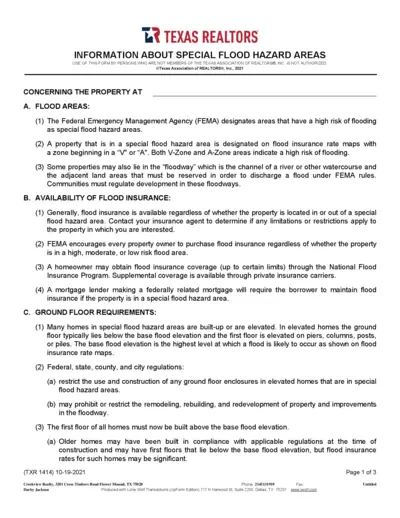

Texas REALTORS Special Flood Hazard Areas Information

This document provides essential information about Special Flood Hazard Areas as designated by FEMA. It includes details about flood insurance availability, ground floor requirements, compliance issues, and the importance of elevation certificates. Buyers and property owners can use this information to understand flood regulations and insurance requirements for properties located in flood-prone areas.

Property Taxes

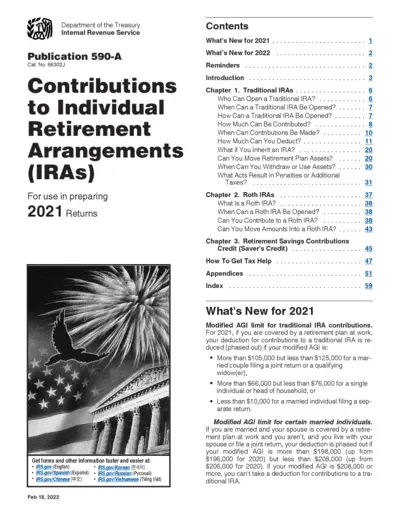

IRS Publication 590-A - Contributions to Individual Retirement Arrangements (IRAs)

Publication 590-A provides detailed information on contributions to Individual Retirement Arrangements (IRAs). It includes rules, limits, and guidelines for traditional and Roth IRAs. This publication is useful for taxpayers preparing their 2021 tax returns.

Property Taxes

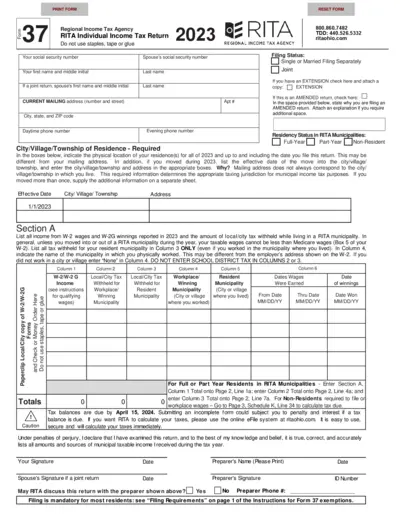

RITA Individual Income Tax Return Form 37 for 2023

This file contains the RITA Individual Income Tax Return Form 37 for the year 2023. It provides instructions and fields for reporting income, calculating taxes, and claiming refunds for residents of RITA municipalities. The form includes sections for W-2 wages, self-employment income, and other taxable income.

Real Estate

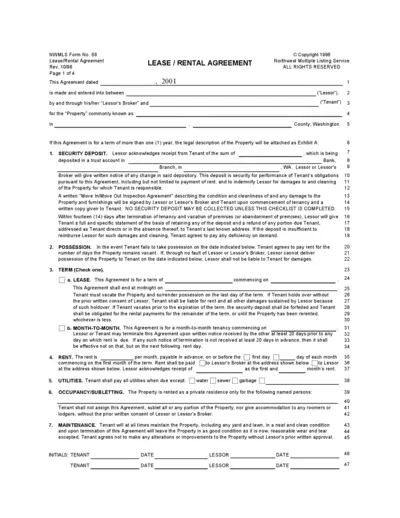

NWMLS Lease/Rental Agreement Form

This Lease/Rental Agreement Form is designed for Washington state landlords and tenants to formalize rental terms, property conditions, and compliance requirements. The standard form includes sections on security deposits, rent, maintenance, utilities, and other essential lease terms. Easily fill out, sign, and share the agreement.

Property Taxes

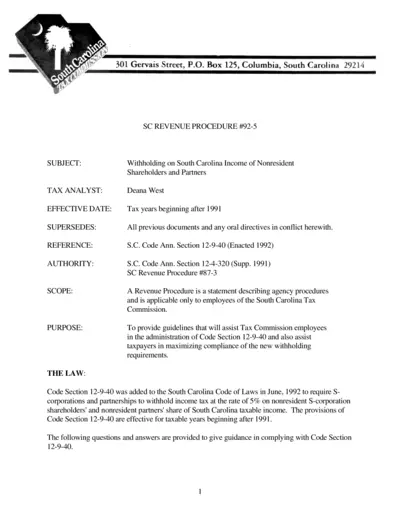

South Carolina Nonresident Income Tax Withholding Guidelines

This document provides detailed guidelines for withholding South Carolina Income Tax on nonresident shareholders and partners. It includes instructions on withholding rates, computation, remittance, and exceptions. South Carolina's tax compliance procedures are also covered.

Property Taxes

South Carolina 2022 Individual Income Tax Form and Instructions

This document contains the South Carolina Department of Revenue's 2022 SC1040 form and instructions for individual income tax filing. It includes filing guidelines, important dates, and payment options. This is essential for South Carolina residents to complete their state tax returns accurately and on time.

Property Taxes

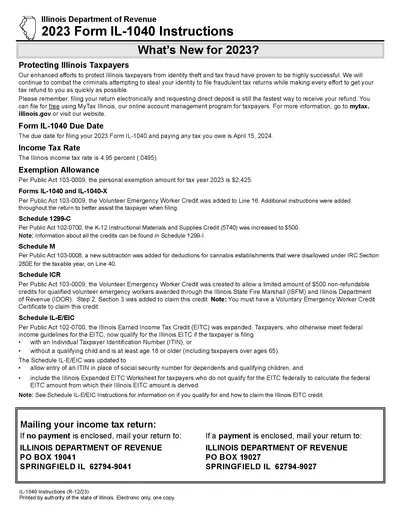

Illinois Department of Revenue, 2023 Form IL-1040 Instructions

This file contains detailed instructions and information for filing the 2023 Illinois Form IL-1040 tax return. It includes updates on tax rates, credits, and deductions relevant to Illinois taxpayers. The document also provides step-by-step guidance on how to complete and submit the form to the Illinois Department of Revenue.

Property Taxes

Creating a Written Information Security Plan for Tax & Accounting

This file provides comprehensive instructions and guidelines for creating a Written Information Security Plan (WISP) tailored for tax and accounting practices. It explains the requirements under the Gramm-Leach-Bliley Act and offers sample templates to assist professionals in safeguarding customer data. The document is designed to help tax professionals comply with legal requirements and protect sensitive information.

Property Taxes

PA Department of Revenue Form 1099-G and INT FAQs

This document provides answers to frequently asked questions about Pennsylvania Department of Revenue Forms 1099-G and 1099-INT. It explains what these forms are, why you might receive them, and how they affect your tax returns. It also offers guidance on what to do if you have questions or need corrections.

Property Taxes

IRS Publication 915: Social Security and Equivalent Railroad Retirement Benefits for 2023

This document provides federal income tax guidelines for social security and equivalent tier 1 railroad retirement benefits, including taxable benefits and deductions. It's updated with the latest rules and filing statuses. Beneficiaries will find explanatory notes for special cases and resources for further assistance.

Property Taxes

New York S Corporation Franchise Tax Return Instructions

Instructions for Form CT-3-S, the New York S Corporation Franchise Tax Return, detailing requirements and steps for filing.