Property Taxes Documents

Property Taxes

Connecticut Nonresident and Part-Year Resident Income Tax Return

The Connecticut Form CT-1040NR/PY is essential for nonresidents and part-year residents to file their income taxes. This form provides taxpayers with the necessary instructions to accurately report their income in Connecticut. Ensure you meet all requirements for a successful filing with this comprehensive guide.

Property Taxes

Florida Partnership Information Return - Form F-1065

The Florida Partnership Information Return, Form F-1065, is essential for partnerships filing taxes in Florida. This form captures income, adjustments, and partnership details. Ensure compliance with state tax regulations by accurately completing this return.

Property Taxes

2023 Form M1PR Homestead Credit Refund Instructions

This file provides essential instructions for completing the 2023 Form M1PR, a key tax form for claiming Homestead Credit Refunds. It assists homeowners and renters in understanding the requirements for tax refunds. Ensure you follow the guidelines carefully to maximize your potential refund.

Property Taxes

Colorado Charitable Contributions Tax Guide

This guide provides information on how to claim charitable contributions on your Colorado tax return. It outlines eligibility requirements and qualifying contributions. Use this document to ensure proper filing and maximize your deductions.

Property Taxes

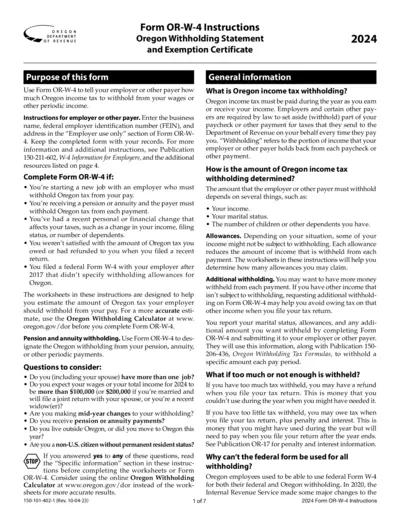

Oregon Withholding Statement Exemption Certificate

This document provides instructions for completing the Oregon Form OR-W-4 for withholding tax purposes. It outlines the necessary steps for employees and payers to ensure correct tax withholding. Use this form to communicate your tax withholding preferences to your employer.

Property Taxes

Instructions for IT-2663 Nonresident Real Property Tax

This document provides essential instructions for completing Form IT-2663 for nonresident individuals and entities involved in real property transactions in New York State. It outlines tax obligations related to property gains and the filing process. Users will find guidelines on how to accurately estimate and report their income tax liabilities for real estate sales or transfers.

Property Taxes

Schedule M Form 8858 Instructions and Details

This document provides detailed instructions for filling out Schedule M of Form 8858, related to foreign disregarded entities and foreign branches. It covers the necessary fields and transactions to report, ensuring compliance with IRS regulations. Utilize this guide to accurately prepare your submission to avoid errors.

Property Taxes

IRS Form 8949 Instructions and Reporting Relief

This file provides detailed instructions for completing IRS Form 8949. It explains the relief provided for reporting capital gain and loss transactions. Ideal for businesses and individuals needing guidance on capital asset reporting.

Property Taxes

Arizona Resident Personal Income Tax Form 140

This document outlines the Arizona Form 140 for Resident Personal Income Tax. It includes forms for filing taxes and instructions for taxpayers. Essential for residents filing their personal income taxes in Arizona.

Property Taxes

Furnishing Form 26A Electronically for Tax Benefits

This document outlines the procedure for electronically furnishing Form 26A to resolve withholding tax defaults. It highlights the necessary steps required to benefit from the changes in tax provisions. It's vital for taxpayers to understand how to utilize this form effectively.

Property Taxes

Form 1065-X Amended Return Instructions

Form 1065-X is used to request an amended return or administrative adjustment request for partnerships. This form is crucial for ensuring accurate partnership tax filings. Proper completion can help rectify errors on previously submitted returns.

Property Taxes

Kentucky Individual Income Tax Return Form 740 2021

The Kentucky Individual Income Tax Return Form 740 is for residents to report their income and calculate their tax liability. It includes sections for personal information, income adjustments, deductions, and tax credits. This form must be completed accurately to ensure compliance with state tax regulations.