Property Taxes Documents

Property Taxes

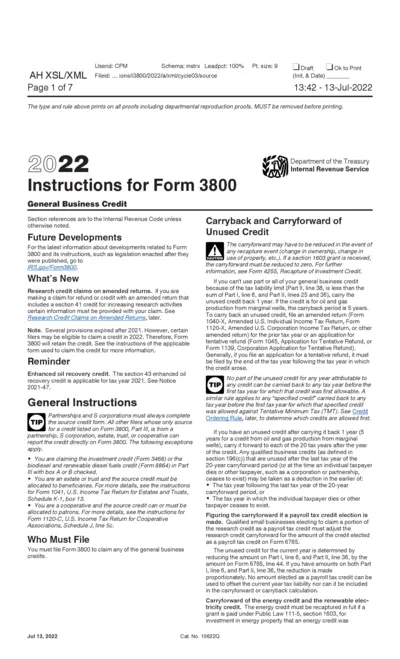

Instructions for Form 3800: General Business Credit

This file contains essential instructions for Form 3800, which details the general business credit. It offers guidelines and relevant updates for tax filers. Understanding these instructions is crucial for accurate tax reporting and credit claims.

Property Taxes

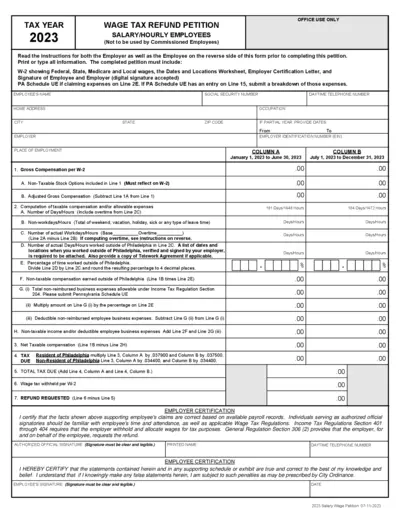

2023 Wage Tax Refund Petition Form for Employees

This file contains the Wage Tax Refund Petition for salary and hourly employees. It includes essential filing instructions and necessary documents for tax-related claims. Use this form to claim a refund for withheld wage tax.

Property Taxes

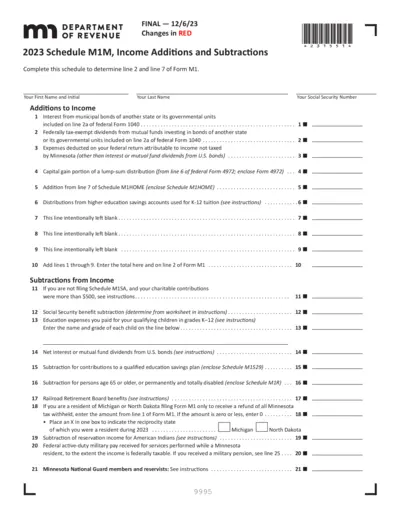

2023 Schedule M1M Income Additions and Subtractions

This file contains detailed instructions for the 2023 Schedule M1M, which is used to report income additions and subtractions. It provides guidance on how to complete the form to determine your taxable income effectively. Essential for individuals looking to comply with Minnesota tax regulations.

Property Taxes

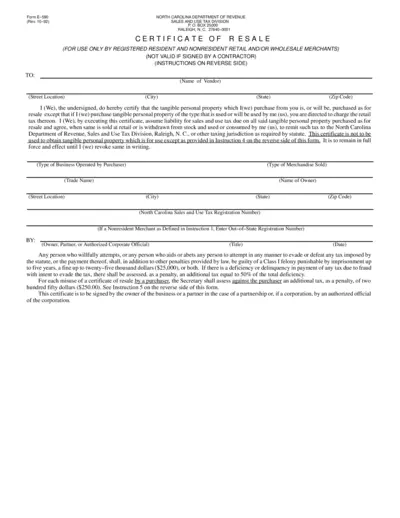

North Carolina Resale Certificate Form E-590 Instructions

The North Carolina E-590 form is a resale certificate for registered merchants, allowing them to purchase tangible personal property for resale. It outlines the requirements and responsibilities of merchants while providing a legal framework for tax exemptions on resale items. Completing this form accurately is essential for compliance with state tax regulations.

Property Taxes

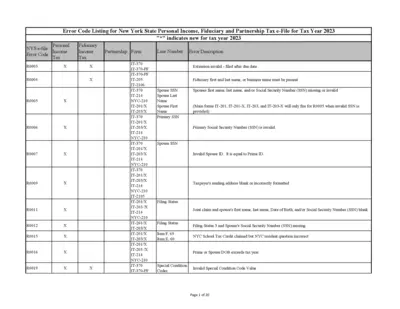

New York State Personal Income Tax e-File Error Codes

This document lists error codes for New York State Personal Income, Fiduciary and Partnership Tax e-File for the 2023 tax year. It provides essential error codes and descriptions to assist taxpayers in identifying and correcting filing issues. Understanding these codes will help ensure accurate and timely submission of tax returns.

Property Taxes

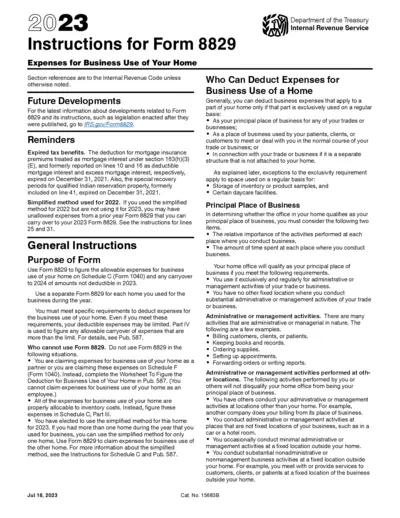

IRS Form 8829 Instructions for Business Home Use

This file provides detailed guidance on completing Form 8829 for deducting business expenses related to the use of your home. It outlines eligibility criteria, necessary calculations, and specific instructions for various scenarios. Ideal for taxpayers who need clarity on home office deductions.