Property Taxes Documents

Property Taxes

New Jersey Transfer Inheritance Tax Instructions

This document provides comprehensive guidance on the New Jersey Transfer Inheritance Tax. It outlines tax rates, exemptions, and filing requirements necessary for beneficiaries. Perfect for anyone navigating the complexities of estate and inheritance tax in New Jersey.

Property Taxes

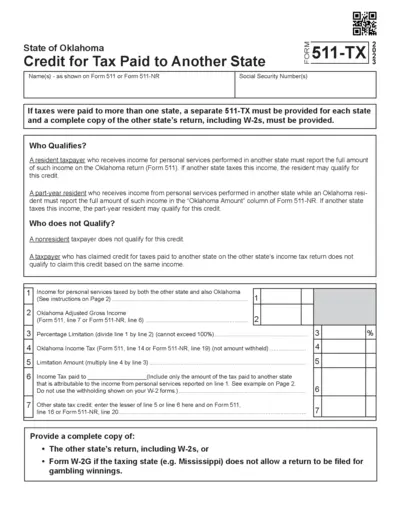

Oklahoma Credit for Tax Paid to Another State Form 511-TX

The Oklahoma 511-TX form allows residents and part-year residents to claim a credit for taxes paid to another state. Taxpayers must report income taxed in both states to qualify. This form requires a complete copy of the other state's return.

Property Taxes

Oregon Annual Withholding Tax Reconciliation Form

The Oregon Annual Withholding Tax Reconciliation Form (Form OR-WR) is essential for all Oregon employers. It ensures proper reporting of withholding taxes for the year 2017. This form must be submitted by January 31, 2018, to avoid penalties.

Property Taxes

2023 Form 1040-V Payment Voucher Instructions

This file contains the payment details and instructions for Form 1040-V for the year 2023. It provides guidance on filling out the form and submitting payments electronically or via check. Essential for taxpayers who owe amounts on their tax returns.

Property Taxes

Arkansas Individual Income Tax Forms and Instructions

This document provides essential forms and instructions for Arkansas Individual Income Tax for residents, part-year residents, and nonresidents. It includes information about e-filing, taxpayer assistance, and important contacts. Ideal for taxpayers looking to file their state income taxes accurately and efficiently.

Property Taxes

IRS Form 14654 Certification for Offshore Procedures

Form 14654 is utilized by U.S. taxpayers who are residing in the United States for certifying compliance with Streamlined Domestic Offshore Procedures. This form captures information related to foreign financial assets and tax returns for the past three years. It is essential for individuals seeking to rectify past non-compliance with U.S. tax laws.

Property Taxes

Maryland Sales and Use Tax Form 202 Instructions

This document provides detailed instructions for completing Maryland's Sales and Use Tax Form 202. It covers eligibility criteria, taxable sales, and refund processes. Ensure compliance and accurate reporting with the guidelines outlined here.

Property Taxes

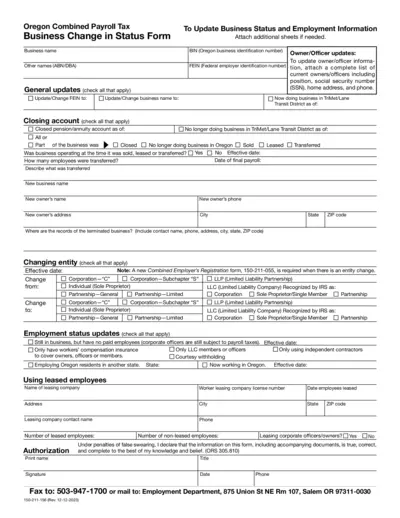

Oregon Combined Payroll Tax Business Change Form

This form allows Oregon businesses to update their employment and business status. It is essential for compliance with payroll tax regulations. Use this to report changes to the Employment Department or other agencies.

Property Taxes

Instructions for Form 8949 Sales and Dispositions

This file provides vital instructions for filling out Form 8949, designed for reporting sales and other dispositions of capital assets. It outlines necessary steps, requirements, and details needed for accurate submission. Essential for individuals and businesses alike to ensure proper tax compliance.

Property Taxes

Maryland Form 510D Pass-Through Entity Income Tax

Maryland Form 510D is used by pass-through entities to declare and remit estimated income tax. This form is essential for nonresident members and entities to ensure compliance with Maryland tax laws. By completing and submitting this form, entities can manage their tax obligations effectively.

Property Taxes

DeKalb County PT-61 Tax Filing Form Instructions

This PT-61 form is used for tax computation and filing in DeKalb County. It contains sections for seller and buyer information, property details, and tax payment calculation. Ensure you fill out all sections accurately to avoid issues.

Property Taxes

Instructions for Form 8829 Business Use of Home

This file provides comprehensive instructions on how to fill out Form 8829 for calculating expenses related to the business use of your home. It includes future developments, reminders about expired benefits, and specific guidelines for different types of users. Essential for business owners who want to maximize their tax deductions.