Property Taxes Documents

Property Taxes

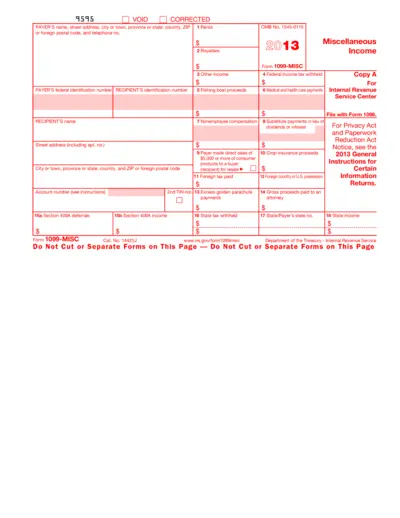

Form 1099-MISC: Miscellaneous Income for 2013

This file is a 2013 version of the IRS Form 1099-MISC used to report miscellaneous income. It includes fields for reporting various types of payments made to individuals or entities. The form is typically filed by payers to report income paid to recipients.

Property Taxes

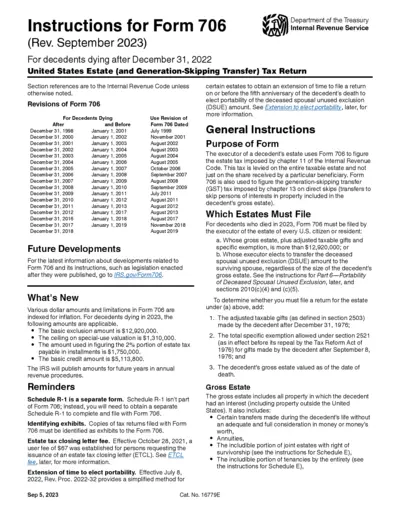

Instructions for Form 706 (Rev. September 2023)

This document provides detailed instructions for completing Form 706, the United States Estate (and Generation-Skipping Transfer) Tax Return for decedents dying after December 31, 2022. It includes information on revisions, general instructions, and specific filing requirements. The instructions also cover important updates and reminders related to the form.

Property Taxes

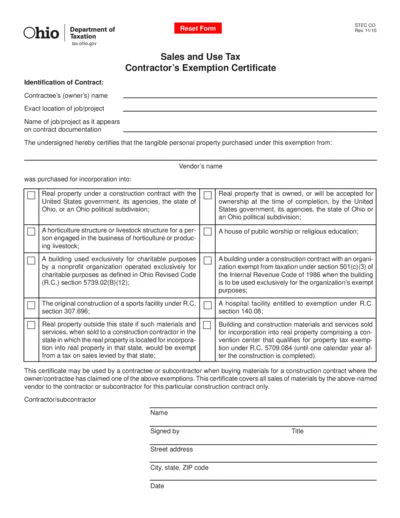

Ohio Sales and Use Tax Contractor's Exemption Certificate

This document is the Ohio Sales and Use Tax Contractor's Exemption Certificate. Contractors use this form to claim exemptions on certain taxable goods for specified exempt uses. It's crucial for contractors working with tax-exempt entities or on tax-exempt projects.

Property Taxes

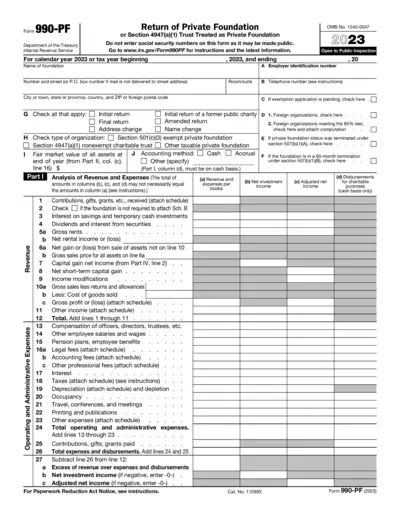

Return of Private Foundation Form 990-PF 2023

Form 990-PF is a return for private foundations required by the IRS. It includes information on revenue, expenses, and other financial details. Avoid entering social security numbers on this form.

Property Taxes

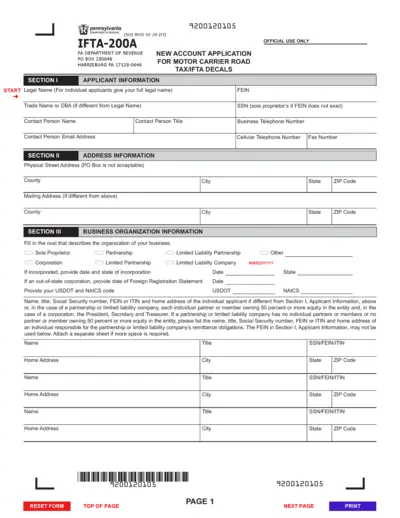

Pennsylvania Motor Carrier Road Tax/IFTA Decals Application

This file is the application form for new accounts needing Pennsylvania Motor Carrier Road Tax (MCRT) and/or International Fuel Tax Agreement (IFTA) decals. It captures applicant, business organization, address and tax reporting service information, along with exemptions, decal requests and certifications. This form must be filled out completely and accurately to ensure proper processing and issuance of the decals.

Property Taxes

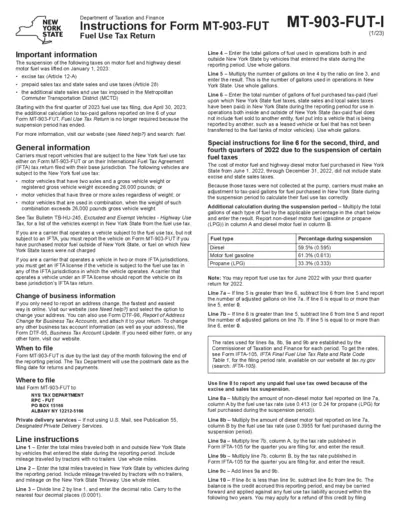

New York State Fuel Use Tax Return Instructions

Instructions for completing the New York State Form MT-903-FUT, including details on fuel use tax, reporting requirements, and filing deadlines.

Property Taxes

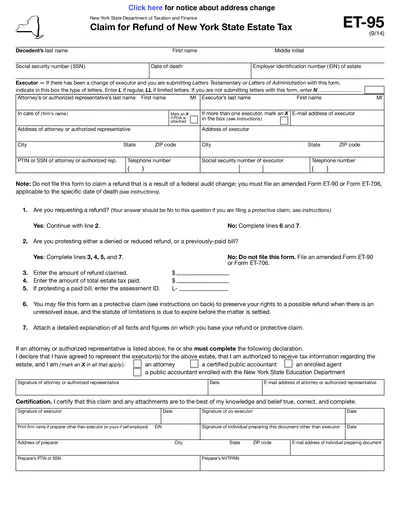

Claim for Refund of New York State Estate Tax - ET-95 Form

The ET-95 form is used to claim a refund of New York State estate tax for protested denied refunds, protective claims, and protested paid bills. This form must be filled accurately to ensure the claim is processed correctly. Learn how to fill, edit, and submit this form using our PDF editor.

Property Taxes

H&R Block 2023 Tax Forms and Instructions Overview

This file contains a comprehensive list of H&R Block tax forms and instructions for the tax year 2023. It includes forms for individual income tax returns, health coverage, credits, and various other tax-related documents. Users can find detailed instructions on how to fill out these forms.

Property Taxes

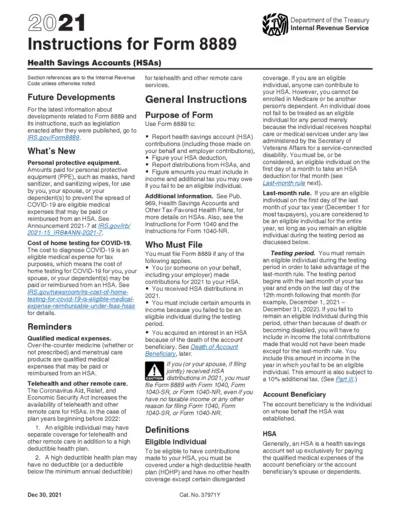

2021 Instructions for Form 8889, Health Savings Accounts

This file contains detailed information and instructions on filling out Form 8889 for Health Savings Accounts (HSAs), including new updates, general instructions, who must file, definitions, and specific instructions.

Property Taxes

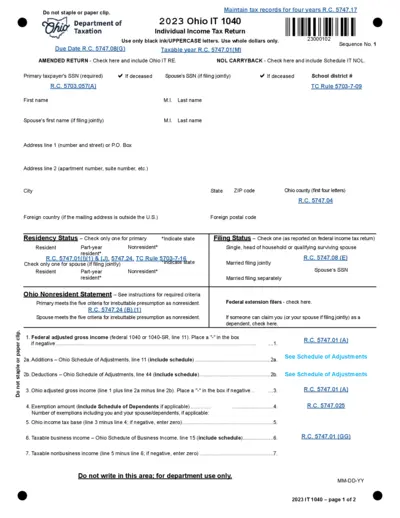

Ohio IT 1040 Individual Income Tax Return 2023

This file is for the 2023 Ohio IT 1040 Individual Income Tax Return. It includes detailed instructions for residents, nonresidents, and part-year residents. It also provides information on credits, deductions, and income reporting.

Property Taxes

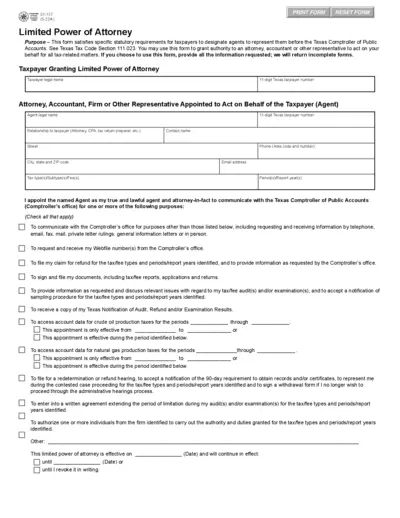

Texas Comptroller Limited Power of Attorney Form

This form grants limited power of attorney for taxpayers to designate agents. It allows representatives to act on taxpayers' behalf. Ensure all required information is provided.

Property Taxes

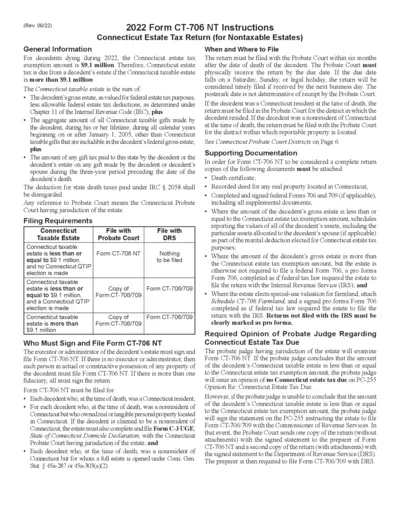

CT-706 NT Nontaxable Estates Form Instructions

This document provides detailed instructions for filling out the Connecticut Estate Tax Return (CT-706 NT) for non-taxable estates. It includes filing requirements, necessary documentation, and steps for proper submission.