Property Taxes Documents

Property Taxes

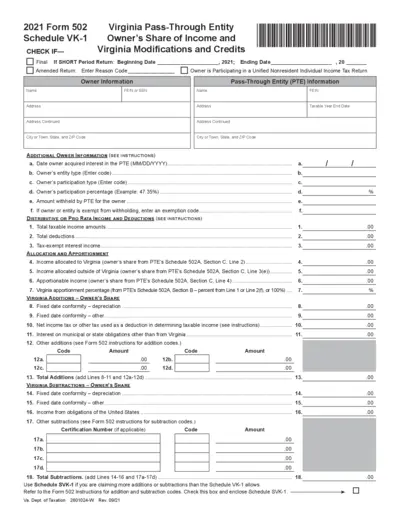

2021 Virginia Schedule VK-1 Owner's Share Income

This file provides details about the Owner's Share of Income for Virginia's Pass-Through Entities. It includes instructions for completing the form and information about Virginia tax credits. Ideal for business owners and tax professionals dealing with Virginia taxation.

Property Taxes

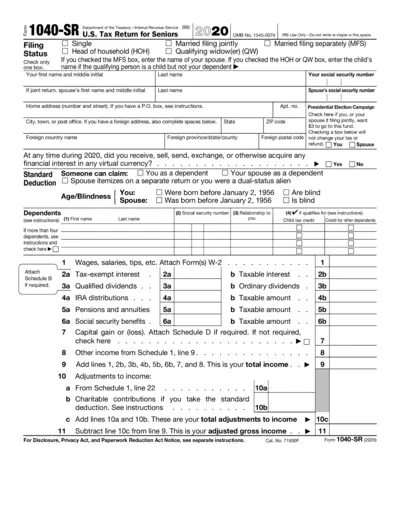

U.S. Tax Return for Seniors 2020 - Form 1040-SR

The 1040-SR form is designed for seniors to file their taxes. It simplifies the tax filing process with clear instructions. Use this form to report your income and claim deductions effectively.

Property Taxes

Client Tax Return Disclosure Consent Form

This document outlines the rules for disclosing your tax return information. It ensures you understand your rights regarding your tax data. Please read carefully to know how your information is handled.

Property Taxes

IRS Form W-4V Voluntary Withholding Request

Form W-4V enables individuals receiving specific government payments to request federal income tax withholding. This file contains vital information for tax purposes. Ensure proper withholding by following the instructions carefully.

Property Taxes

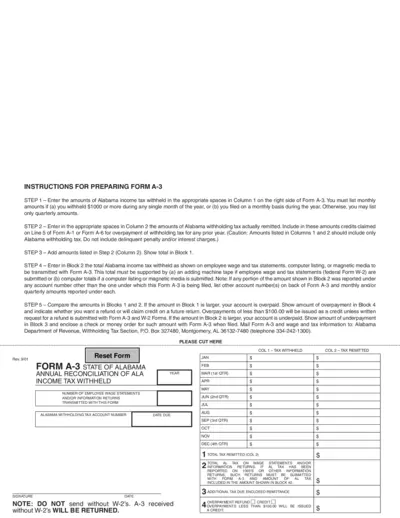

Alabama Form A-3 Annual Reconciliation Instructions

This file contains detailed instructions for completing Form A-3 for Alabama income tax withholding. It guides users through the necessary steps to accurately report tax withheld and remitted. Users can refer to these instructions to ensure compliance with state tax regulations.

Property Taxes

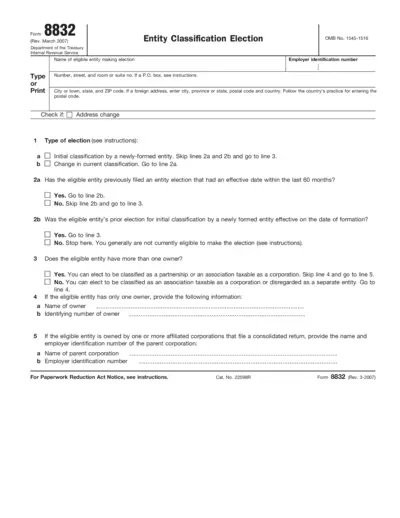

Form 8832 Entity Classification Election Instructions

Form 8832 is used for electing the classification of eligible entities for federal tax purposes. This file provides step-by-step instructions for properly completing the form. It is essential for business entities aiming for the correct classification with the IRS.

Property Taxes

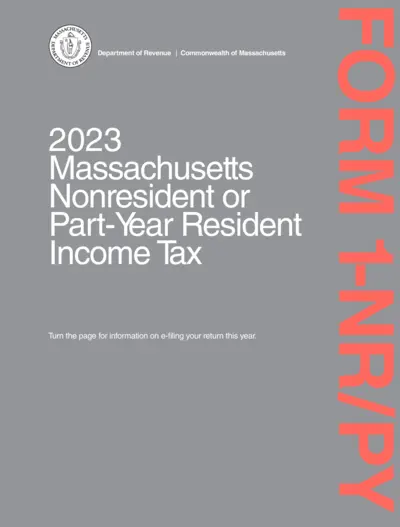

Massachusetts Nonresident Part-Year Resident Income Tax

This file provides comprehensive instructions for filing the Massachusetts Form 1-NR/PY for nonresidents and part-year residents. It offers important information about eligibility, filing requirements, and due dates. Utilize this file to ensure accurate and timely submission of your tax return.

Property Taxes

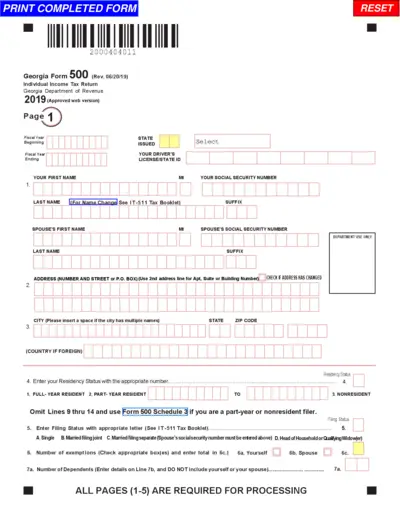

Georgia Form 500 Individual Income Tax Return

Georgia Form 500 is an important document used for filing individual income tax returns in the state of Georgia. This form provides essential details required for accurate tax reporting and ensures compliance with state tax regulations. It is crucial for residents and part-year residents who need to report their income and calculate their tax liabilities.

Property Taxes

Montana MW-3 Wage Withholding Tax Instructions

The Montana MW-3 form is designed for employers to report annual wage withholding tax. This easy-to-use form allows for electronic filing, payment, and submission of W-2s and 1099s. Ensure compliance with Montana's tax laws by following the detailed instructions provided.

Property Taxes

Texas Nexus Questionnaire - AP-114 Form Details

The Texas Nexus Questionnaire helps entities provide necessary information for tax purposes in Texas. It includes instructions on business activities, legal names, and federal identification. This form is essential for compliance with Texas tax regulations.

Property Taxes

Power of Attorney and Declaration of Representative

This file is essential for appointing a representative to handle tax matters. It grants limited authority to discuss confidential issues. Users must complete this form accurately to ensure proper representation.

Property Taxes

Philadelphia Business Income & Receipts Tax 2022

This file is the 2022 Business Income & Receipts Tax form for the City of Philadelphia. It provides essential details for filing tax returns and understanding tax liability. Follow the given instructions to accurately complete the form.