Property Taxes Documents

Property Taxes

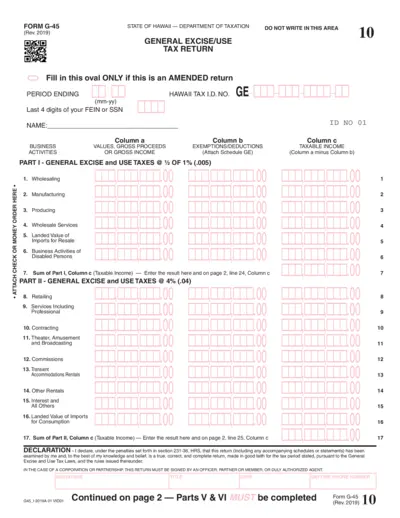

Hawaii Department of Taxation Form G-45 Instructions

This file contains important instructions and details for filling out Form G-45, which is the General Excise/Use Tax return for businesses in Hawaii. It provides guidelines for reporting gross income and calculating taxes owed. Users are encouraged to review this document carefully to ensure compliance with state tax requirements.

Property Taxes

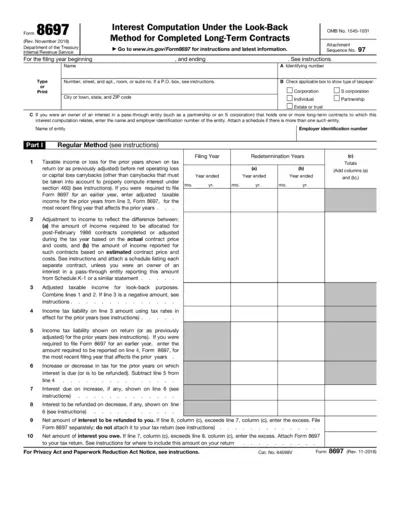

Interest Computation Look-Back Method for Contracts

Form 8697 is used for computing interest under the look-back method for completed long-term contracts. It is crucial for taxpayers involved in long-term contracts to accurately report their tax liability. This form ensures proper allocation of income and consideration of adjustments for the prior years.

Property Taxes

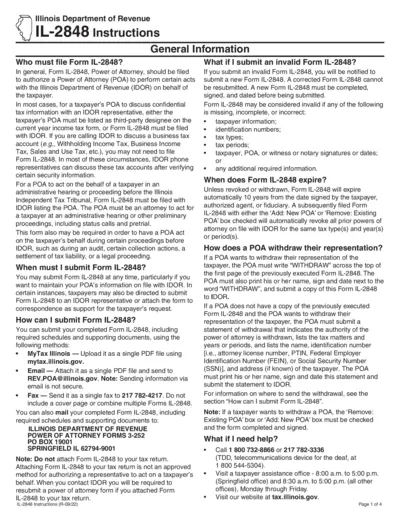

IL-2848 Power of Attorney Instructions for Illinois

Form IL-2848 provides guidance for taxpayers in Illinois to authorize a Power of Attorney. This form is essential for allowing your representative to act on your behalf for various tax matters. Proper submission ensures compliance and expedites communication with the Illinois Department of Revenue.

Property Taxes

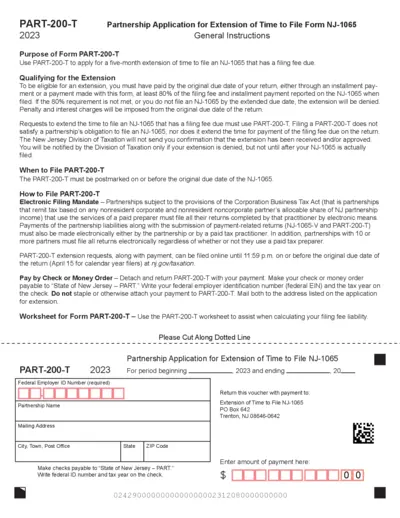

NJ Partnership Extension Application PART-200-T

The PART-200-T form is used for applying for a five-month extension to file the NJ-1065. This extension allows partnerships to submit their returns later while managing filing fees. Failure to meet specific requirements could lead to penalties.

Property Taxes

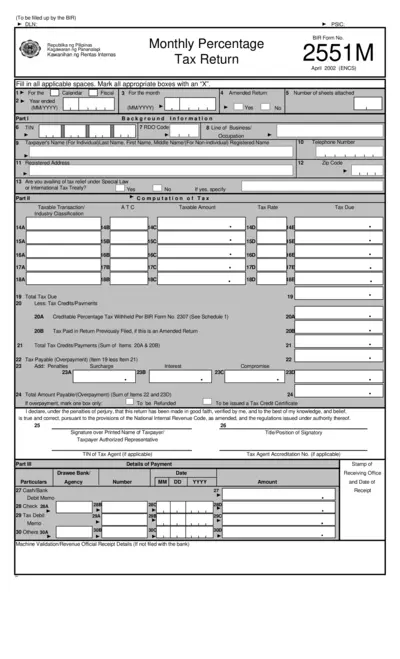

BIR Form 2551M Monthly Percentage Tax Return

This PDF form is crucial for taxpayers filing their monthly percentage tax return in the Philippines. It contains detailed sections for taxpayer information, computation of tax, and payment instructions. Utilize this form to ensure compliance with local tax regulations.

Property Taxes

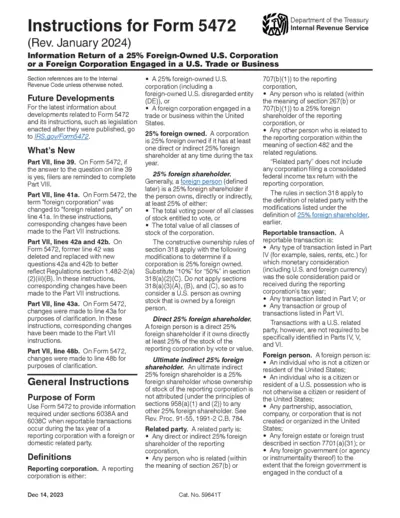

Instructions for Form 5472 Information Return

This file contains the detailed instructions for Form 5472, which is used by foreign-owned U.S. corporations or foreign corporations engaged in U.S. trade. It provides essential information required under sections 6038A and 6038C during a reporting corporation's tax year.

Property Taxes

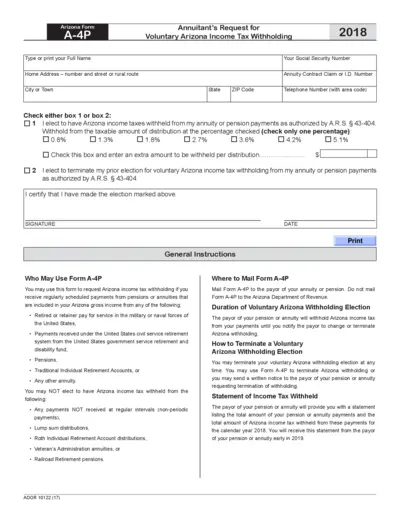

Arizona Form A-4P Voluntary Income Tax Withholding

The Arizona Form A-4P allows annuitants to request voluntary income tax withholding from their pension or annuity payments. This form is essential for ensuring monthly tax compliance. Completing this form accurately ensures proper withholding from your taxable distributions.

Property Taxes

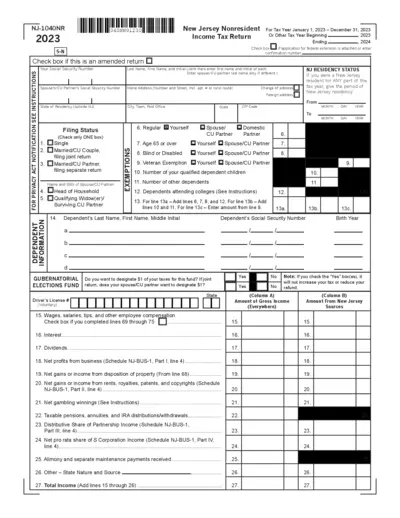

New Jersey Nonresident Income Tax Return 2023

This file is the New Jersey Nonresident Income Tax Return for the tax year 2023. It allows nonresidents to report their taxable income and calculate the taxes owed. Complete this form to ensure compliance with New Jersey tax laws.

Property Taxes

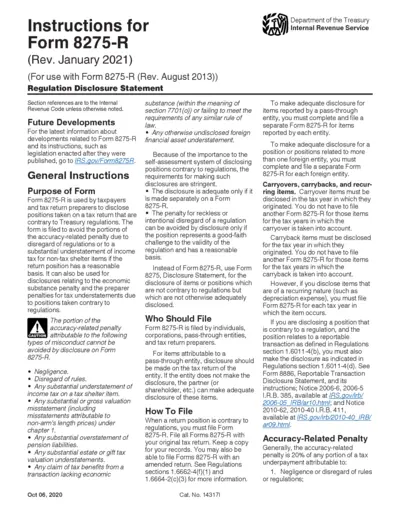

Form 8275-R Instructions for Regulation Disclosure

This document provides comprehensive instructions for filling out Form 8275-R. It includes information on filing requirements, penalties, and disclosure obligations. Taxpayers and preparers should consult these instructions to ensure compliance with the IRS.

Property Taxes

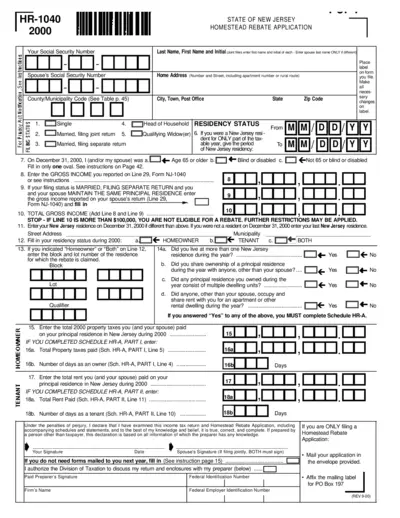

New Jersey Homestead Rebate Application Guide

This document provides the necessary instructions and information to correctly file the New Jersey Homestead Rebate Application. It includes detailed sections on eligibility, filing status, and necessary information for applicants. Users can refer to this document to ensure they meet all requirements and submit accurately.

Property Taxes

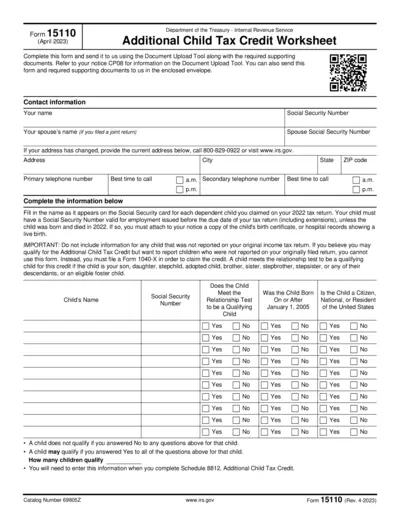

Additional Child Tax Credit Worksheet Form 15110

The Additional Child Tax Credit Worksheet helps individuals claim the Additional Child Tax Credit. This form is essential for taxpayers to report dependent children correctly. Fill this form accurately to ensure your claim is processed efficiently.

Property Taxes

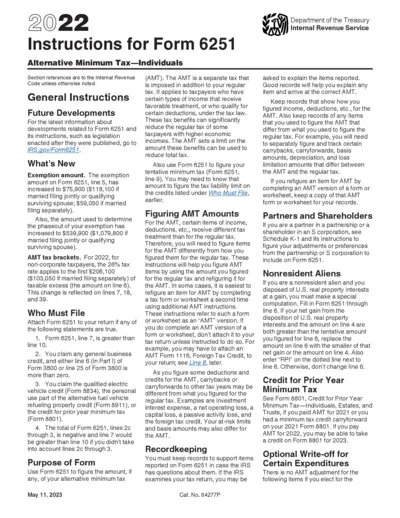

Instructions for Form 6251: Alternative Minimum Tax

This file provides essential instructions for filling out Form 6251 for the Alternative Minimum Tax. It outlines important guidelines, exemptions, and who must file. Understanding this form is crucial for correct tax reporting.