Property Taxes Documents

Property Taxes

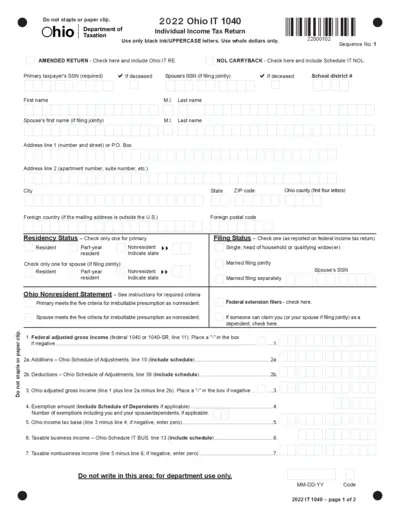

2022 Ohio IT 1040 Individual Income Tax Return

The 2022 Ohio IT 1040 is essential for residents filing their individual income taxes. It provides guidance on forms and instructions for various tax situations. Complete this form accurately to ensure compliance and avoid penalties.

Property Taxes

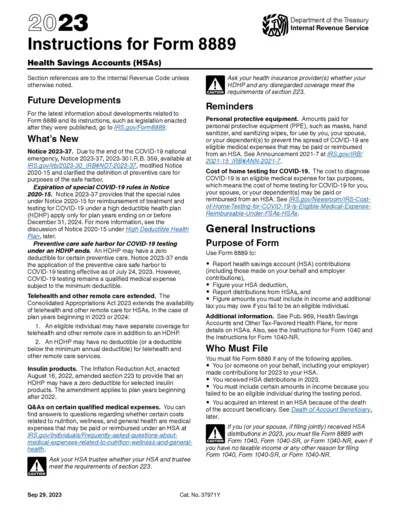

Instructions for Form 8889 Health Savings Accounts

This document provides vital instructions on filling out Form 8889, which is used for Health Savings Accounts (HSAs). It explains eligibility, contributions, and distribution reporting. This is essential for taxpayers managing their HSAs.

Property Taxes

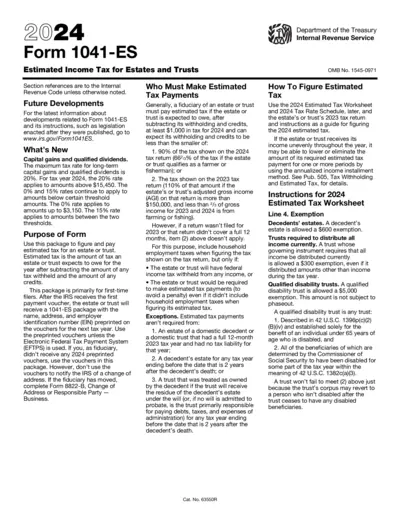

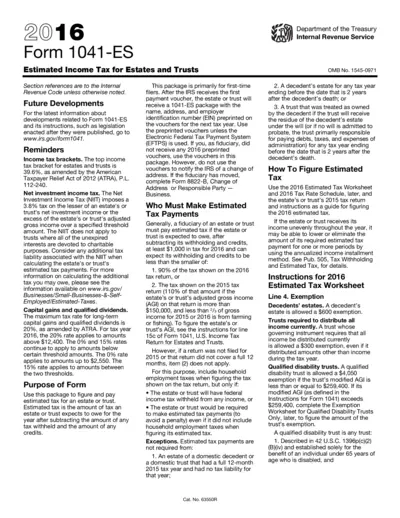

2024 Form 1041-ES Estimated Income Tax Instructions

This document provides essential instructions for filing Form 1041-ES, the Estimated Income Tax for Estates and Trusts for the year 2024. It details estimated tax payment requirements, filing deadlines, and important exemptions. Perfect for fiduciaries managing estates or trusts.

Property Taxes

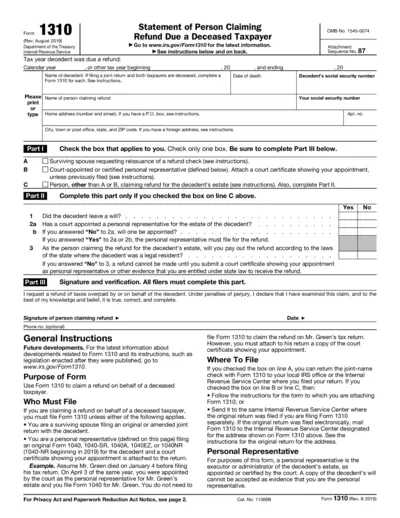

IRS Form 1310 Claim Refund Deceased Taxpayer

IRS Form 1310 allows individuals to claim a tax refund on behalf of a deceased taxpayer. It is essential for personal representatives and surviving spouses to ensure proper execution. This form is vital for managing estate taxes and refunds efficiently.

Property Taxes

Form 1041-ES Estimated Income Tax for Estates

This file provides essential instructions and details on filing estimated tax payments for estates and trusts. It outlines the requirements and guidelines necessary for compliance. Users can benefit from understanding the payment schedules and exemptions applicable to their estates or trusts.

Property Taxes

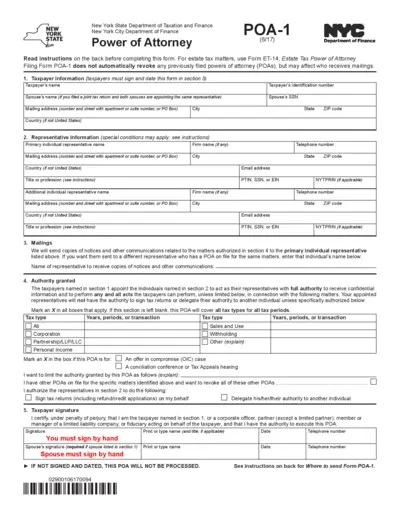

New York State Power of Attorney Form Instructions

This file provides detailed instructions on how to complete the New York State Power of Attorney Form POA-1. It includes information about the necessary taxpayer information, representative information, and filing instructions. Ensure compliance with tax obligations and authority granted.

Property Taxes

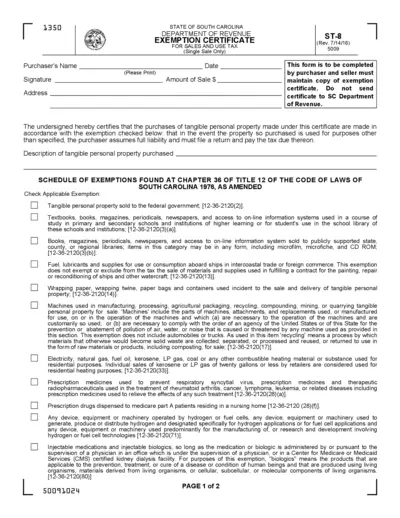

South Carolina Sales and Use Tax Exemption Certificate

The South Carolina Sales and Use Tax Exemption Certificate is essential for individuals and organizations to claim tax exemptions on purchases. This document outlines the necessary steps and exemptions applicable under South Carolina state law. Completing this certificate accurately ensures compliance and facilitates tax savings.

Property Taxes

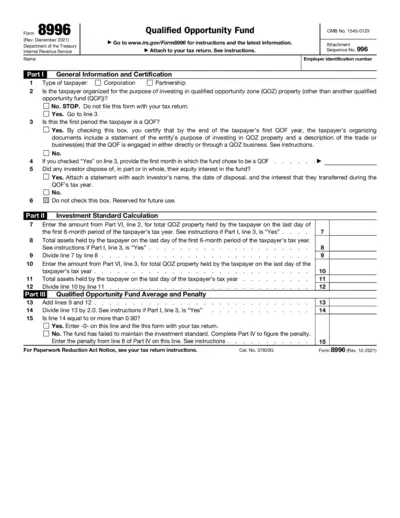

Form 8996 Instructions for Qualified Opportunity Fund

Form 8996 is used to certify a Qualified Opportunity Fund (QOF). Properly filled out, this form helps in tax benefits related to investments in Opportunity Zones. Ensure to follow the guidelines provided to maintain compliance.

Property Taxes

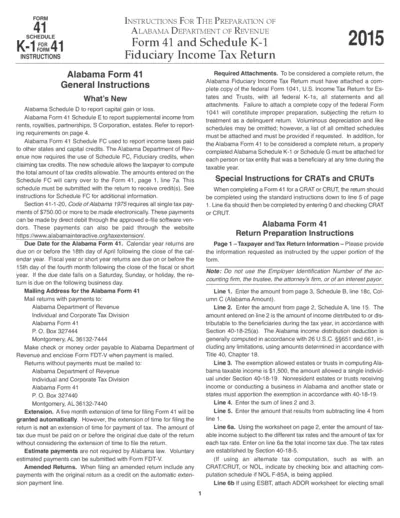

Alabama Form 41 Instructions and Schedule K-1 Details

This file provides comprehensive instructions for completing the Alabama Form 41 and its associated Schedules. It covers submission guidelines, important dates, and the necessary attachments required for a successful filing. Designed for fiduciaries and tax professionals, this guide aims to simplify the preparation process.

Property Taxes

Instructions for Form 8960 - Net Investment Income Tax

This document provides detailed instructions for completing Form 8960. It outlines the process for calculating Net Investment Income Tax for individuals, estates, and trusts. Users can find necessary definitions, filing requirements, and key updates within the document.

Property Taxes

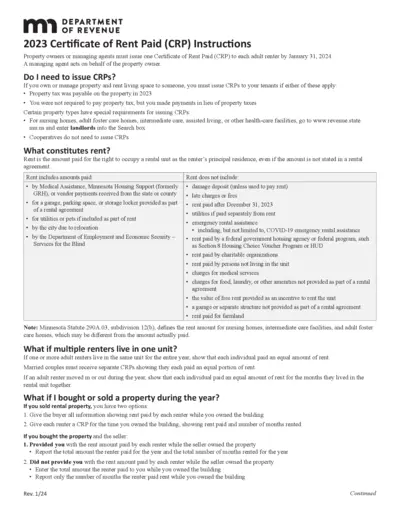

2023 Certificate of Rent Paid Instructions

The 2023 Certificate of Rent Paid (CRP) Instructions provide essential information for property owners and managers on issuing CRPs to tenants by January 31, 2024. It details the conditions under which CRPs are required and guidelines for filling them out accurately. This document is crucial for ensuring compliance with Minnesota state requirements regarding rental properties.

Property Taxes

IRS Form 2555-EZ Foreign Earned Income Exclusion

Form 2555-EZ allows U.S. citizens to exclude foreign earned income. This form helps in avoiding double taxation for individuals working abroad. Proper completion is essential for accurate tax reporting.