Property Taxes Documents

Property Taxes

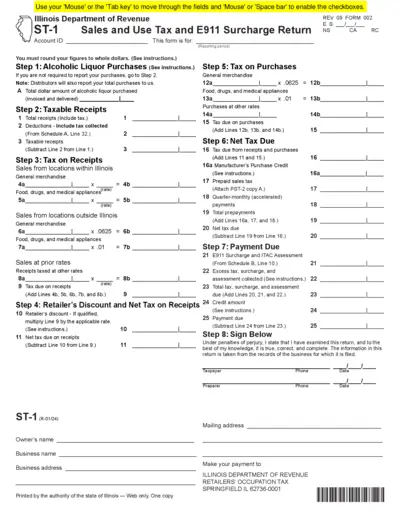

Illinois Sales and Use Tax Return Instructions

This document provides users with detailed instructions on how to fill out the Illinois ST-1 Sales and Use Tax Return. It includes guidance on various steps and calculations required for compliance. Perfect for business owners in Illinois who need to file their taxes accurately.

Property Taxes

Franchise and Excise Tax Return Instructions

This document contains detailed instructions on how to complete the Franchise and Excise Tax Return. It is essential for businesses operating in Tennessee to ensure compliance. The instructions include filing requirements, tax computations, and important timelines.

Property Taxes

Engagement Letter for Tax Form Preparation

This document outlines the engagement terms for tax form preparation. It specifies responsibilities of both the CPA firm and the client. Essential for ensuring compliance and understanding the structure of the engagement.

Property Taxes

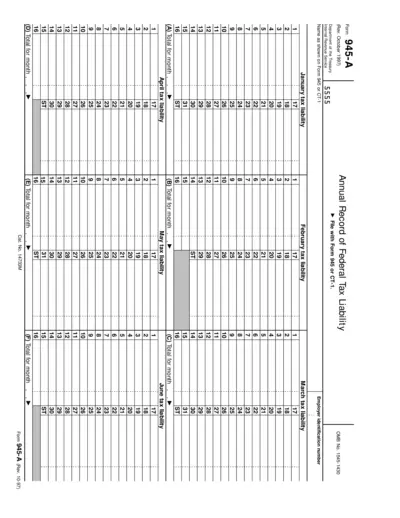

Form 945-A Annual Record of Federal Tax Liability

Form 945-A is used to report annual federal tax liabilities related to nonpayroll income. It is essential for businesses that withhold taxes on various income types, including pensions and gambling winnings. Correct completion of Form 945-A ensures accurate tax reporting to the IRS.

Property Taxes

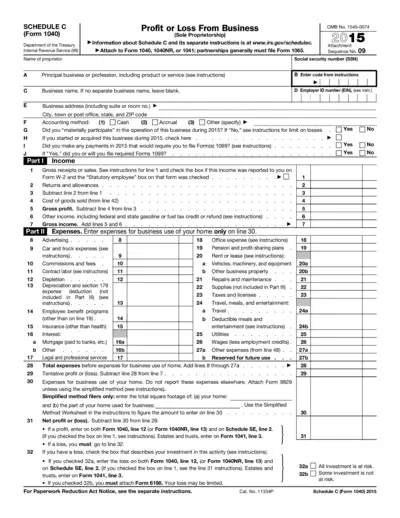

Schedule C Form 1040 Instructions for Business Filers

This document provides detailed instructions for completing Schedule C, the form used for reporting profit or loss from a business operated as a sole proprietorship. It includes essential guidelines on reporting income, expenses, and calculating net profit or loss for tax purposes. Ideal for individuals claiming business income on their personal tax returns.

Property Taxes

Maryland 2022 Form 511 Instructions for Pass-Through Tax

This file provides essential instructions for completing the Maryland Form 511 for Electing Pass-Through Entities in 2022. It details necessary steps for filing and important tax credits available. Perfect for business entities to ensure compliance and accurate tax returns.

Property Taxes

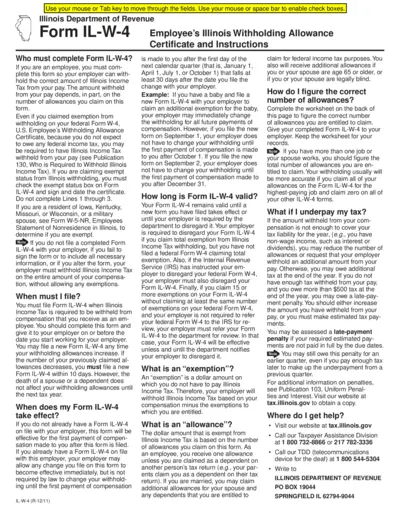

Employee's Illinois Withholding Allowance Form IL-W-4

The Illinois Form IL-W-4 is essential for employees to determine the correct amount of state income tax to withhold from their pay. It allows you to claim allowances that may reduce your withholdings based on personal circumstances. Complete this form to ensure accurate tax withholding and avoid surprises during tax filing.

Property Taxes

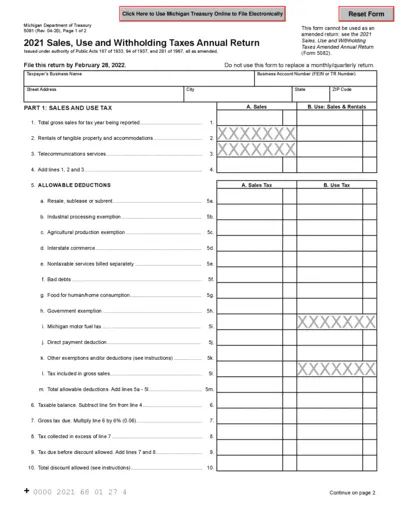

Michigan Treasury Sales Use and Withholding Tax Return

This file contains the Michigan Department of Treasury's 2021 Sales, Use and Withholding Taxes Annual Return (Form 5081). Complete and submit by the due date to ensure compliance with state tax regulations. Utilize the detailed instructions provided for accurate filing.

Property Taxes

Form 940 2024 Employer's Annual Federal Unemployment Tax Return

This is the IRS Form 940 for 2024, used by employers to report and pay Federal Unemployment Tax (FUTA). This form is essential for all employers who need to fulfill their federal tax obligations. Make sure to follow the instructions carefully to ensure accurate submission.

Property Taxes

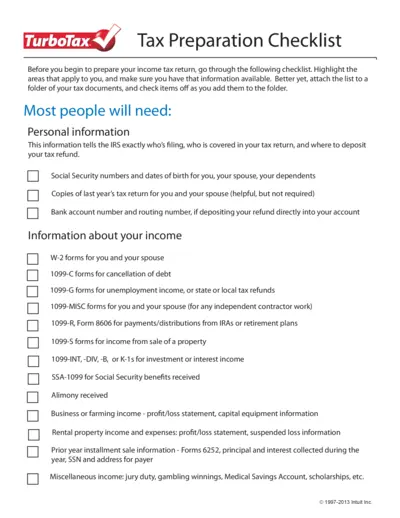

Tax Preparation Checklist for TurboTax Users

This TurboTax Tax Preparation Checklist helps users gather necessary information for filing their income tax return. Completing this checklist ensures you have all required documents to maximize your tax refund. Follow these guidelines to streamline your tax preparation process.

Property Taxes

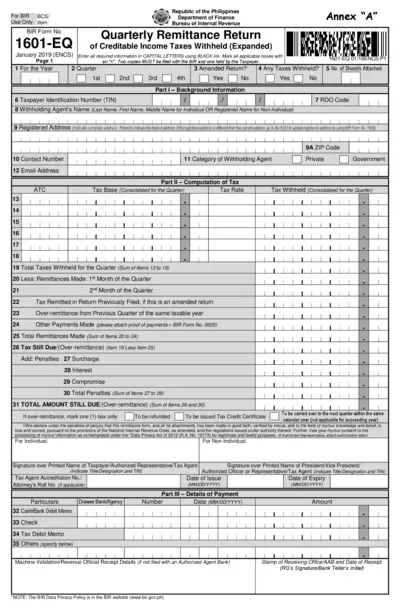

BIR Form 1601-EQ Quarterly Income Tax Remittance

This file contains the BIR Form 1601-EQ, which is used for the quarterly remittance of creditable income taxes withheld. It provides all the necessary instructions and requirements for submitting the form. Ensure your information is accurate to avoid penalties.

Property Taxes

IRS Form 8949 Instructions for Tax Filing 2024

This document provides instructions for Form 8949, which is used to report sales and other dispositions of capital assets. Users can learn how to fill out the form correctly and understand its purpose within the tax filing process. Designed for both individuals and businesses, this form helps in accurately reporting financial transactions to the IRS.