Property Taxes Documents

Property Taxes

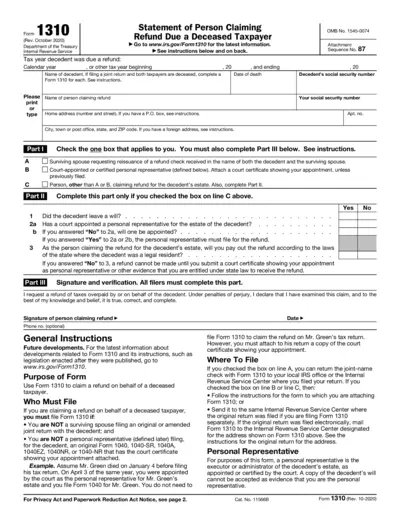

Form 1310 Instructions for Claiming Deceased Taxpayer Refunds

Form 1310 is used to claim a tax refund for a deceased taxpayer. This guide provides essential instructions and details for users filing this form. Ensure you meet the eligibility requirements before completing the form.

Property Taxes

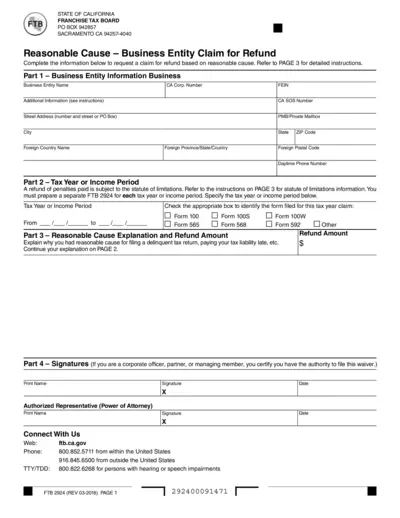

California Franchise Tax Board Refund Claim

This file offers a claim form for refund based on reasonable cause for business entities. It provides guidelines on filing and necessary details. Ensure to carefully follow the instructions for a successful submission.

Property Taxes

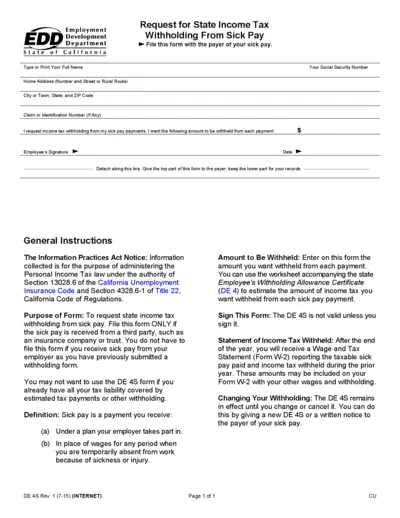

Request for State Income Tax Withholding from Sick Pay

This form allows individuals to request state income tax withholding from their sick pay. It is used in cases when sick pay is received from a third party, such as an insurance company. By submitting this request, you ensure the appropriate amount of tax is withheld from your payments.

Property Taxes

Instructions for Form IT-2105.9 Underpayment Tax

This file contains detailed instructions for individuals and fiduciaries on how to handle underpayment of estimated tax for New York State. It outlines important changes in tax rates and methods for calculating penalties. Users will find guidance on who must pay penalties and how to avoid them.

Property Taxes

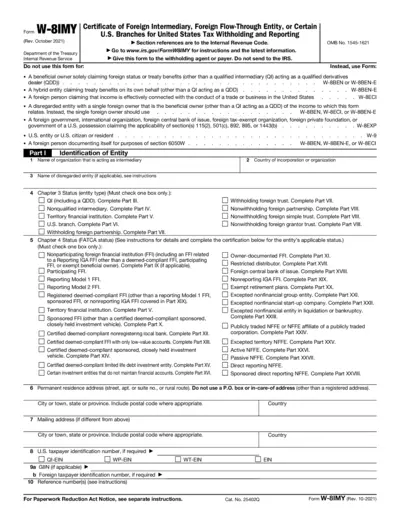

W-8IMY: Certificate of Foreign Intermediary Instructions

The W-8IMY form is used to certify the status of foreign intermediaries for U.S. tax withholding and reporting. It's crucial for entities acting on behalf of foreign owners to ensure proper tax treatment. This form must be submitted to the withholding agent, not to the IRS.

Property Taxes

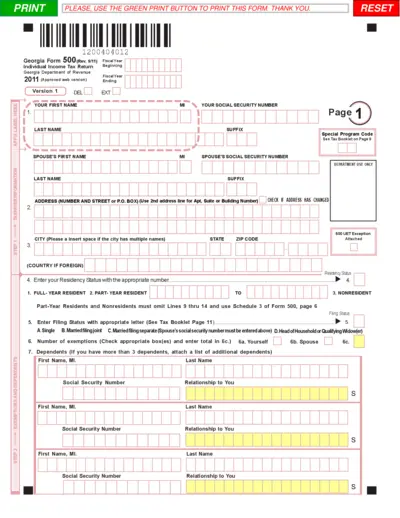

Georgia Individual Income Tax Return Form 500

The Georgia Form 500 is the state's official Individual Income Tax Return form for the fiscal year 2011. This form is essential for individual taxpayers to report their income and calculate their tax liability. It ensures compliance with Georgia tax regulations while maximizing eligible deductions.

Property Taxes

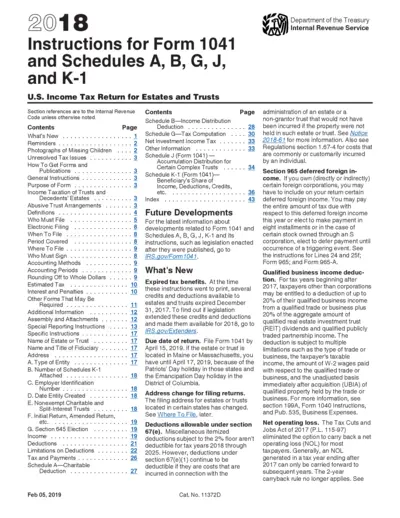

Instructions for Form 1041 and Related Schedules

This file provides essential instructions for filing Form 1041, U.S. Income Tax Return for Estates and Trusts. It covers important information regarding income, deductions, and necessary schedules. Users will benefit from a comprehensive guide to ensure accurate and timely submissions.

Property Taxes

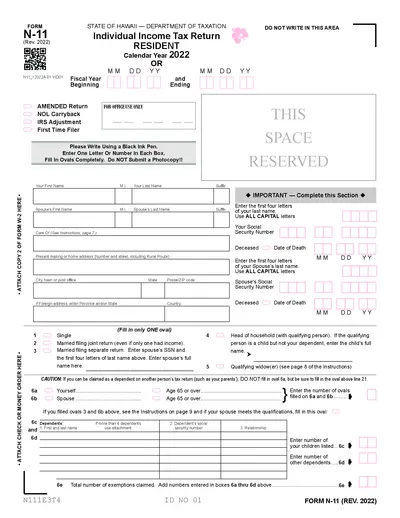

Hawaii Individual Income Tax Return N-11 Form 2022

The N-11 form is used for filing individual income taxes in Hawaii. It is essential for residents to accurately report their income for tax purposes. Ensure to complete the form fully to avoid penalties.

Property Taxes

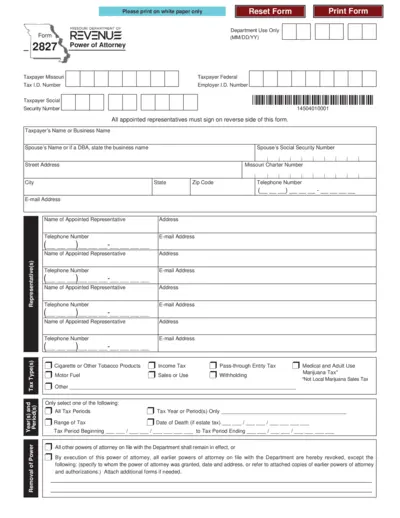

Missouri Power of Attorney Form 2827 Instructions

This file contains the Missouri Form 2827 for Power of Attorney. It is essential for taxpayers in Missouri to designate representatives for tax matters. Follow the detailed instructions provided to fill out and submit the form correctly.

Property Taxes

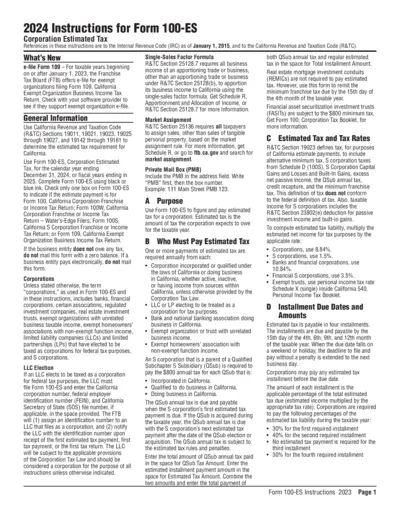

2024 Corporation Estimated Tax Instructions

This document provides essential instructions for corporations to calculate and submit estimated tax in California for 2024. It details requirements, payment methods, and important regulatory information. Businesses should use this guide to ensure compliance with state tax laws.

Property Taxes

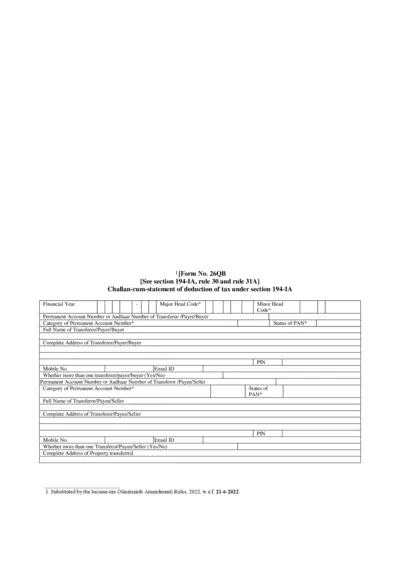

Form 26QB - Challan for Tax Deduction Under 194-IA

Form 26QB is a Challan-cum-statement for tax deduction under section 194-IA. It is crucial for individuals involved in real estate transactions for tax compliance. The form captures essential details regarding property transfer and tax deductions.

Property Taxes

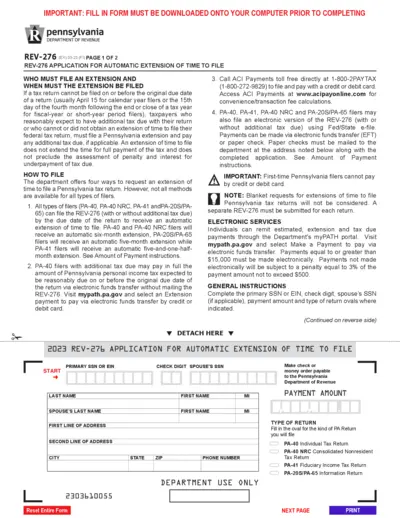

Application for Automatic Extension to File PA Tax

The REV-276 form is essential for taxpayers in Pennsylvania who need an extension to file their tax returns. This document outlines the necessary steps for filing and the associated deadlines. Ensure compliance with state regulations by completing and submitting this application.