Property Taxes Documents

Property Taxes

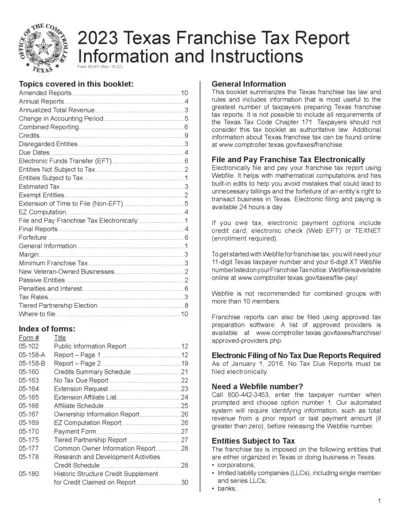

2023 Texas Franchise Tax Report: Information and Instructions

This file provides detailed information and instructions for businesses to file the Texas Franchise Tax Report for the year 2023. It includes guidelines on electronic filing, entities subject to tax, and specific tax rates. This document is essential for understanding compliance requirements under Texas Tax Code Chapter 171.

Property Taxes

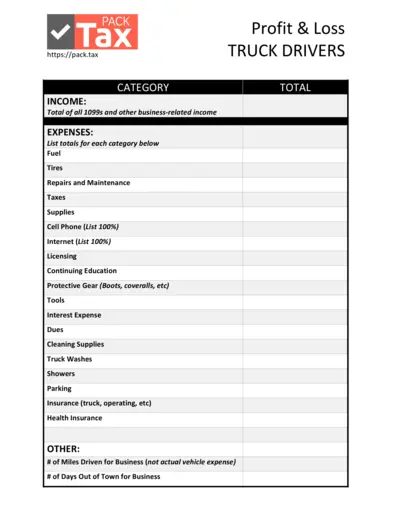

Tax Form for Truck Drivers: Income and Expenses

This file is essential for truck drivers to accurately track their income and expenses for tax purposes. It provides detailed categories for reporting all relevant financial data. Using this document can simplify your tax filing process significantly.

Property Taxes

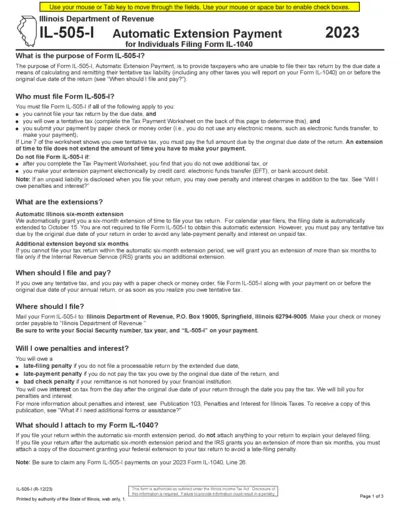

IL-505-I Automatic Extension Payment Filing Instructions

This document outlines the instructions for filing Form IL-505-I, the Automatic Extension Payment for individuals. It provides information on who must file, how to calculate tentatives taxes and where to submit the payment. Understanding this form ensures you meet your Illinois tax obligations timely.

Property Taxes

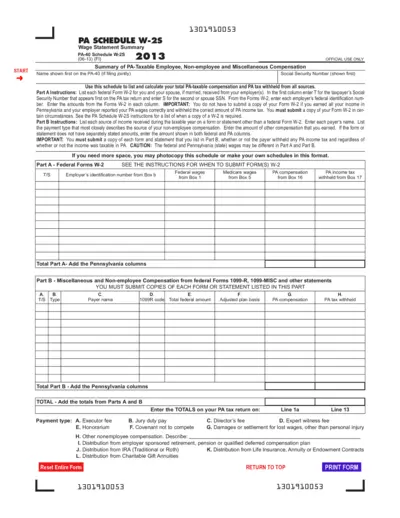

PA W-2S Schedule: Wage Statement Summary

The PA W-2S form assists users in listing and calculating their total Pennsylvania taxable compensation. It provides essential instructions for reporting income from various sources. Perfect for employees and self-employed individuals in Pennsylvania.

Property Taxes

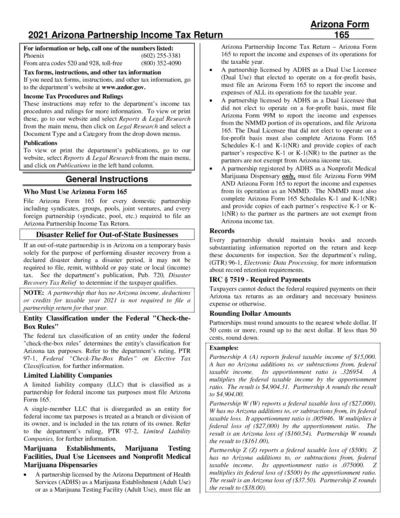

2021 Arizona Partnership Income Tax Return Form 165

This document provides detailed information about the 2021 Arizona Partnership Income Tax Return (Form 165). It includes instructions for filling out the form and essential guidelines for partnerships operating in Arizona. Make sure to follow the guidelines provided to ensure timely and accurate tax submissions.

Property Taxes

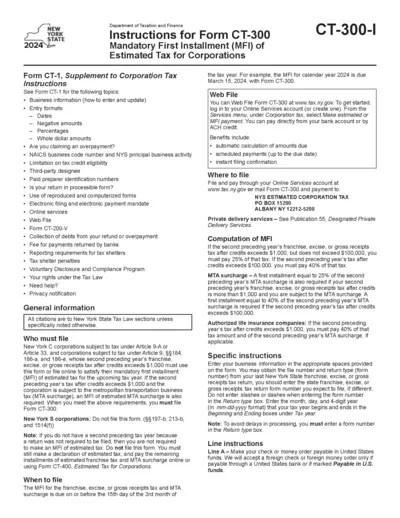

CT-300-I Instructions for Form CT-300 2024

This file provides detailed instructions for the CT-300 form, which is necessary for Corporate Estimated Tax payments in New York. It covers essential filing information, eligibility requirements, and computation methods for the Mandatory First Installment (MFI) of estimated taxes. Corporations must follow these guidelines to ensure compliance with New York State tax laws.

Property Taxes

Instructions for Form 5329 Additional Taxes

This document provides detailed instructions for Form 5329, which reports additional taxes related to qualified retirement plans. It outlines who must file, how to complete the form, and important information regarding penalties. This is essential for taxpayers managing IRAs and retirement distributions.

Property Taxes

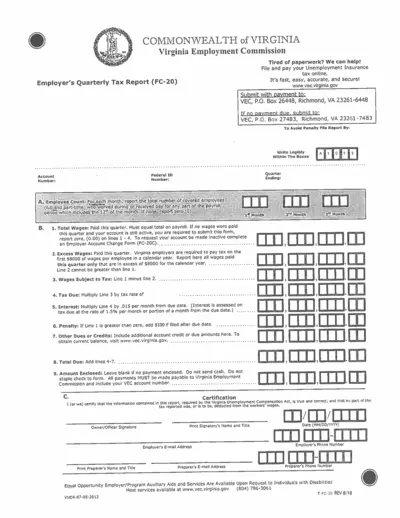

Virginia Employment Commission Quarterly Tax Report

The Virginia Employment Commission's Employer's Quarterly Tax Report (FC-20) is essential for reporting unemployment insurance taxes. This form helps employers accurately file and pay their taxes online. Ensure compliance and avoid penalties by submitting the report on time.

Property Taxes

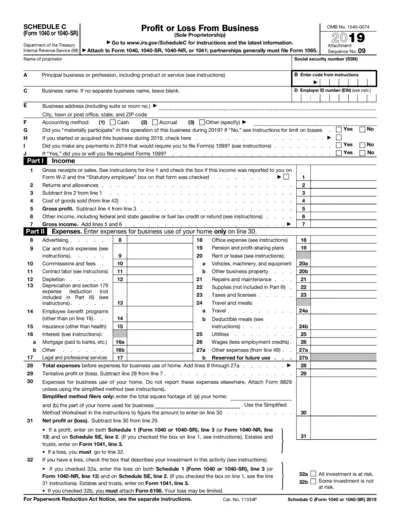

Schedule C Form 1040 or 1040-SR Profit and Loss

Schedule C (Form 1040 or 1040-SR) is used to report income or loss from a business operated as a sole proprietorship. It provides the IRS with information about your business's financial performance. Accurate completion of this form is vital for your tax return.

Property Taxes

South Carolina ST-3 Sales and Use Tax Return

The South Carolina ST-3 Sales and Use Tax Return is essential for businesses to report their sales tax. It must be filed even if no tax is due during the period. Filing guidance and details are provided to ensure compliance with state regulations.

Property Taxes

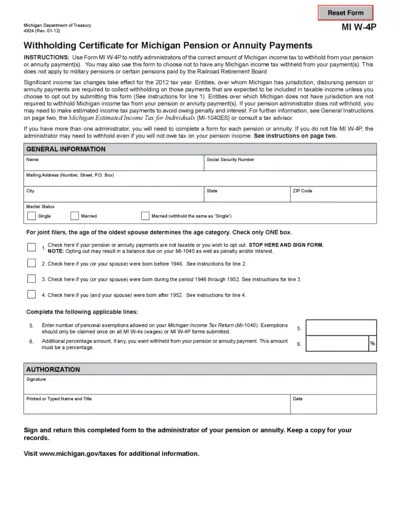

MI W-4P Withholding Certificate for Pension Payments

This form allows Michigan residents to manage their income tax withholding from pension or annuity payments. Users can opt out of withholding or specify exemptions. Essential for ensuring correct tax handling on annuity income.

Property Taxes

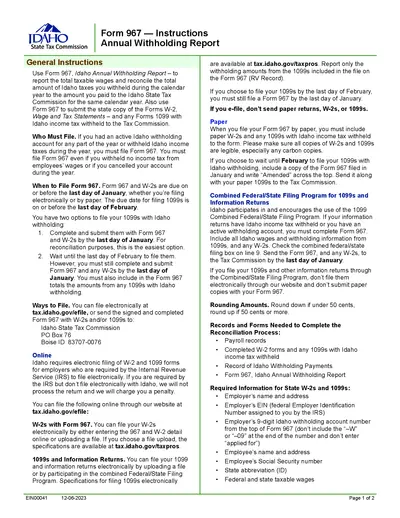

Idaho Annual Withholding Report Form 967 Instructions

This document includes detailed instructions for completing the Idaho Annual Withholding Report (Form 967). It is essential for employers to report taxable wages and taxes withheld. Learn how to submit your forms accurately to comply with Idaho tax regulations.