Property Taxes Documents

Property Taxes

2023 Paid Preparer's Due Diligence Checklist - Form 8867

This file is a checklist designed to assist paid tax preparers with their due diligence requirements for various tax credits and the head of household filing status. It includes specific actions to be performed and documented to avoid penalties. The checklist references Form 8867 and IRS Publication 4687 for additional guidance.

Property Taxes

HMRC Starter Checklist for Employers and Employees

The HMRC Starter Checklist is crucial for employers to gather employee information before the first payday and ensure the correct tax code is used. This form includes employee details, bank information, and necessary identification numbers. Do not send this form to HMRC.

Property Taxes

Form 8962 Instructions for 2022 Tax Year

This file provides instructions for filling out Form 8962, which is used for Premium Tax Credit (PTC). It includes a detailed table for calculating amounts. The instructions are vital for accurate tax filing.

Property Taxes

Missouri Department of Revenue Sales Tax Return Form

This file is a Sales Tax Return Form (53-1) issued by the Missouri Department of Revenue. It includes various fields for reporting sales tax collected, adjustments, and deductions. Instructions for completing and submitting the form are also provided.

Property Taxes

2023 S Corporation Instructions for Schedules K-2 and K-3

The 2023 S Corporation Instructions for Schedules K-2 and K-3 provide detailed guidance on completing these forms, which report items of international tax relevance. Learn who must file, how to fill out the schedules, and when and where to file them. This document is essential for S Corporations with international tax obligations.

Property Taxes

Delaware Division of Revenue Wholesale Exemption Certificate

Form 373 is used to substantiate exempt sales to out of state purchasers who pick up goods in Delaware. This form ensures sales tax exemption and must be filled out accurately. Ensure all required fields are filled and signed by authorized individuals.

Property Taxes

Ohio State Sales Tax Return Form

The Ohio State Sales Tax Return Form is used by vendors to report sales tax collected within the specified filing period. This form requires a one-time registration with the Ohio Department of Taxation. It should be submitted according to the filing frequency specified for the vendor.

Property Taxes

Massachusetts Form 3M: Income Tax Return for Non-Profit Organizations

Form 3M is the Massachusetts Income Tax Return for Clubs and other Organizations not involved in profit-making activities. This form must be filed for the calendar year 2022 or the respective taxable period. Detailed instructions for specific income calculations and tax computations are provided within the form.

Property Taxes

Instructions for Form 8871, Political Organization Notice of Section 527 Status

Form 8871 is used by political organizations to notify the IRS that the organization is to be treated as a tax-exempt section 527 organization. The form also reports any material changes or terminations of the organization. Failure to file this form on time may result in the organization not being treated as tax-exempt for the period before filing.

Property Taxes

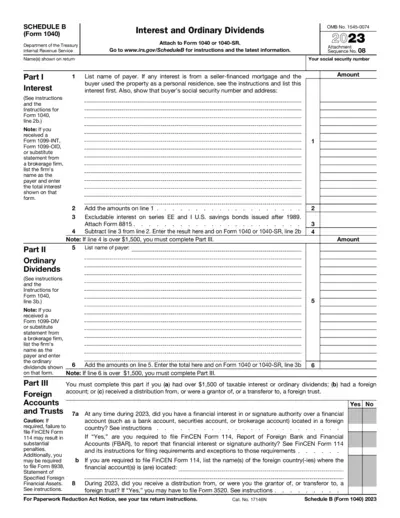

Schedule B (Form 1040) Instructions & Information

Schedule B (Form 1040) is used to report interest and ordinary dividends. Attach it to Form 1040 or 1040-SR. Ensure you complete Part III if necessary.

Property Taxes

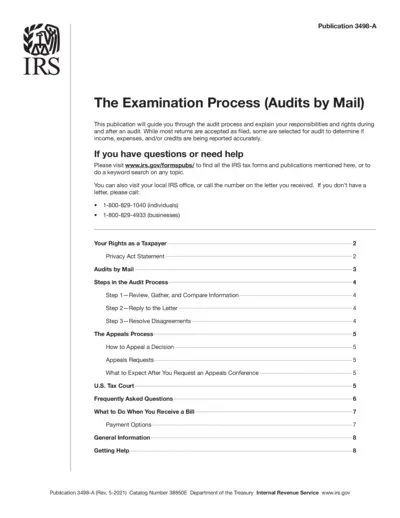

IRS Publication 3498-A: The Examination Process Guide

This guide provides detailed information on the IRS audit process, taxpayer rights, and steps to resolve disagreements. It helps understand the appeals process, payment options, and how to get help with tax-related issues. Essential for taxpayers undergoing an audit.

Property Taxes

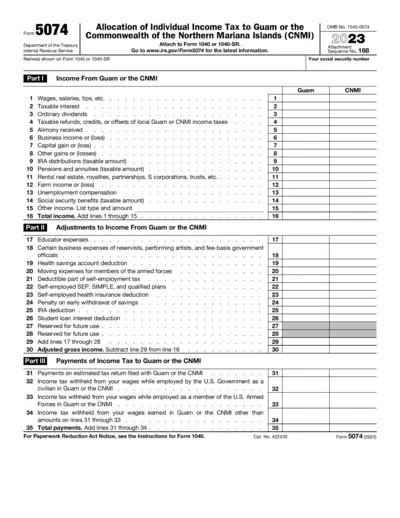

Form 5074 Instructions for Guam and CNMI Tax Reporting

Form 5074 is used by U.S. citizens and resident aliens for Guam or CNMI tax reporting. This form assists in determining individual income tax obligations. Complete this form alongside your 1040 or 1040-SR for accurate income allocation.