Tax Forms Documents

Tax Forms

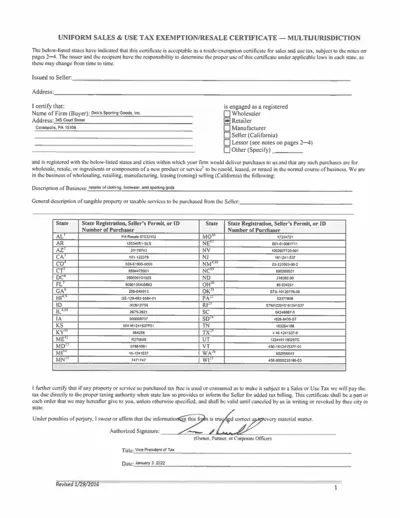

Uniform Sales & Use Tax Exemption Certificate

The Uniform Sales & Use Tax Exemption Certificate is a multi-jurisdictional form accepted by various states. This certificate allows buyers to claim tax exemption for eligible purchases. Ensure to provide accurate information and check state-specific guidelines.

Tax Forms

W-3 Transmittal of Wage and Tax Statements 2024

This file is the W-3 Transmittal of Wage and Tax Statements for 2024. It provides essential details for employers filing W-2 forms. Use this form to report wages and tax information to the SSA.

Tax Forms

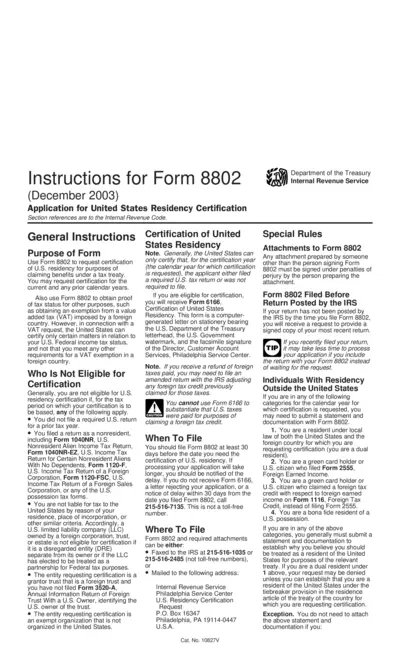

Instructions for Form 8802 Application for Residency Certification

Form 8802 helps individuals request certification of U.S. residency for tax treaty benefits. This form is essential for verifying tax status to claim exemptions, especially from foreign taxes. It is applicable for the current and any prior calendar years.

Tax Forms

Form 8621 - Shareholder Information Return

This file is the IRS Form 8621, used by shareholders to report income from passive foreign investment companies. It is essential for tax compliance regarding foreign investments. Complete this form accurately to avoid penalties and ensure proper tax reporting.

Tax Forms

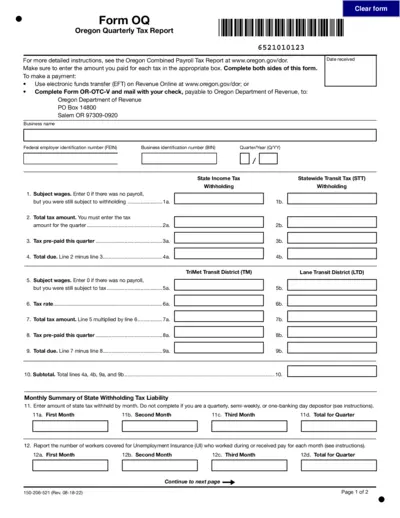

Oregon Quarterly Tax Report Form OQ Instructions

The Oregon Quarterly Tax Report Form OQ is essential for businesses to report and pay quarterly taxes. This form facilitates the correct calculation and remittance of state taxes, including income and employment taxes. Ensure compliance by accurately completing this form each quarter.

Tax Forms

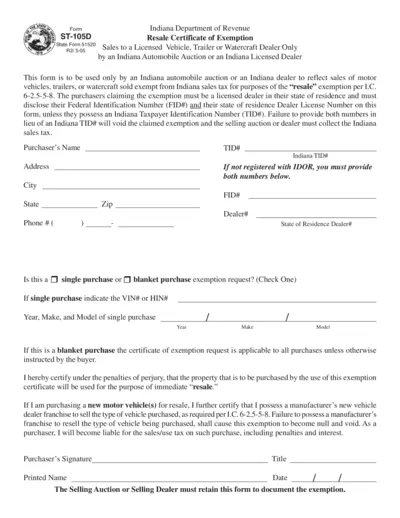

Indiana Resale Certificate Exemption Form ST-105D

The Indiana Resale Certificate of Exemption Form ST-105D is used by licensed dealers to exempt sales from Indiana sales tax. It serves as proof for automobile auctions and dealers making tax-exempt sales for resale purposes. Complete this form accurately to avoid taxes on eligible transactions.

Tax Forms

Form 8992 Instructions for U.S. Shareholder GILTI

Form 8992 provides instructions for U.S. shareholders regarding the calculation of Global Intangible Low-Taxed Income (GILTI). It is essential for compliance with tax laws set by the IRS. Understanding these instructions ensures accurate reporting and claims for deductions.

Tax Forms

Delaware Corporation Income Tax Return Form 1100

The Delaware Corporation Income Tax Return Form 1100 is essential for corporations operating in Delaware. This form needs to be filled out for accurate tax reporting. Ensure you adhere to the instructions for compliance and avoid penalties.

Tax Forms

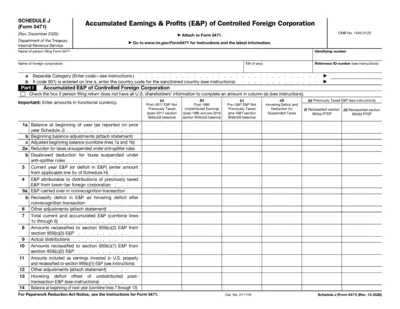

Form 5471 Schedule J Instructions and Details

This file provides the instructions for filling out Schedule J of Form 5471. It outlines the accumulated earnings and profits of controlled foreign corporations. Users must reference these instructions to ensure accurate reporting and compliance with tax regulations.

Tax Forms

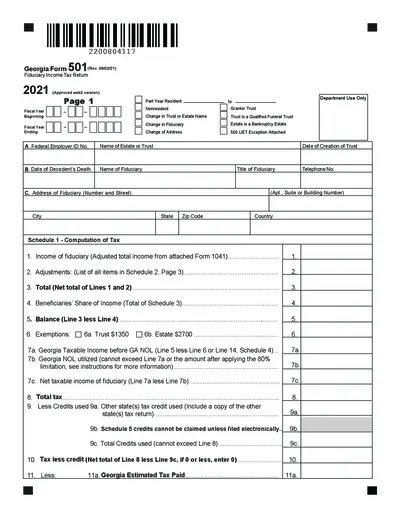

Georgia Fiduciary Income Tax Return Form 501

The Georgia Fiduciary Income Tax Return Form 501 is essential for fiduciaries of estates and trusts to report income. It provides a structured format for calculating taxable income and credits. Accurate completion is necessary to ensure compliance with state tax regulations.

Tax Forms

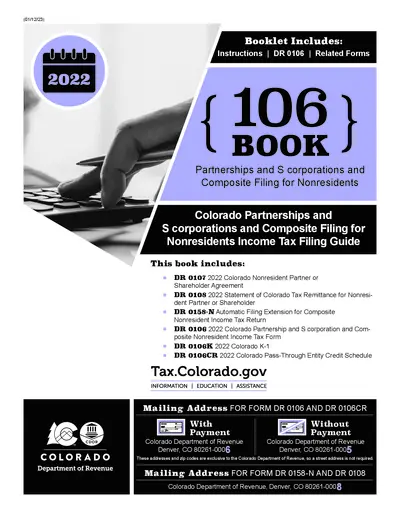

Colorado Nonresident Partner Tax Filing Guide

This guide provides essential instructions for filing the Colorado Nonresident Partner or Shareholder Agreement. It assists users in understanding the necessary requirements and forms needed for compliance. Use this resource to navigate nonresident income tax filing efficiently.

Tax Forms

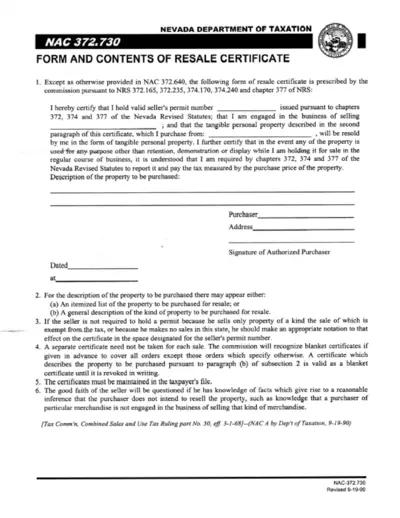

Nevada Resale Certificate Instructions and Details

This file provides guidelines on how to properly fill out the Nevada resale certificate. It ensures compliance with Nevada tax laws when purchasing goods for resale. Use this document to understand the forms and requirements needed for tax exemption.