Tax Forms Documents

Tax Forms

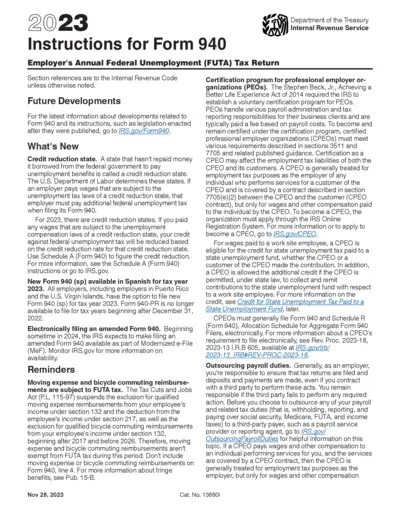

Instructions for Form 940 - Employer's Annual FUTA Tax Return

This file provides comprehensive instructions for the Form 940 filing process, ensuring employers understand their federal unemployment tax obligations. It includes guidance on who must file, key deadlines, and detailed descriptions of various sections of the form. Utilize this resource to ensure compliance with the Internal Revenue Service requirements.

Tax Forms

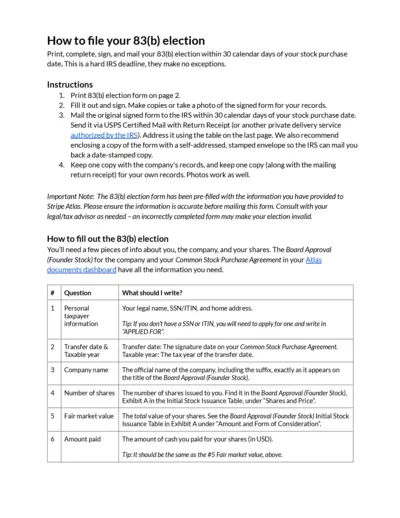

83(b) Election Filing Instructions and Details

This file provides detailed instructions for filing your 83(b) election. Follow the steps to ensure compliance with IRS regulations. Ensure your information is accurate to avoid an invalid election.

Tax Forms

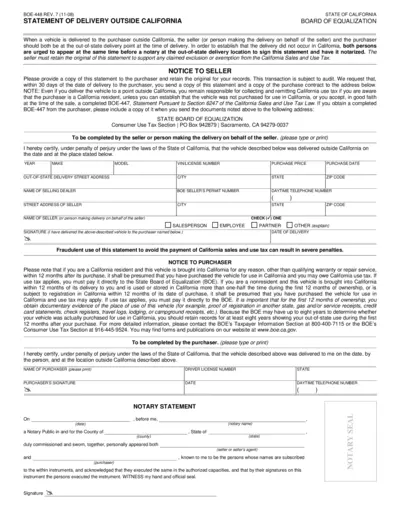

California Delivery Statement Form BOE-448

The BOE-448 form is used for documenting vehicle deliveries outside California. It provides essential guidance for sellers and purchasers regarding tax responsibilities. This form helps ensure compliance with California Sale and Use Tax laws.

Tax Forms

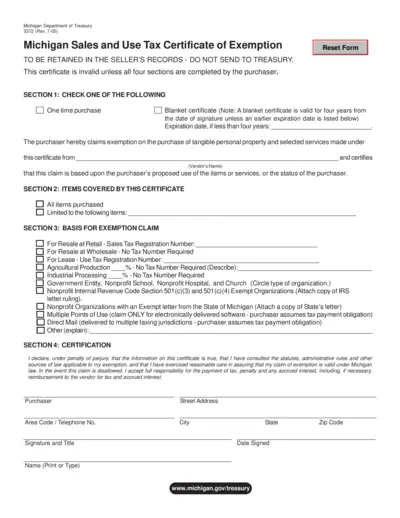

Michigan Sales and Use Tax Certificate of Exemption

This document serves as a Michigan Sales and Use Tax Certificate of Exemption. It allows purchasers to claim exemption on certain purchases. Ensure to complete all four sections for validity.

Tax Forms

IRS Form 8804 Instructions for Partnerships

This file contains essential instructions for completing IRS Form 8804, applicable to partnerships. It outlines key details about the underpayment penalty and filing requirements for foreign partners. Users can find step-by-step guidance for accurately filling out the form.

Tax Forms

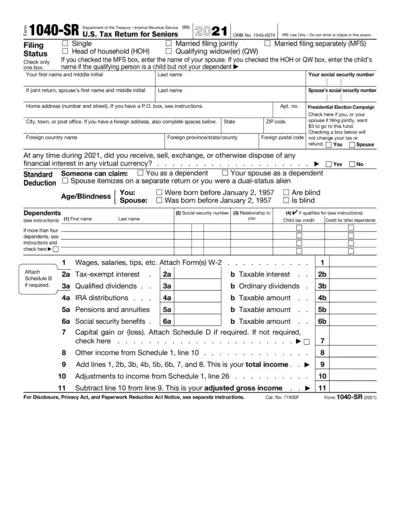

U.S. Tax Return for Seniors Form 1040-SR 2021

The U.S. Tax Return for Seniors Form 1040-SR is designed specifically for senior citizens. This form simplifies the tax filing process, making it easier to report income and claim deductions. Use this form to ensure you meet your tax obligations and maximize your eligible benefits.

Tax Forms

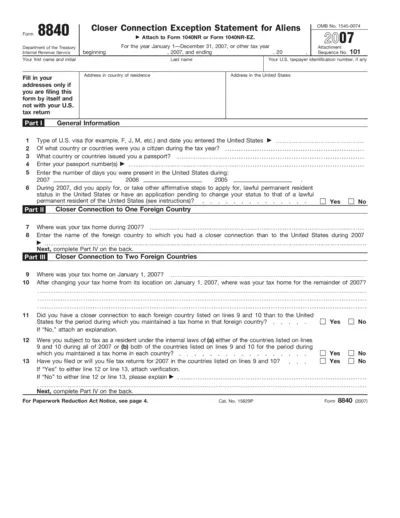

Form 8840 Closer Connection Exception Statement

Form 8840 is an IRS form designed for aliens to claim a closer connection to foreign countries for tax purposes. It is essential for those who want to establish nonresident status in the U.S. and avoid being taxed as residents. This form comprises various sections that detail personal information and tax residency.

Tax Forms

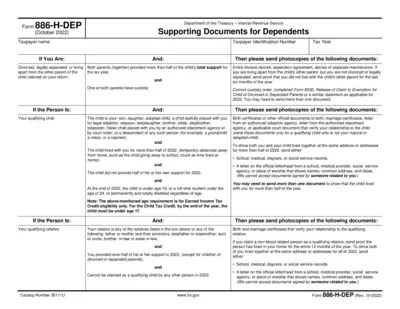

Supporting Documents for Dependents - Form 886-H-DEP

Form 886-H-DEP provides instructions for submitting necessary supporting documents related to dependents for tax purposes. It includes guidance for taxpayers who are divorced or separated. Ensure you have the correct documents to qualify for tax credits.

Tax Forms

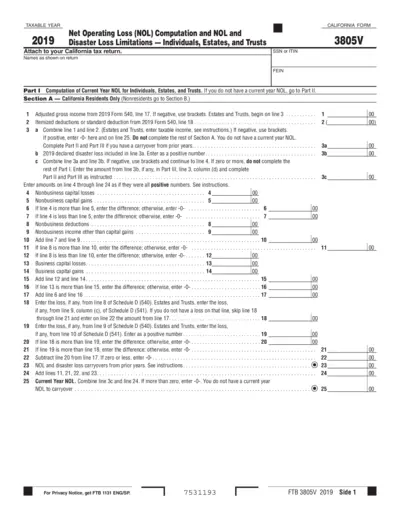

California NOL Computation and Limitations 2019

This document provides essential instructions for calculating 2019 Net Operating Loss (NOL) for California tax purposes. It helps individuals, estates, and trusts understand their qualifications and limitations. Follow the guidelines carefully to ensure accurate tax reporting.

Tax Forms

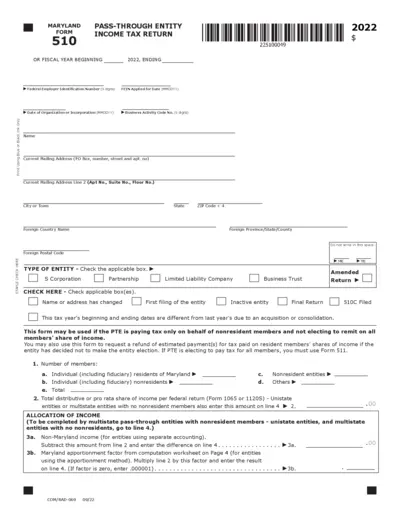

Maryland 510 Pass-Through Entity Income Tax Return

The Maryland Form 510 is a vital document for pass-through entities to report income on behalf of its members. It captures the entity's tax obligations for nonresident members for the tax year 2022. This form is essential for compliance and accurate tax reporting.

Tax Forms

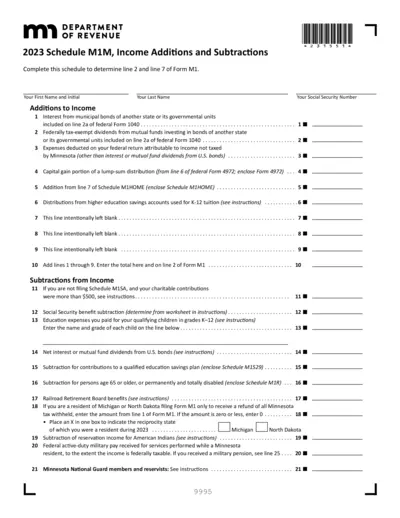

2023 Schedule M1M Income Additions and Subtractions

This file contains instructions and forms for the 2023 Schedule M1M. It is vital for determining income additions and subtractions for tax purposes. Complete this schedule accurately to ensure compliance with Minnesota tax regulations.

Tax Forms

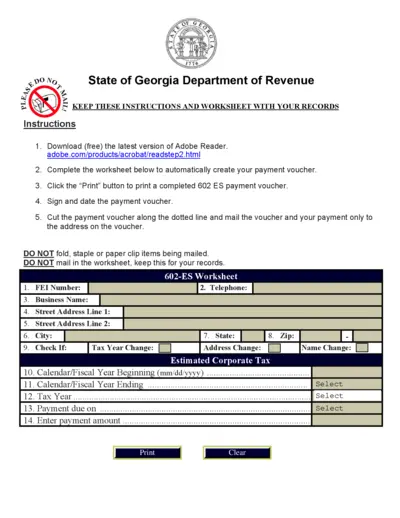

Georgia Department of Revenue Estimated Tax Form

This file provides important instructions and a worksheet for completing the Georgia Department of Revenue's Estimated Tax Form. Follow the steps to ensure your payments are processed correctly. It includes contact information and guidance for corporations filing estimated tax.