Tax Forms Documents

Tax Forms

Instructions for Form 4797 - Sales of Business Property

Form 4797 is essential for reporting sales and exchanges of business property, involuntary conversions, and recapture amounts. Proper completion of this form is required to report gains or losses on the sale of depreciable assets. This guide will help users understand the filing process and ensure compliance with IRS regulations.

Tax Forms

Instructions for Form IT-203-A Business Allocation Schedule

This file provides comprehensive instructions for filling out Form IT-203-A, the Business Allocation Schedule required for New York State income tax. It is essential for nonresidents and those conducting business in the Metropolitan Commuter Transportation District. This document guides users on how to accurately allocate business income and complete the necessary forms.

Tax Forms

2023 Instructions for Form 8814 IRS Parents Election

This document provides detailed instructions for parents electing to report their child's interest and dividends on their tax return. It outlines eligibility criteria, filling out the form, and tax implications. Use this form to simplify reporting your child's income and avoid additional tax filings.

Tax Forms

California Exempt Organization Business Income Tax Return

This file is essential for California exempt organizations to report their income, deductions, and tax obligations for 2023. It includes detailed instructions and necessary fields to ensure compliance with state regulations. Use this file to accurately complete your tax return and avoid potential fines.

Tax Forms

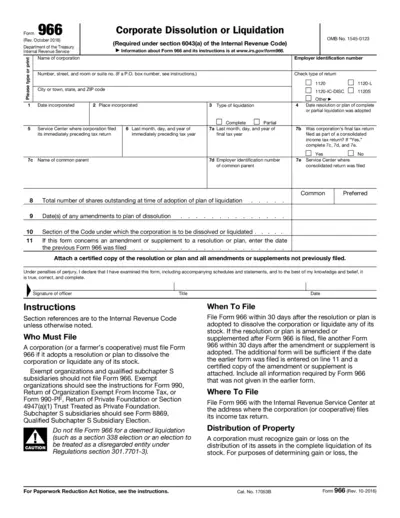

Corporate Dissolution or Liquidation - Form 966

Form 966 is essential for corporations planning to dissolve or liquidate. It ensures compliance with IRS regulations. Complete this form to officially notify the IRS of your corporation’s dissolution or liquidation.

Tax Forms

How to View and Download Your W2 from ADP Workforce

This file provides comprehensive instructions for retrieving your W2 form from ADP Workforce Now. It guides you step-by-step through the process to ensure you can access and download your tax statements easily. Ideal for employees seeking their W2 documentation swiftly.

Tax Forms

Illinois CRT-61 Certificate of Resale Instructions

This file provides the necessary instructions and details for filling out the CRT-61 Certificate of Resale. It outlines the required information for both sellers and purchasers in Illinois. Completing this certificate is essential for tax exemption during resale transactions.

Tax Forms

North Dakota Individual Income Tax Return Form ND-1

This file contains the North Dakota Individual Income Tax Return Form ND-1 for tax filers. It provides essential filing information, guidelines, and specifications crucial for accurate tax submission. Use this form to report your income and calculate your tax liability effectively.

Tax Forms

IRS Form W-2C Corrected Wage and Tax Statement

The IRS Form W-2C is used to correct errors on previously filed Forms W-2. This form is essential for ensuring accurate tax reporting. Employers must complete this form to amend wage and tax information for employees.

Tax Forms

W-9 Taxpayer Identification Number Request Form

The W-9 form is used to provide your taxpayer identification number to requesters. This form is essential for individuals and entities receiving income. It helps ensure that the right information is reported for tax purposes.

Tax Forms

NY State Form IT-214 Instructions for Tax Credit

This file contains comprehensive instructions for filling out Form IT-214 to claim the Real Property Tax Credit for Homeowners and Renters in New York State. It details eligibility criteria, filing instructions, and important deadlines. Understanding these guidelines will help you maximize your tax credit benefit effectively.

Tax Forms

1040EZ Tax Form Instructions for Simplified Filing

The 1040EZ tax form provides easy instructions for filing your taxes electronically. It is ideal for individuals with simple tax situations. Follow the guidelines included to ensure accurate submissions and maximize your refund.