Tax Forms Documents

Tax Forms

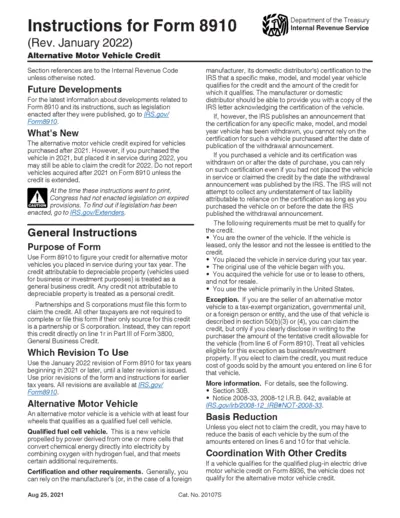

Form 8910 Instructions for Alternative Motor Vehicle Credit

This file provides detailed instructions for Form 8910 related to the Alternative Motor Vehicle Credit. Users can learn about eligibility, submission, and guidelines. It is essential for tax year 2022 and beyond for certain vehicle owners.

Tax Forms

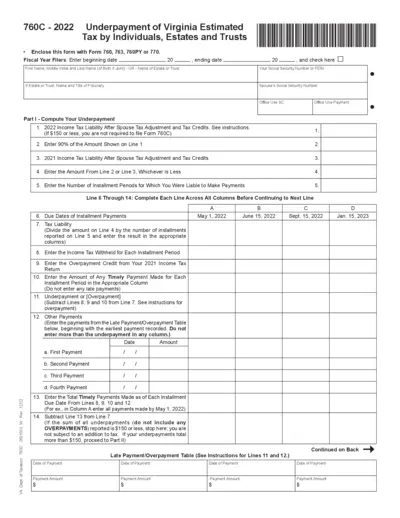

Virginia Estimated Tax Underpayment Form 760C

The Virginia Estimated Tax Underpayment Form 760C is essential for individuals, estates, and trusts that have underpaid their estimated taxes. This form helps in determining the underpayment and calculates any potential additions to tax. It provides detailed instructions for accurate filling.

Tax Forms

Instructions for Form 1042 - IRS Annual Withholding Tax

Form 1042 is essential for reporting taxes withheld on income earned by foreign persons in the U.S. It provides vital instructions for U.S. withholding agents and intermediaries. This form ensures compliance with IRS regulations regarding U.S. source income.

Tax Forms

Form 8898 Bona Fide Residence Statement IRS

Form 8898 is the IRS statement for individuals declaring their bona fide residence in a U.S. possession. It is crucial for tax residents to notify the IRS of their status. Proper completion ensures compliance and avoids issues with taxation.

Tax Forms

Texas Agricultural Sales and Use Tax Exemption

This form is used by agricultural producers in Texas to claim a sales and use tax exemption when purchasing qualifying items. It details the necessary information required for proper completion and submission. Ensure accuracy to avoid complications in tax exemptions.

Tax Forms

Form 1125-A Cost of Goods Sold Instructions

Form 1125-A is used to calculate and report cost of goods sold for tax purposes. It is essential for businesses to accurately report their expenses related to inventory. Users must ensure they follow the IRS guidelines for compliance.

Tax Forms

Instructions for Form 1065 U.S. Return of Partnership Income

This document provides detailed instructions for filing Form 1065, which reports the income, gains, losses, deductions, and credits of a partnership. It includes essential guidelines for partnerships to fulfill their tax obligations. Understanding this form is crucial for accurate tax reporting.

Tax Forms

Partner's Instructions for Schedule K-1 Form 1065

This file provides detailed guidance on how partners can correctly fill out Schedule K-1 (Form 1065). It includes instructions on reporting income, deductions, and credits from partnerships. Understanding these instructions is essential for accurate tax reporting.

Tax Forms

IRS Form 4562 Instructions for Depreciation and Amortization

This document provides detailed instructions on how to fill out IRS Form 4562 for claiming depreciation and amortization. It includes information on eligibility, filing guidelines, and definitions of key terms. Perfect for taxpayers and businesses seeking to understand their tax obligations related to depreciation.

Tax Forms

California Earned Income Tax Credit Form 3514

This document outlines the California Earned Income Tax Credit for the year 2021. It includes eligibility requirements and instructions for completing the form. Be sure to provide necessary personal information to effectively claim your credits.

Tax Forms

Schedule G Form 1120 Instructions for Corporations

This file details the instructions for Schedule G of Form 1120, which is necessary for corporations regarding stock ownership. It outlines the requirements for reporting entities and individuals with significant ownership. The form is essential for compliance with IRS regulations.

Tax Forms

Massachusetts S Corporation Return Form 355S Instructions

This document provides essential instructions for completing the Massachusetts S Corporation Return Form 355S. It includes filing requirements, important dates, and contact information for assistance. Perfect for business owners navigating their tax obligations.