DC Withholding Tax Reporting Instructions for 2023

This file contains the employer/payor withholding tax reporting instructions for the year 2023. It includes essential details on filing the FR-900Q form each quarter. Employers should refer to this file for guidelines to ensure compliance with DC tax laws.

Edit, Download, and Sign the DC Withholding Tax Reporting Instructions for 2023

Form

eSign

Add Annotation

Share Form

How do I fill this out?

Filling out this form is essential for accurate reporting. Ensure you have your Federal Employer Identification Number (FEIN) handy. Follow the detailed instructions provided for each section to complete the form correctly.

How to fill out the DC Withholding Tax Reporting Instructions for 2023?

1

Gather your FEIN and business information.

2

Complete the necessary fields in the FR-900Q form.

3

Indicate any overpayment options if applicable.

4

Review your completed form for accuracy.

5

Submit the form by the due date.

Who needs the DC Withholding Tax Reporting Instructions for 2023?

1

Employers who pay wages to DC residents and withhold taxes.

2

Business owners registering for DC taxes for the first time.

3

Payroll service providers managing DC tax filings for clients.

4

Individuals filing for refunds due to overpayment.

5

Tax professionals assisting clients with tax compliance.

How PrintFriendly Works

At PrintFriendly.com, you can edit, sign, share, and download the DC Withholding Tax Reporting Instructions for 2023 along with hundreds of thousands of other documents. Our platform helps you seamlessly edit PDFs and other documents online. You can edit our large library of pre-existing files and upload your own documents. Managing PDFs has never been easier.

Edit your DC Withholding Tax Reporting Instructions for 2023 online.

Editing the PDF on PrintFriendly is straightforward and user-friendly. You can easily modify text fields and adjust formatting to suit your needs. Enjoy a comprehensive editing experience with tools designed to enhance your document clarity.

Add your legally-binding signature.

You can conveniently sign your PDF on PrintFriendly using our intuitive signing tool. Simply upload your document and apply your digital signature in just a few clicks. Signing has never been easier, ensuring your document is ready for submission.

Share your form instantly.

Sharing your PDF on PrintFriendly is effortless. Use the built-in sharing options to distribute your document with others via email or social media. Collaborate effectively by allowing others to view or edit your shared PDF.

How do I edit the DC Withholding Tax Reporting Instructions for 2023 online?

Editing the PDF on PrintFriendly is straightforward and user-friendly. You can easily modify text fields and adjust formatting to suit your needs. Enjoy a comprehensive editing experience with tools designed to enhance your document clarity.

1

Open your PDF document in PrintFriendly.

2

Select the 'Edit' option to access editing tools.

3

Make necessary changes to text and format.

4

Save your edits to the document.

5

Download the updated PDF for your records.

What are the instructions for submitting this form?

To submit the FR-900Q form, you can file online through MyTax.DC.gov. Ensure that you have your FEIN and business details ready for accurate reporting. If mailing, send your completed form and payment to the Office of Tax and Revenue, PO Box 96385, Washington, DC 20090-6385.

What are the important dates for this form in 2024 and 2025?

In 2024, the due dates for the FR-900Q are July 31, October 31, January 31, and April 30. For 2025, the dates will follow the same quarterly schedule. Always file your returns on time to avoid penalties.

What is the purpose of this form?

The purpose of the FR-900Q form is to facilitate the accurate reporting of DC withholding tax for employers. This ensures that employees' taxes are withheld correctly and that employers remain compliant with district tax laws. The form collects essential information regarding wages paid and taxes withheld for each quarter.

Tell me about this form and its components and fields line-by-line.

- 1. FEIN: Federal Employer Identification Number required for filing.

- 2. Business Name: Legal name of the business or employer.

- 3. Address: Business address where the employer operates.

- 4. Quarter: Indicate the quarter for which you are filing.

- 5. Wages Paid: Total wages paid to employees during the quarter.

What happens if I fail to submit this form?

Failing to submit the FR-900Q form can result in penalties and interest on the owed taxes. The District of Columbia may pursue collections for unpaid taxes, leading to further financial consequences.

- Penalties: Late filing may incur additional fees based on the amount of tax due.

- Interest Charges: Interest accrues on any unpaid tax amounts from the original due date.

- Legal Action: Persistent non-compliance can lead to legal action by the tax authority.

How do I know when to use this form?

- 1. Quarterly Reporting: Report DC withholding for January-March, April-June, July-September, and October-December.

- 2. Final Return: File a final return if ceasing operations or employment.

- 3. Amended Return: Use this form to correct previously submitted information.

Frequently Asked Questions

What is the FR-900Q form?

The FR-900Q form is a quarterly return for reporting DC withholding tax. It is mandatory for employers paying wages to DC residents.

Who needs to file the FR-900Q?

Any employer who withholds DC income tax from employee wages must file the FR-900Q.

When is the FR-900Q due?

The FR-900Q is due by the last day of the month following the end of each quarter.

How can I edit the FR-900Q PDF?

You can edit the FR-900Q PDF on PrintFriendly by uploading it and using the editing tools provided.

Can I submit the FR-900Q electronically?

Yes, the FR-900Q can be submitted electronically through MyTax.DC.gov.

What is required to file the FR-900Q?

You must have a valid FEIN and be registered with the District of Columbia.

What happens if I miss the filing deadline?

Late submissions may result in penalties and interest on the taxes owed.

Can I file a final return using FR-900Q?

Yes, you can file a final return if you stop paying wages or go out of business.

Is it necessary to use a third-party service for filing?

While not necessary, using a payroll service can simplify the filing process.

Where can I find additional instructions for FR-900Q?

Additional instructions can be found on the Office of Tax and Revenue website.

Related Documents - FR-900Q Instructions

PANDORA Village Pointe Return Form Instructions

This file provides the return form for PANDORA Village Pointe. It includes sections to fill out the original purchaser information, return reason, and item details. Ensure all fields are completed accurately before sending.

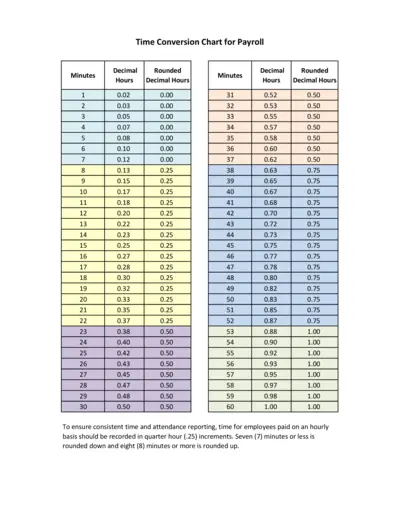

Time Conversion Chart for Payroll

This file provides a time conversion chart for payroll, converting minutes into decimal hours. It aids in accurate and consistent time reporting. Ideal for employees paid on an hourly basis.

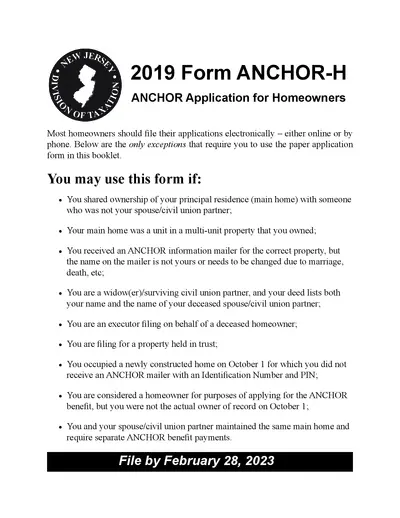

2019 ANCHOR Application for Homeowners - New Jersey

The 2019 ANCHOR Application for Homeowners provides eligibility details and instructions for applying for the New Jersey ANCHOR benefit. Learn how to file, eligibility requirements, and submission guidelines. This document ensures proper benefit distribution for eligible homeowners.

QuickBooks Online Payroll Taxes and Liabilities Guide

This file provides comprehensive instructions on how to set up, pay, and file payroll taxes and liabilities using QuickBooks Online. Employers can track and report income taxes, CPP, and EI contributions. The guide also covers entering tax history and accessing various payroll forms and reports.

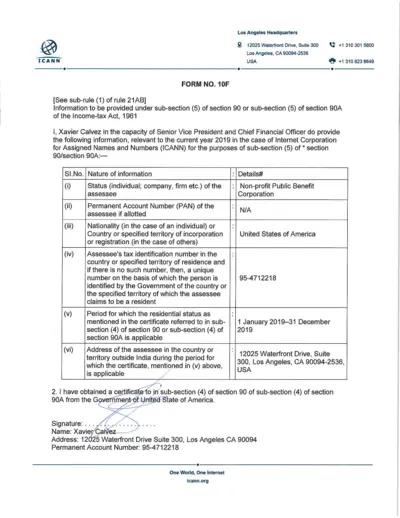

ICANN Income Tax Form 2019 for Tax Compliance

This file contains the information required under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961 for ICANN. It includes details about tax identification, residential status, and a verification declaration for the year 2019. The information is provided by Xavier Calvez, the Senior Vice President and Chief Financial Officer at ICANN.

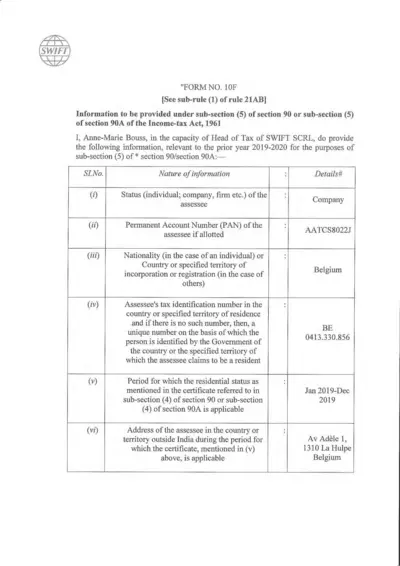

Form 10F: Information under Section 90/90A of Income-tax Act

Form 10F is used to provide information under sub-section (5) of section 90 or 90A of the Income-tax Act, 1961. It is relevant for the prior year 2019-2020 for SWIFT SCRL in Belgium. This form includes details about the assessee's status, account numbers, residency period, and address.

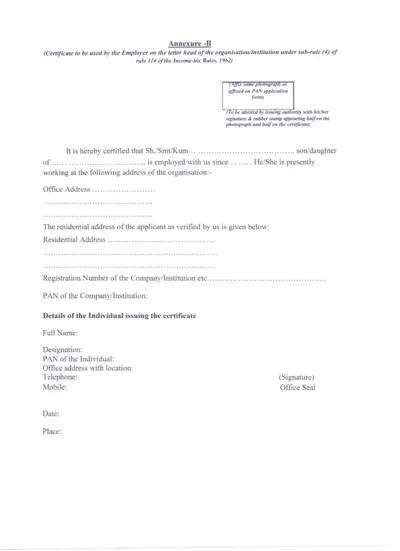

Employer Certificate for PAN Application - Income-tax Rules

This certificate is used by the employer to certify the employment status of an individual for PAN application under Income-tax Rules, 1962. It includes organization details, employee verification, and needs to be attested.

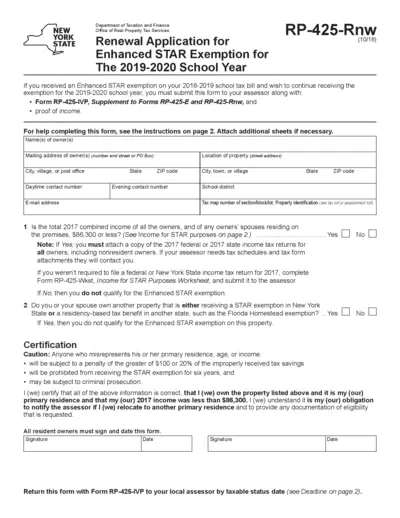

Renewal Application for Enhanced STAR Exemption 2019-2020

The form is used to reapply for the Enhanced STAR exemption on school taxes for the 2019-2020 school year. It requires income proof and the completion of Form RP-425-IVP. Submission is necessary to the local assessor by the taxable status date.

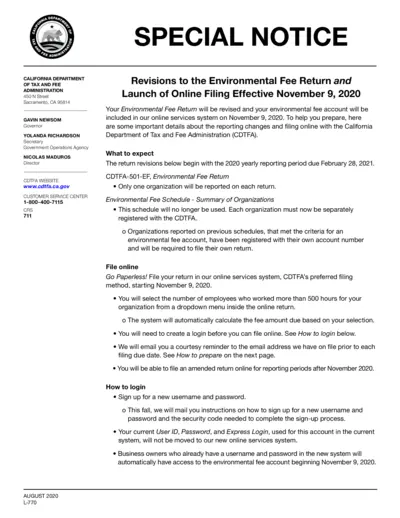

Revisions to Environmental Fee Return & Online Filing

This file details the revisions to the environmental fee return and the launch of online filing effective November 9, 2020. It includes important information on what to expect, how to login, and how to prepare for filing. The instructions provided are essential for organizations required to file the Environmental Fee Return.

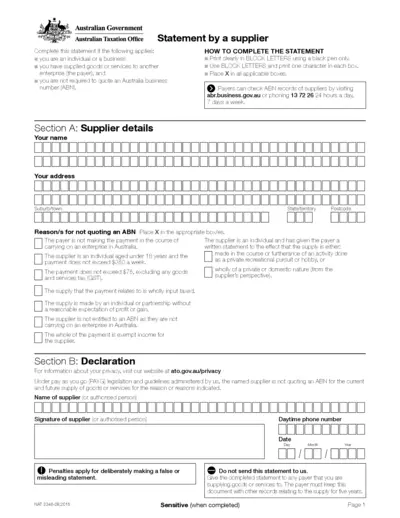

Statement by a Supplier - Australian Taxation Office Form

This form is used by individuals or businesses supplying goods or services without quoting an Australian Business Number (ABN). It helps in providing reasons for not quoting an ABN. The payer must keep this completed form for their records for five years.

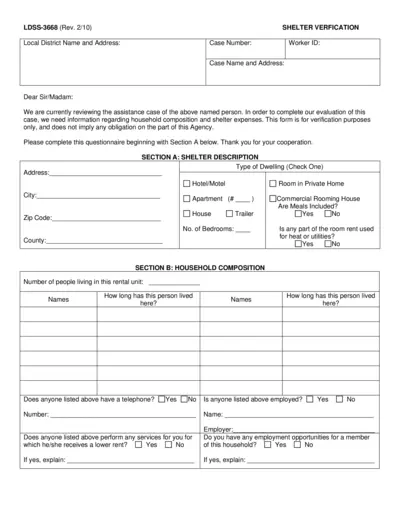

Shelter Verification Form for Assistance Evaluation

This form is used to verify household composition and shelter expenses for assistance evaluation purposes. It includes sections for shelter description, household composition, and shelter expenses. Complete the questionnaire for accurate verification.

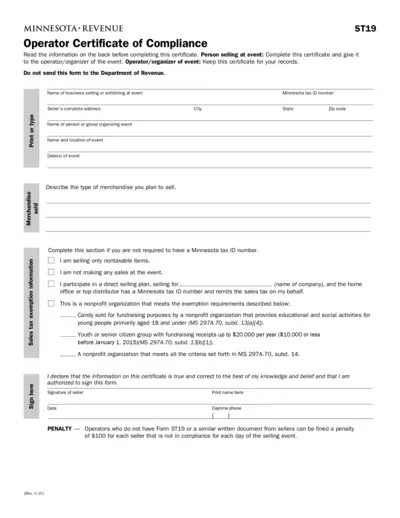

Minnesota ST19 Operator Certificate of Compliance

The Minnesota ST19 Operator Certificate of Compliance is required by law for sellers and event operators to certify compliance with sales tax regulations. The form must be completed by the seller and provided to the operator of the event. Penalties apply for non-compliance.