Tax Documents

Cross-Border Taxation

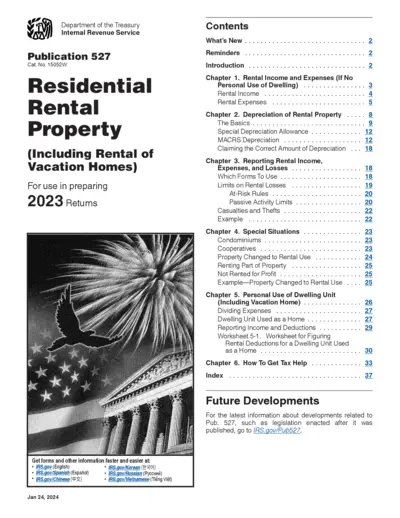

IRS Publication 527 Residential Rental Property 2023

This file contains essential information related to IRS Publication 527 for Residential Rental Property, including guidance on reporting income and expenses. Learn about deductions, depreciation, and special rental situations. It's a must-read for anyone involved in residential rental activities.

Tax Returns

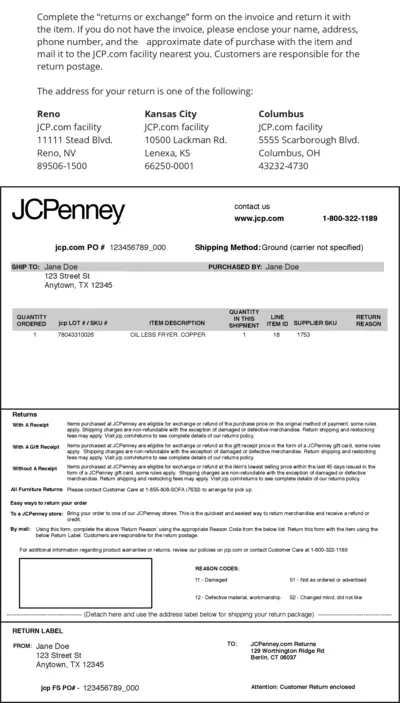

JCPenney Returns and Exchange Form Instructions

This file provides detailed instructions on how to complete returns or exchanges at JCPenney. It outlines the necessary information needed and the process to follow for a successful return. Use this guide to understand the return policy and your responsibilities.

Cross-Border Taxation

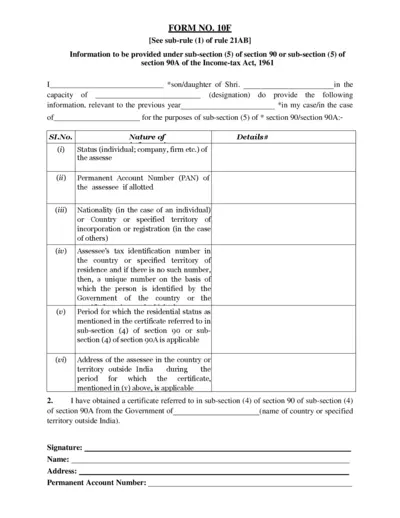

Form No. 10F: Income Tax Information Submission

Form No. 10F is required for providing tax information under sections 90 and 90A. Use this form to ensure compliance with tax regulations. Accurately filled forms help facilitate seamless processing of your tax-related matters.

Cross-Border Taxation

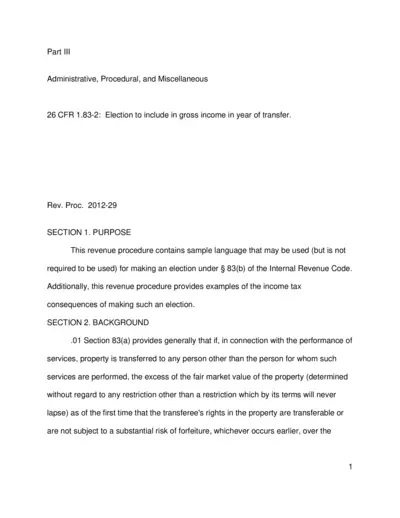

Election to Include in Gross Income under 83(b)

This document outlines the process of making an election under Section 83(b) of the Internal Revenue Code. It provides guidelines on the tax consequences and filing procedures necessary for individuals transferring property. Understanding these details is crucial for compliant tax reporting.

Cross-Border Taxation

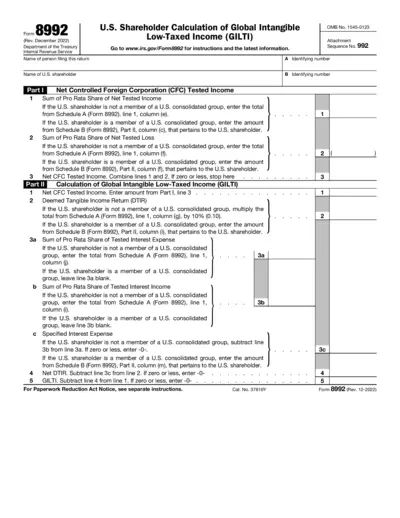

Global Intangible Low-Taxed Income (GILTI) Form 8992

Form 8992 is a crucial document for U.S. shareholders calculating their Global Intangible Low-Taxed Income (GILTI). It assists in reporting income from controlled foreign corporations. Understanding this form is vital for compliance with U.S. tax regulations.

Cross-Border Taxation

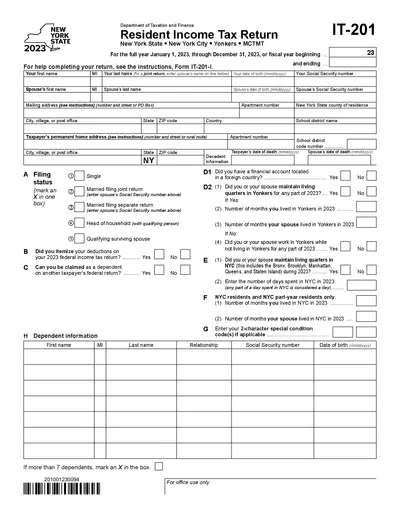

New York State Resident Income Tax Return 2023

This document is the New York State Resident Income Tax Return form for 2023. It is essential for individuals filing their state income taxes. This form includes detailed instructions and sections for reporting income and deductions.

Payroll Tax

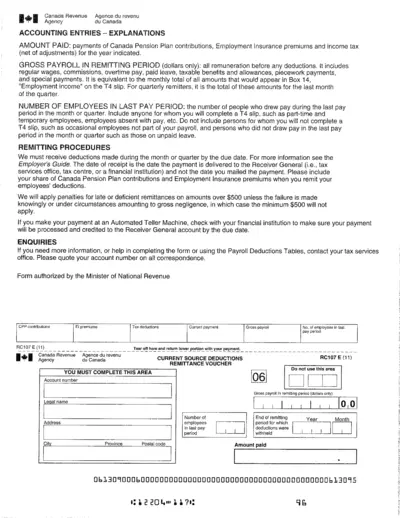

Canada Revenue Agency Accounting Entries Explanations

This file provides detailed explanations regarding accounting entries relevant to Canada Revenue Agency. It includes instructions for payroll remittances and how to report deductions. A must-have resource for employers handling payroll in Canada.

Cross-Border Taxation

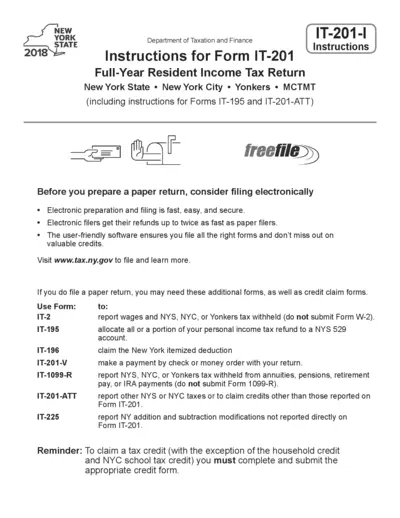

New York State 2018 IT-201-I Tax Filing Instructions

This document provides detailed instructions for filing the 2018 New York IT-201-I tax form. It includes essential information about credits and forms required for full-year resident taxpayers. Ideal for individuals seeking guidance on electronically or paper filing their tax returns.

Cross-Border Taxation

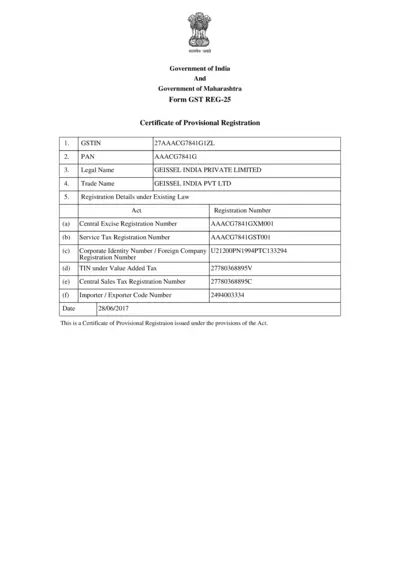

Certificate of Provisional Registration GST REG-25

This file is a certificate for provisional registration under GST. It includes essential details such as GSTIN and PAN. Businesses applying for GST registration must use this file.

Tax Returns

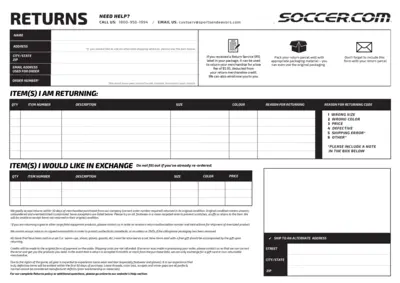

Easy Returns Process for Soccer.com

This file provides detailed instructions for returning purchased items to Soccer.com. It includes important information on how to fill out the return form, acceptable return conditions, and contact details for assistance. Use this document to help ensure a smooth and hassle-free return experience.

Cross-Border Taxation

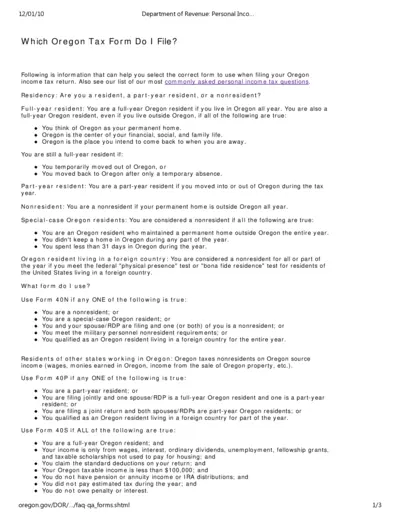

Oregon Department of Revenue Personal Income Tax Forms

This document provides essential information for filing personal income tax forms in Oregon. It includes guidelines for residents and nonresidents, along with important form selection criteria. Understanding your residency status and the appropriate forms is crucial for accurate tax filing.

Cross-Border Taxation

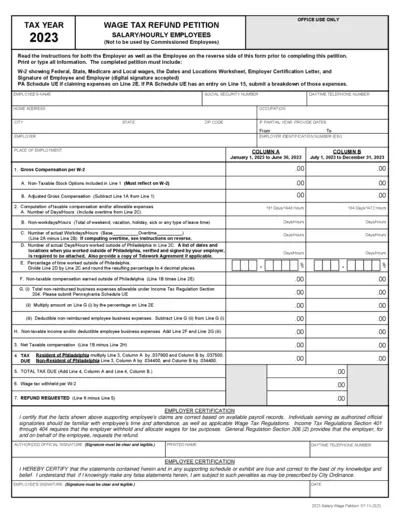

2023 Wage Tax Refund Petition Instructions

This document provides essential instructions for filling out the 2023 Wage Tax Refund Petition. It is designed for salary and hourly employees who are seeking a refund of over-withheld wage taxes. Follow the detailed guidelines to ensure your petition is completed correctly.