Tax Documents

Cross-Border Taxation

Form E-500 Sales and Use Tax Return Instructions

This file provides detailed instructions for completing Form E-500, used for filing North Carolina state, local, and transit sales and use taxes. It outlines necessary information, penalties for non-compliance, and specific requirements for various types of transactions. Ideal for business owners and tax professionals needing guidance on accurate tax filing.

Cross-Border Taxation

Essential IRS Tax Filing Checklist for 2024

This comprehensive checklist outlines the necessary documents required for efficient tax preparation. It aids individuals and families in gathering relevant information to file their taxes. Ensure you're well-prepared for your tax appointment by reviewing this essential resource.

Tax Returns

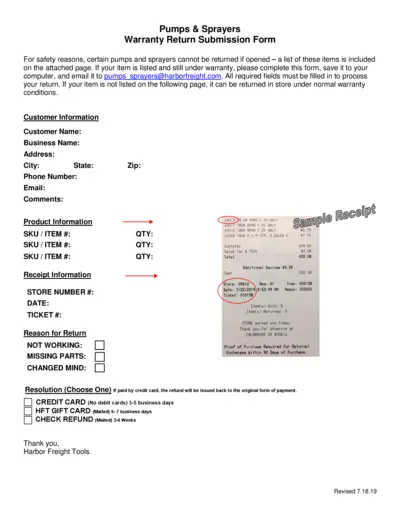

Pumps and Sprayers Warranty Return Submission Form

This form is designed for customers to return pumps and sprayers under warranty. It provides detailed instructions for submitting returns. Ensure all fields are filled to expedite the process.

Cross-Border Taxation

New York State 2021 IT-201-X Amended Tax Return

The IT-201-X form is for New York residents looking to amend their income tax return for the year 2021. This form provides instructions for reporting changes to income, deductions, and credits. Utilize this document to ensure accurate tax filings and to recover any potential refunds.

Cross-Border Taxation

Virginia Pass-Through Entity Tax Form 502 Instructions

This file contains the detailed instructions for filing the Virginia Pass-Through Entity Return of Income for tax purposes. It includes information on important changes, how to complete the form, and various tax credits available. Essential for businesses and individuals engaging with Virginia’s taxation system.

Cross-Border Taxation

Instructions for Form 8869 Qualified Subsidiary Election

This document provides instructions for filing Form 8869, which allows a parent S corporation to elect to treat its eligible subsidiaries as qualified subchapter S subsidiaries (QSub). It details the process, eligibility requirements, and essential timelines needed for proper filing.

Cross-Border Taxation

Form IL-1040 Instructions for Illinois Tax Filing

This document provides comprehensive instructions for filling out the 2017 Form IL-1040 for Illinois taxpayers. It includes important updates, tax rates, exemption allowances, and credits available to filers. Utilize this guide to ensure accurate and timely submission of your state tax return.

Cross-Border Taxation

Arizona Transaction Privilege Tax Return Instructions

This document provides comprehensive instructions for filing the Arizona Transaction Privilege, Use, and Severance Tax Return (TPT-1). It outlines who must file, due dates, penalties for late submissions, and how to amend previous returns. Ideal for businesses operating within Arizona, it's essential for compliant tax reporting.

Cross-Border Taxation

Instructions for Form 2553 Election by a Small Business Corporation

This file provides detailed instructions for completing Form 2553, which is essential for small business corporations electing S corporation status. It includes updated fax numbers and guidance for timely filings. Essential for understanding eligibility and submission processes.

Cross-Border Taxation

Form 6251 Alternative Minimum Tax for Individuals

Form 6251 is used to calculate the Alternative Minimum Tax (AMT) for individuals. It helps taxpayers determine if they owe AMT in addition to regular tax. This form is essential for those who have certain tax preferences and deductions.

Cross-Border Taxation

Oregon Tax Forms 40N and 40P Instructions

This file contains detailed instructions for completing Oregon Tax Forms 40N and 40P. It provides essential steps for filing accurately. Follow the guidelines to ensure timely processing of your tax return.

Cross-Border Taxation

2023 Shareholder Instructions for Schedule K-1

This file contains the essential instructions and details for the Schedule K-1 (Form 1120-S). It helps shareholders understand their share of income, deductions, credits, and other crucial tax information. These guidelines are vital for accurate tax reporting and compliance.