Tax Documents

Cross-Border Taxation

Instructions for New York State Estate Tax Return Form ET-706

This file provides essential instructions for completing the New York State Estate Tax Return Form ET-706. It outlines eligibility criteria, filing requirements, and essential deadlines to ensure compliance with New York tax laws. The document is vital for executors managing estates of individuals who died on or after January 1, 2023.

Agricultural Property Tax

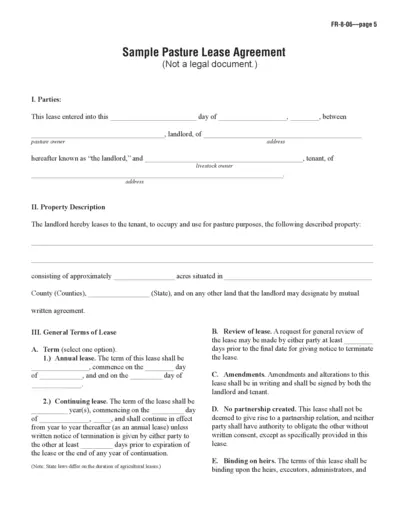

Sample Pasture Lease Agreement Template

This Sample Pasture Lease Agreement serves as a template for landlords and tenants involved in agricultural leasing. It outlines the terms, responsibilities, and agreements necessary for effective pasture use and management. Ideal for livestock owners and pasture landlords looking to formalize their leasing arrangements.

Cross-Border Taxation

Form No 15G Declaration for Income Tax Exemption

Form No 15G is a declaration meant for individuals and non-corporate entities, allowing them to claim certain incomes without tax deduction. It simplifies the process of submitting income details to avoid unnecessary tax deductions. This form is essential for those who wish to manage their tax liabilities efficiently.

Cross-Border Taxation

New York State Taxation Nonresidency Certificate

This document is a Certificate of Nonresidency for New York State, allowing non-residents to claim exemption from state and local sales tax when purchasing motor vehicles or vessels. It is essential for individuals who do not reside in New York State and are making eligible purchases. Proper completion of this form is crucial to avoid tax liabilities.

Cross-Border Taxation

Instructions for Form 941-X - Federal Tax Return

This file provides detailed instructions for completing Form 941-X, which is used to adjust employer's quarterly federal tax return or claim for refund. It includes essential guidelines, deadlines, and credits applicable for employers. Users must refer to these instructions to ensure accurate corrections to their payroll filings.

Cross-Border Taxation

BIR Form 1601-C Monthly Remittance Return of Income Taxes

This file contains the BIR Form 1601-C instructions and details for withholding tax on compensation. It is essential for employees and payors to understand the filing requirements. Make sure to fill in all necessary information accurately.

Tax Returns

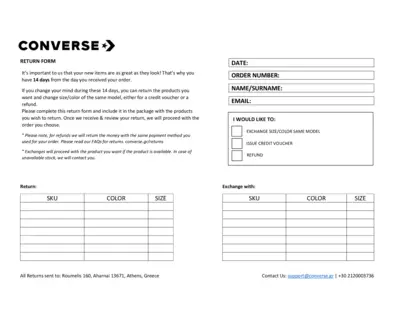

Converse Return Form Instructions and Details

This file contains essential information and instructions for returning Converse products. Users have 14 days to return items for refunds or exchanges. The form must be completed and included with the returned items.

Cross-Border Taxation

Form W-4 Instructions for Non-Resident Aliens

This file contains instructions for non-resident aliens on how to fill out Form W-4. It outlines necessary steps, details on exemptions, and key information regarding federal income tax withholding. It serves as a vital resource for ensuring accurate tax documentation.

Cross-Border Taxation

Power of Attorney Declaration - Form POA-1 Instructions

Form POA-1 allows taxpayers to grant authority to representatives for tax-related matters. This form ensures that appointed representatives can act on behalf of the taxpayer. It includes instructions for filling out the form and information about its purpose and usage.

Cross-Border Taxation

New York State Estimated Tax for Corporations

The CT-400-MN form allows corporations in New York to estimate their tax obligations. It is crucial for compliance and financial planning. Properly filling out this form ensures timely payments and avoids penalties.

Cross-Border Taxation

Wisconsin 2022 Form PW-1 Instructions and Guidelines

The Wisconsin 2022 Form PW-1 offers detailed instructions for filing withholding tax for nonresidents. It outlines requirements, exemptions, and filing methods. Understanding this form is essential for pass-through entities operating within Wisconsin.

Tax Returns

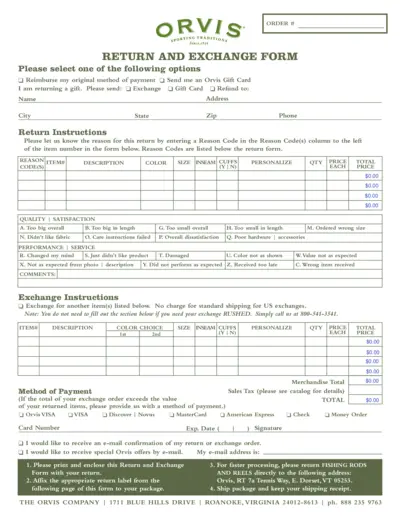

Orvis Return and Exchange Form Instructions

This file contains detailed instructions for the Orvis Return and Exchange process. It guides users on how to fill out the form, and the steps involved in returning or exchanging items. A must-have for anyone needing to process returns or exchanges with Orvis.