Cross-Border Taxation Documents

Cross-Border Taxation

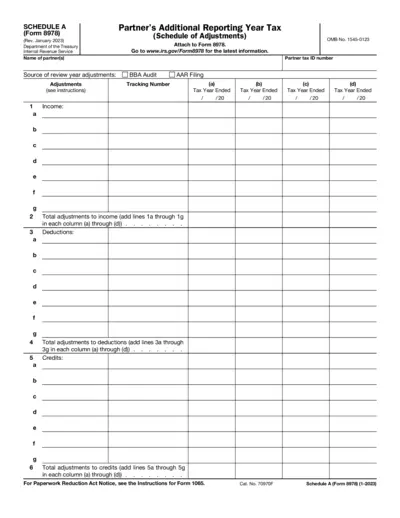

Schedule A Form 8978 Instructions and Overview

This file contains the instructions for Schedule A of Form 8978. It's essential for partners reporting additional tax information. Use this guidance to ensure accurate tax filing and compliance.

Cross-Border Taxation

IRS Relief for Late Entity Classification Elections

This document provides guidance for eligible entities seeking relief for late entity classification elections with the IRS. It outlines the procedures, requirements, and relevant sections required for filing. Users will find valuable information for tax-related classifications.

Cross-Border Taxation

Instructions for Form SS-4: EIN Application Guide

This file provides detailed instructions on applying for an Employer Identification Number (EIN). It is essential for businesses, trusts, estates, and various entities for tax purposes. Follow the guidelines accurately to establish your business tax account.

Cross-Border Taxation

FBR Taxpayer Registration Form TRF-01 V-2 Pakistan

This file is the Taxpayer Registration Form (TRF-01 V-2) issued by the Federal Board of Revenue in Pakistan. It is a crucial document for taxpayers to register for Income Tax, Sales Tax, and Federal Excise. Follow the provided instructions carefully to complete the form accurately.

Cross-Border Taxation

Oregon Department of Revenue Form OR-65 Instructions

This document contains detailed instructions for filing the Oregon Form OR-65 for partnerships. It provides crucial information on tax obligations, filing deadlines, and penalties for non-compliance. Perfect for partnership entities conducting business in Oregon.

Cross-Border Taxation

Massachusetts DR-1 Office of Appeals Form Details

This file contains the Massachusetts Form DR-1 for Office of Appeals. It provides essential information for taxpayers filing disputes regarding taxes and penalties. Use this form to seek a pre-assessment, post-assessment, or other type of request regarding your tax situation.

Cross-Border Taxation

2024 Colorado Employee Withholding Certificate

This file is the 2024 Colorado Employee Withholding Certificate needed for state tax withholding purposes. Employees can use this form to adjust their Colorado withholding based on their individual tax situation. It provides detailed instructions to ensure accurate tax calculations.

Cross-Border Taxation

California Franchise Tax Board Withholding Guidelines

This document provides comprehensive guidelines on withholding requirements for California Franchise Tax Board. It assists users in understanding their obligations when making payments to nonresident contractors, partners, or beneficiaries. Perfect for businesses and individuals needing to comply with California tax regulations.

Cross-Border Taxation

Instructions for Form W-7 Application for ITIN

This document provides comprehensive instructions on how to complete Form W-7, the application for an IRS Individual Taxpayer Identification Number (ITIN). It outlines eligibility requirements, necessary documentation, and application procedures. Whether you're a nonresident alien or a dependent of a U.S. citizen, this guide is essential for tax purposes.

Cross-Border Taxation

Nebraska Individual Income Tax Booklet 2023

This file contains the 2023 Nebraska Individual Income Tax Booklet which provides essential information for taxpayers. It guides users in e-filing their tax returns, eligibility requirements, and available deductions. Ideal for individuals seeking to understand their tax obligations and options.

Cross-Border Taxation

Schedule 3 Form 1040 Additional Credits and Payments

Schedule 3 is a critical IRS form used to report additional credits and payments when filing your tax return. This form is essential for taxpayers seeking nonrefundable credits, refundable credits, payments, and other tax benefits. Properly filling out this form can help reduce your tax bill or increase your refund.

Cross-Border Taxation

Philadelphia Tax Change Form Update Instructions

This document provides instructions for updating your tax account information in Philadelphia. It details how to fill out the change form and the necessary steps involved. Use this guide to ensure your tax information is current and compliant.