Cross-Border Taxation Documents

Cross-Border Taxation

IRS Form 5329 Instructions for Additional Tax

IRS Form 5329 provides instructions for reporting additional taxes on qualified plans and other tax-favored accounts. It is essential for anyone who has taken early distributions from their retirement accounts. Understanding the details of Form 5329 helps taxpayers comply with IRS requirements.

Cross-Border Taxation

Heavy Highway Vehicle Use Tax Return Form 2290

The IRS Form 2290 is used to report and pay the Heavy Highway Vehicle Use Tax. This tax applies to vehicles that are driven on public highways with a gross weight of 55,000 pounds or more. It is essential for businesses and individuals operating heavy vehicles to complete this form accurately.

Cross-Border Taxation

Instructions for Form IT-2658 on Estimated Tax

This file provides essential guidance for completing Form IT-2658, which is used for estimated tax payments for nonresident individual partners and shareholders in New York. It includes detailed information about filing requirements, deadlines, and compliance with tax laws. Understanding this document is crucial for any entity involved in partnerships or S corporations operating in New York.

Cross-Border Taxation

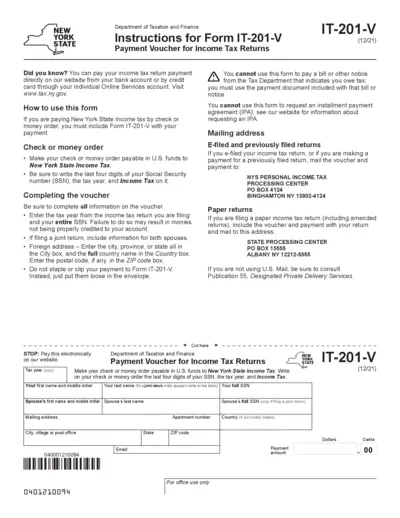

Instructions for Form IT-201-V Payment Voucher

This document provides clear instructions for completing Form IT-201-V, the New York State Payment Voucher for Income Tax Returns. Ensure proper submission to avoid processing delays. Follow the guidelines and utilize online services for convenience.

Cross-Border Taxation

W-8IMY Instructions for Foreign Entities Tax Compliance

This file provides comprehensive instructions for Form W-8IMY. It is essential for foreign intermediaries, entities, and certain U.S. branches regarding U.S. tax withholding and reporting. Users will find guidance on completing the form to ensure compliance with IRS regulations.

Cross-Border Taxation

Missouri Use Tax Return Instructions and Form

This document provides detailed instructions for filing the Missouri Use Tax Return. It includes necessary fields, rates, and guidelines for accurate submissions. Ensure compliance with state laws by following the outlined procedures.

Cross-Border Taxation

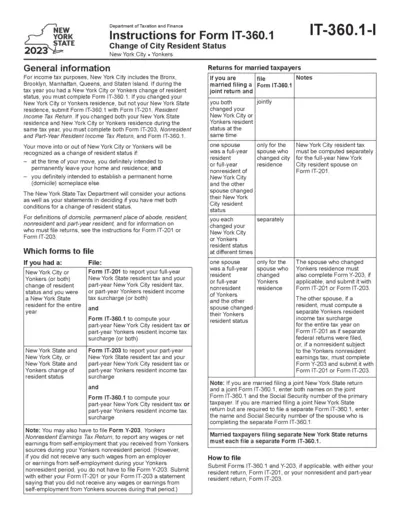

NYC and Yonkers Change of Resident Status Instructions

This file provides step-by-step instructions for completing Form IT-360.1 for New York City and Yonkers change of resident status for tax purposes. It includes essential guidance on necessary forms, eligibility, and filing procedures. Ideal for taxpayers navigating residency status changes in NYC or Yonkers.

Cross-Border Taxation

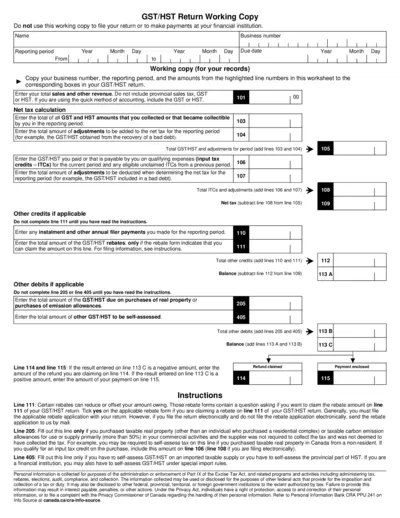

GST/HST Return Working Copy Instructions

This document serves as a working copy for filling out the GST/HST return. It provides essential details and instructions for accurately reporting your sales tax. Ensure you review the highlighted sections for correct entries.

Cross-Border Taxation

Instructions for Form 1042-S - IRS Guidelines

The Instructions for Form 1042-S provide essential information for reporting U.S. source income for foreign persons. This file outlines the necessary steps and requirements for filing the form accurately. It is a crucial resource for withholding agents and tax practitioners dealing with international income.

Cross-Border Taxation

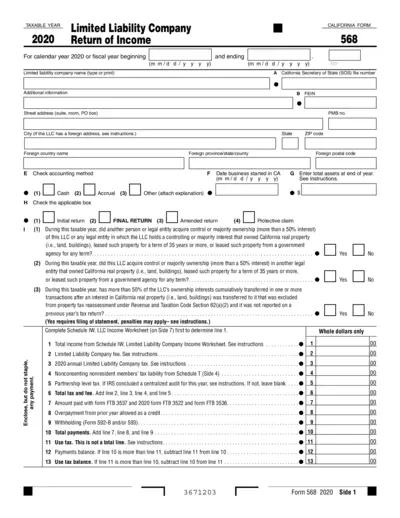

California Form 568 LLC Return of Income 2020

The California Form 568 is utilized by limited liability companies to report their income and taxes. It is essential for compliance with state tax regulations and ensuring accurate income reporting. This form is required for both calendar and fiscal year filings.

Cross-Border Taxation

Minnesota Property Tax Refund Instructions

This document provides essential information regarding the Minnesota Property Tax Refund programs available for homeowners and renters. It outlines eligibility requirements and application processes. Users can find crucial details to ensure they claim their refunds accurately.

Cross-Border Taxation

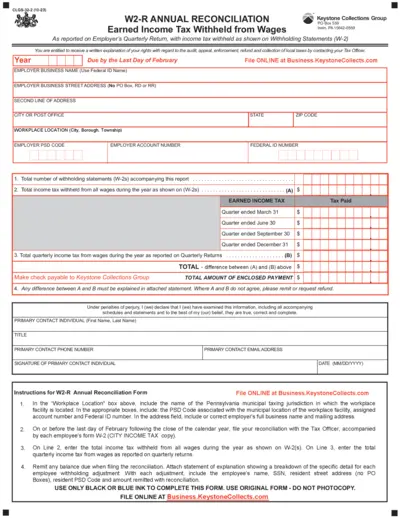

W2-R Annual Reconciliation Form Instructions

The W2-R Annual Reconciliation form is essential for employers to report earned income tax withheld from wages. It is used to reconcile annual income taxes and ensure compliance with local tax regulations. Employers must submit this form by the last day of February following the close of the calendar year.