Cross-Border Taxation Documents

Cross-Border Taxation

Travel Logbook 2021/22 for SARS Tax Deductions

This Travel Logbook is essential for taxpayers receiving a travel allowance from SARS. It guides users in accurately recording business travel for tax deductions. Follow the provided instructions to ensure a valid claim.

Cross-Border Taxation

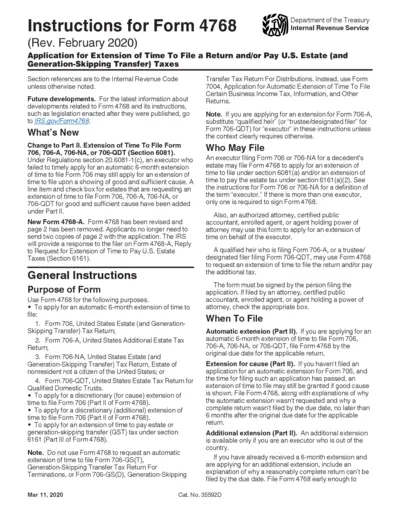

Form 4768 Application for Estate Tax Extension

This file contains the instructions for Form 4768, the application for extension of time to file U.S. estate taxes. It provides essential guidelines for executors seeking an extension, details about eligibility, and instructions on submission. Users can learn how to complete the form accurately and within prescribed timelines to avoid penalties.

Cross-Border Taxation

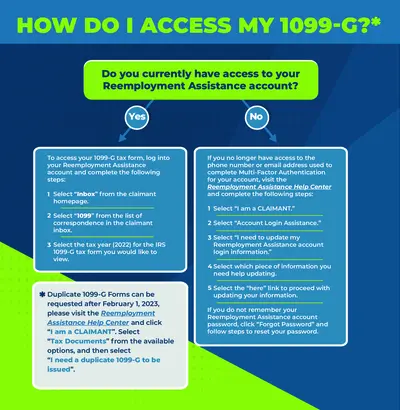

How to Access and Request a 1099-G Tax Form

This document outlines the steps to access your 1099-G tax form through your Reemployment Assistance account. It also provides guidance on how to request duplicate forms if needed. Essential for individuals seeking tax information for the year 2022.

Cross-Border Taxation

Arizona Employee Withholding Election Instructions

This file provides essential instructions for Arizona employees regarding their withholding election. It outlines procedures for new and current employees to complete the Arizona Form A-4. The document also includes information for nonresidents and important deadlines.

Cross-Border Taxation

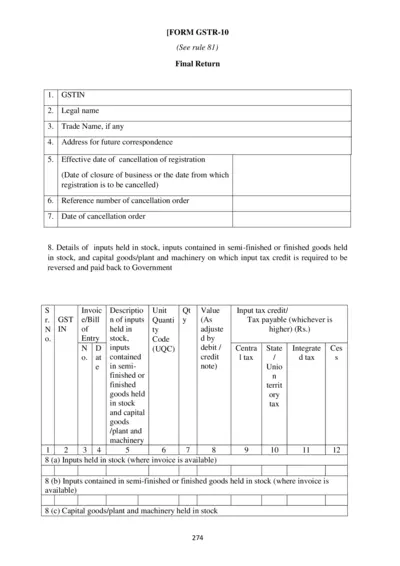

GSTR-10 Final Return Form Instructions and Information

The GSTR-10 form is a final return for taxpayers who cancel their GST registration. It includes details about stock, tax payable, and verification. This document is essential for ensuring compliance with GST regulations during registration cancellation.

Cross-Border Taxation

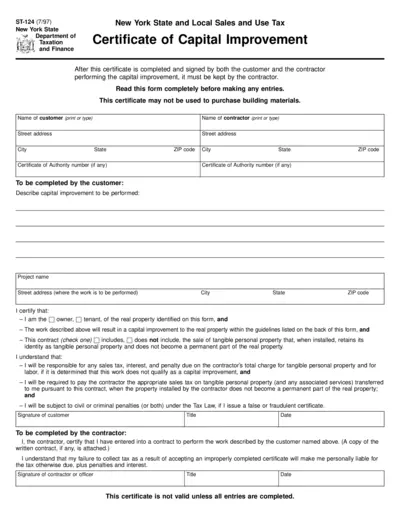

New York State Sales Use Tax Capital Improvement

This file contains the New York State Certificate of Capital Improvement. It details the requirements for customers and contractors regarding sales and use tax exemptions. Following the guidelines in this document is essential for compliance.

Cross-Border Taxation

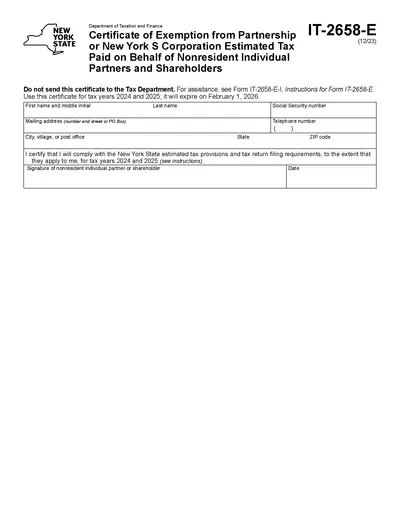

New York State Tax Exemption Certificate IT-2658-E

The New York State Certificate of Exemption is essential for nonresident individual partners and shareholders to claim estimated tax exemptions. This form must be filled out accurately for the tax years 2024 and 2025. Ensure compliance with New York State tax regulations by submitting this certificate timely.

Cross-Border Taxation

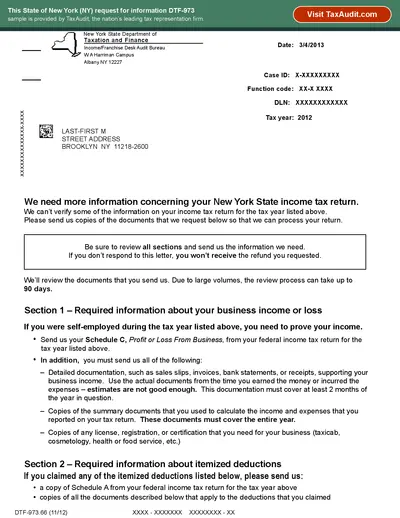

New York State Request for Information DTF-973

This file is a New York State request for information DTF-973, used to gather additional documentation for your tax return. It outlines the necessary documents and requirements to support your income tax claims. Ensure you follow the instructions provided to avoid delays in processing your tax return.

Cross-Border Taxation

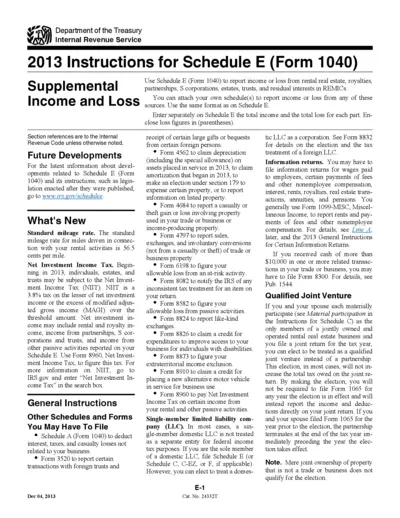

2013 IRS Schedule E Instructions for Income Reporting

This document provides comprehensive instructions for Schedule E, helping individuals to report their supplemental income or loss from various sources. It is essential for taxpayers with rental real estate, royalties, partnerships, or S corporations. Refer to this file for guidance on properly filing your income tax return with the IRS.

Cross-Border Taxation

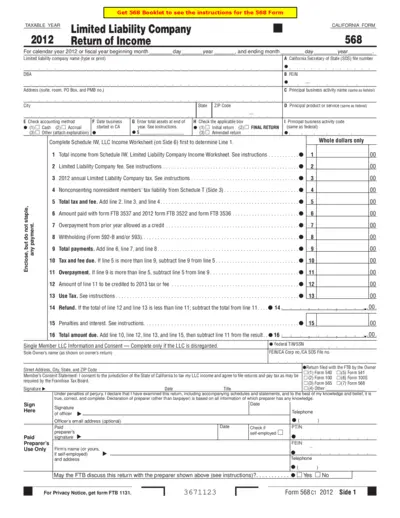

California Form 568 Limited Liability Company Income

The California Form 568 is a return of income for Limited Liability Companies. It provides detailed instructions on reporting income and taxes for LLCs in the state. This form is essential for compliance with California tax regulations.

Cross-Border Taxation

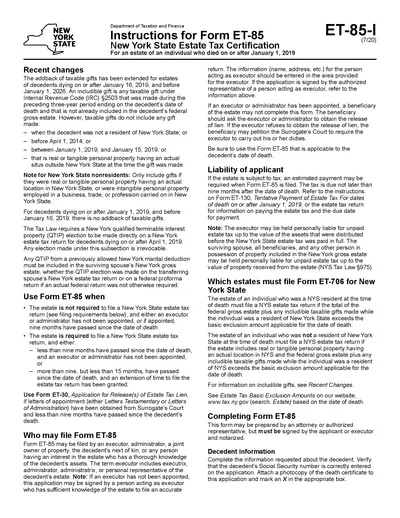

New York State Estate Tax Certification Instructions

This file contains important instructions for filling out Form ET-85 for New York State Estate Tax Certification. It explains the eligibility requirements, filing process, and details necessary for estate executors and beneficiaries. By following these instructions, users can ensure compliance with New York state estate tax laws.

Cross-Border Taxation

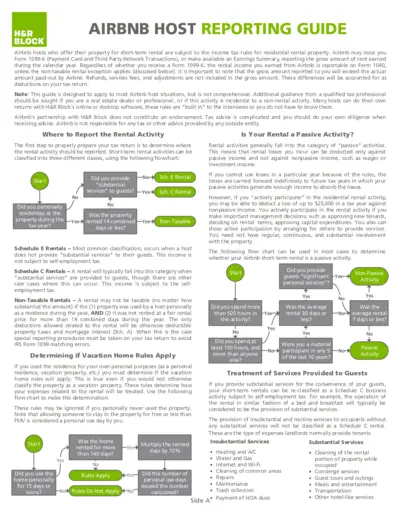

Airbnb Host Reporting Guide by H&R Block

This guide provides essential information for Airbnb hosts regarding income tax obligations. It outlines how to report rental income and expenses. Perfect for short-term rental owners navigating tax requirements.