Property Law Documents

Property Taxes

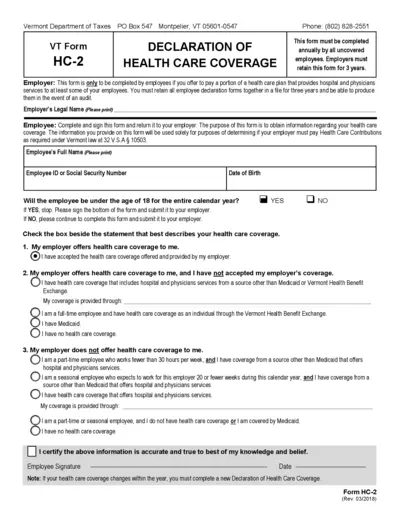

Vermont HC-2 Declaration of Health Care Coverage

This form, required by the Vermont Department of Taxes, must be completed annually by uncovered employees to declare their health care coverage status. Employers must retain this form for three years for auditing purposes. It helps determine if Health Care Contributions are required by the employer under Vermont law.

Property Taxes

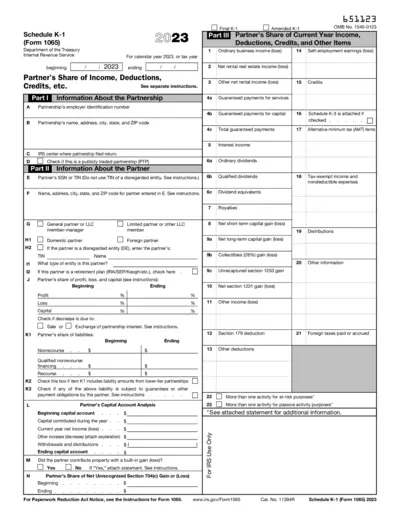

2023 Schedule K-1 Form 1065 Instructions and Details

This file provides the details and instructions required to fill out the 2023 Schedule K-1 form. It includes specific information about the partnership, partner's share of income, deductions, credits, and other relevant data. It's essential for accurate tax reporting.

Property Taxes

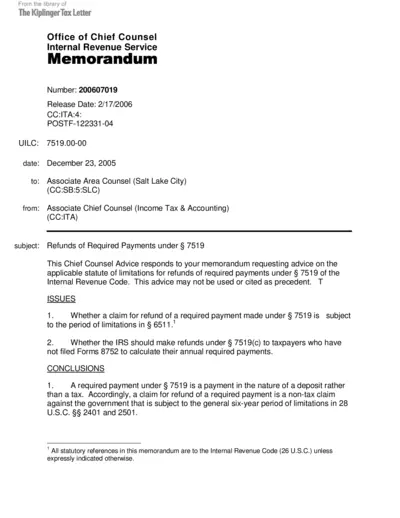

Refunds of Required Payments under Section 7519

This document provides guidance on the statute of limitations applicable to refunds of required payments under Section 7519 of the Internal Revenue Code. It addresses issues such as the period of limitations and the requirement for entities to file Forms 8752. The advice cannot be used as a precedent.

Property Taxes

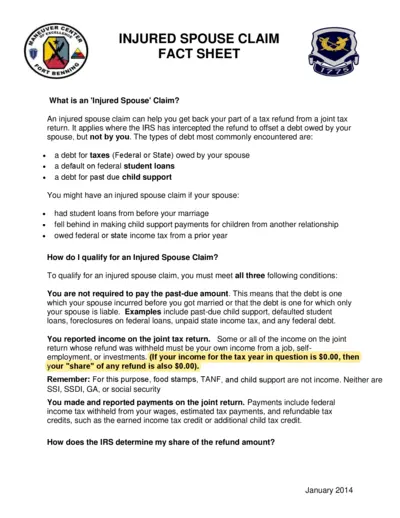

Injured Spouse Claim Form Instructions and FAQs

This document provides detailed instructions and FAQs for filing an Injured Spouse Claim to recover part of a tax refund intercepted by the IRS due to your spouse's debt. It explains eligibility criteria, the filing process, and important considerations. Learn how to complete Form 8379 and reclaim your portion of the tax refund.

Real Estate

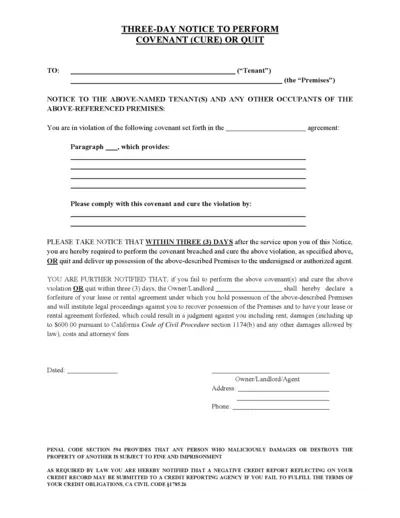

Three-Day Notice to Perform Covenant or Quit - Instructions

This file provides a three-day notice to tenants to comply with a specific covenant or vacate the premises. It outlines the violation, required actions, and legal consequences for non-compliance. Essential for landlords managing rental properties.

Property Taxes

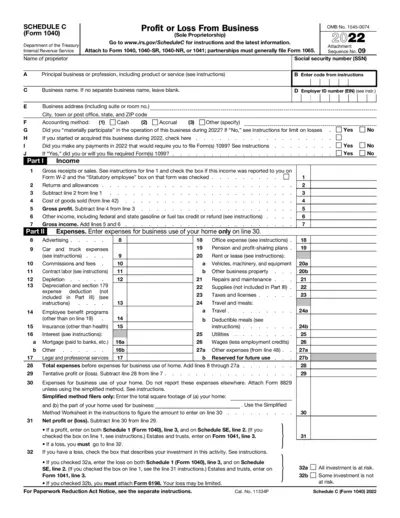

Schedule C (Form 1040) 2022 - Profit or Loss From Business

The Schedule C (Form 1040) is used to report income or loss from a business. It is required for sole proprietors. This form helps individuals calculate their business profit or loss.

Property Taxes

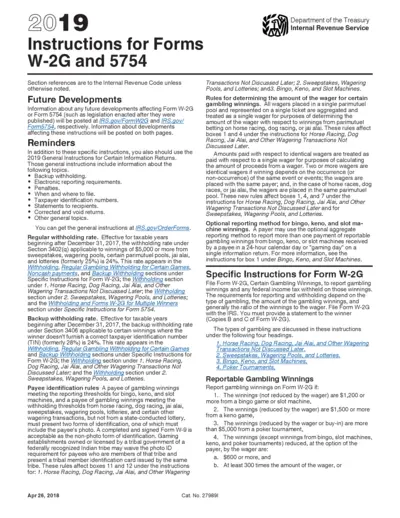

2019 Instructions for Forms W-2G and 5754

This file provides instructions for filing Forms W-2G and 5754. It includes details about withholding, reporting requirements, and specific instructions for different types of gambling winnings. It also includes information on backup withholding and requirements for payee identification.

Property Taxes

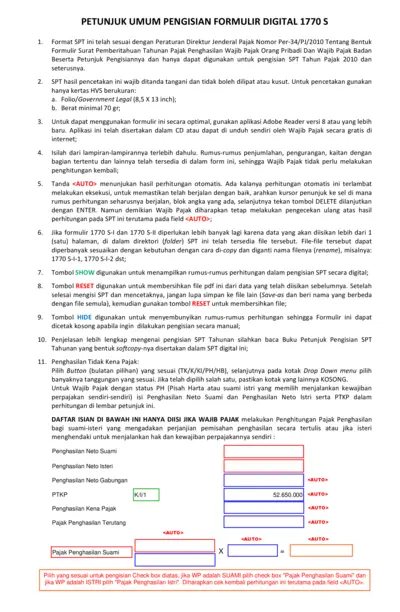

Petunjuk Umum Pengisian Formulir Digital 1770 S

This file provides detailed instructions for filling out the digital Formulir 1770 S for individual taxpayers in Indonesia. It aligns with Peraturan Direktur Jenderal Pajak Nomor Per-34/PJ/2010. Follow the guidelines to ensure accurate tax reporting.

Property Taxes

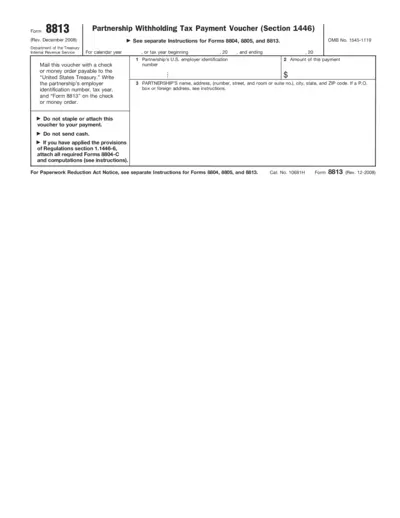

Partnership Withholding Tax Payment Voucher (Form 8813)

Form 8813 is used by partnerships to make withholding tax payments under Section 1446. It includes instructions for completing the form and payment details. Separate instructions are provided for Forms 8804, 8805, and 8813.

Property Taxes

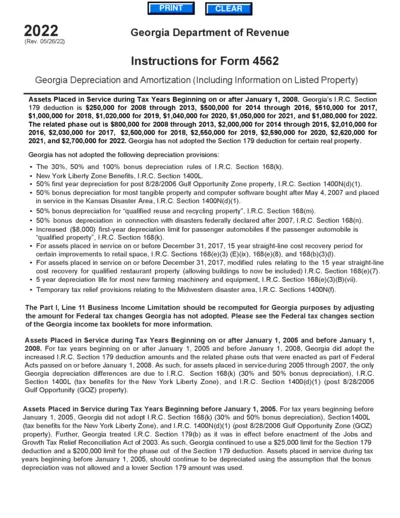

Georgia Department of Revenue Form 4562 Instructions

Detailed instructions for completing the Georgia Department of Revenue Form 4562. This guide covers Georgia Depreciation and Amortization rules for assets placed in service from 2005 to 2022. It includes information on I.R.C. Section 179 and other tax regulations.

Real Estate

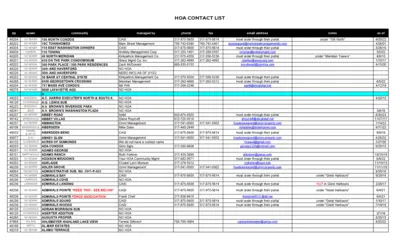

Comprehensive HOA Contact List for Various Residential Areas

This file provides a detailed list of HOA contacts including phone numbers, email addresses, and management companies for various residential areas. It is intended to help homeowners and property managers easily find and reach out to the relevant HOA for their community. The document also specifies whether the listed properties have sewer and HOA details.

Property Taxes

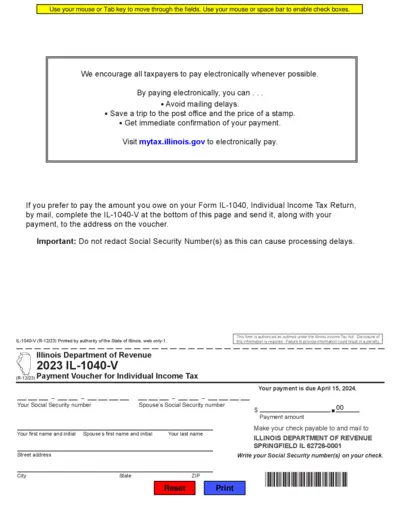

Illinois Individual Income Tax Payment Voucher IL-1040-V

The IL-1040-V form is used by taxpayers in Illinois to pay the amount they owe on their Individual Income Tax Return by mail. This form should be completed and sent along with the payment to the specified address. It is authorized under the Illinois Income Tax Act.