Property Law Documents

Real Estate

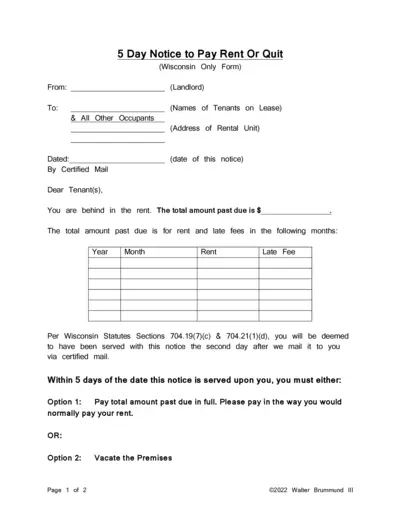

Wisconsin 5 Day Notice to Pay Rent or Quit

This form is used by landlords in Wisconsin to notify tenants of past due rent and provide an option to either pay the rent or vacate the premises within 5 days. It includes details on the total amount past due and the consequences of non-compliance. The form complies with Wisconsin Statutes Sections 704.19(7)(c) & 704.21(1)(d).

Property Taxes

Texas Franchise Tax Forms and Instructions for 2023

This file contains important information and instructions for Texas Franchise Tax reporting. It includes forms such as the Ownership Information Report (OIR) and the E-Z Computation Report. Essential for entities needing to comply with Texas tax regulations.

Property Taxes

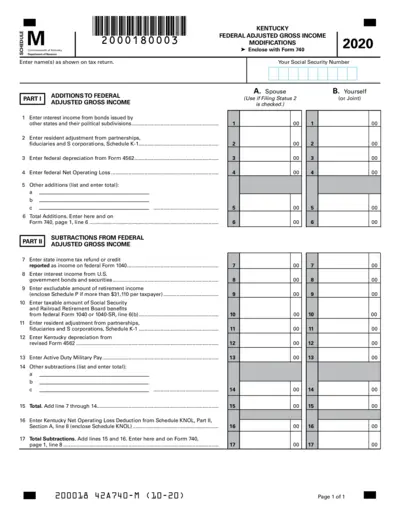

Kentucky State Tax Form Schedule M Instructions and Details

This file contains instructions and details for completing the Kentucky State Tax Form Schedule M. It includes information on additions and subtractions to federal adjusted gross income. This form is crucial for accurate state tax filings.

Property Taxes

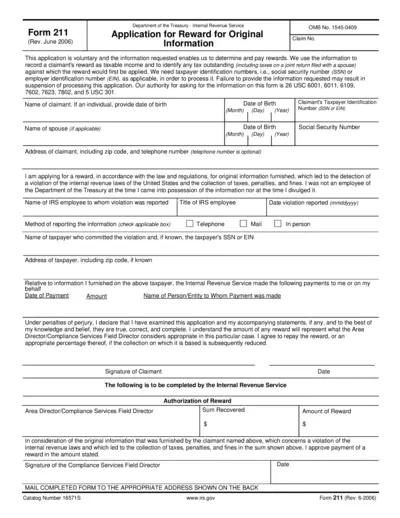

IRS Form 211 - Application for Reward for Original Information

IRS Form 211 is used by individuals to apply for a reward for providing original information that leads to the detection of a violation of internal revenue laws. This form collects claimant's personal details and information about the reported violation. It is submitted to the IRS for approval and processing.

Property Taxes

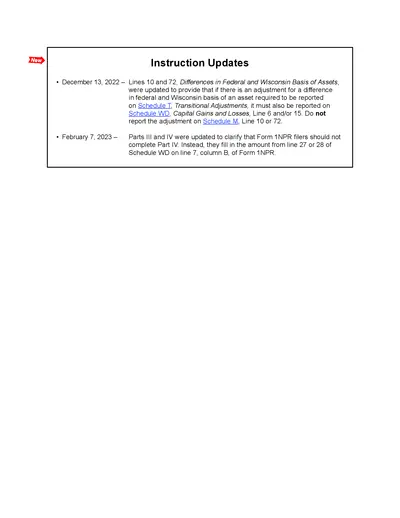

Wisconsin Schedule WD Instructions for Capital Gains and Losses

This document provides detailed instructions for completing Wisconsin Schedule WD, which is used to report capital gains and losses. It includes updates, general and specific instructions, and information on required adjustments. It is essential for individuals and entities dealing with capital gains and losses in Wisconsin.

Property Taxes

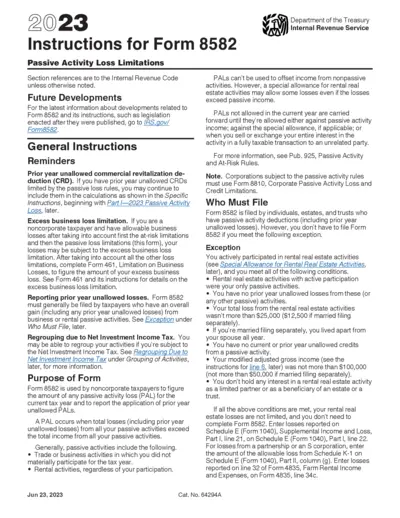

Form 8582 Instructions for Passive Activity Loss Limitations

This document provides detailed instructions for filling out Form 8582, which is used to calculate passive activity loss (PAL) limits for noncorporate taxpayers. It also offers guidance on who must file the form, the purpose of the form, and defines key terms and activities related to the form. Additionally, it includes specific rules and exceptions for rental activities, trade or business activities, and more.

Property Taxes

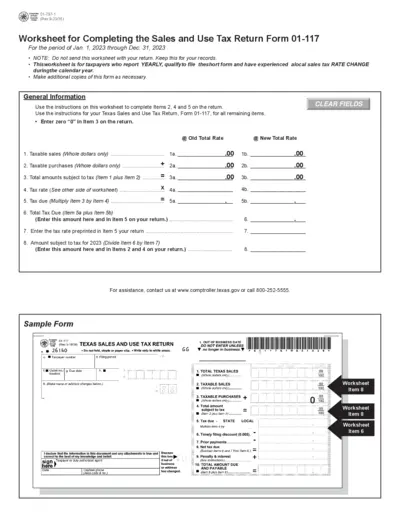

Texas Sales and Use Tax Return Form 01-117 Instructions

This document provides instructions for completing the Texas Sales and Use Tax Return Form 01-117. It includes guidelines for taxpayers who report yearly and details on local sales tax rate changes. It also contains a sample form and information about the new tax rates imposed by various cities and special purpose districts in 2023.

Property Taxes

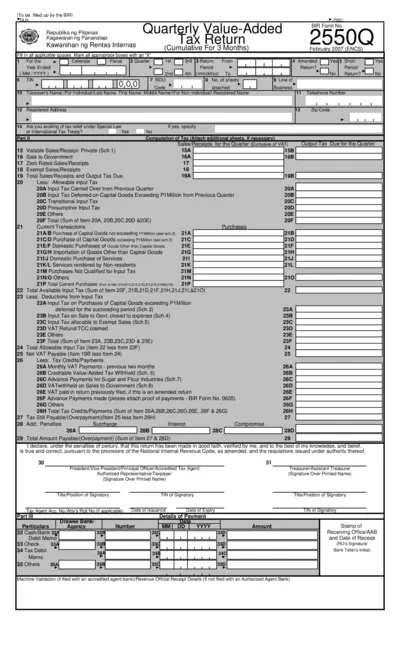

BIR Form No. 2550Q - Quarterly Value-Added Tax Return

This file is the BIR Form No. 2550Q, used for quarterly value-added tax returns. It is filled out by taxpayers to report and pay VAT. The form covers sales, purchases, input and output tax details, and more.

Property Taxes

Massachusetts Estimated Income Tax Payment Instructions

The purpose of this file is to guide taxpayers in Massachusetts on how to make estimated income tax payments. It includes information on who needs to make these payments, when they are due, and how to make them. The file also details the penalties for failing to make estimated tax payments on time.

Property Taxes

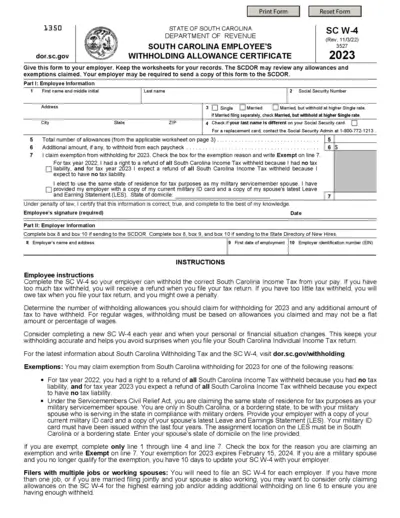

South Carolina Employee's Withholding Allowance Certificate SC W-4 (2023)

This document is the South Carolina Employee's Withholding Allowance Certificate, also known as SC W-4. It is used to determine the amount of South Carolina Income Tax to withhold from an employee's paycheck. Employees should complete this form with accurate information and provide it to their employers.

Property Taxes

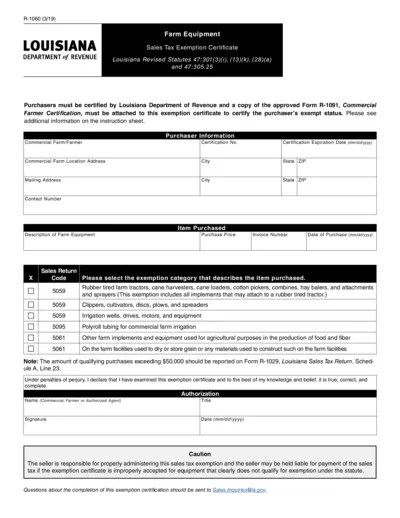

Louisiana Form R-1060: Farm Equipment Sales Tax Exemption Certificate

This document outlines the requirements for Louisiana farm equipment sales tax exemption. Commercial farmers must attach their certification. Learn about qualifying equipment and submission details.

Real Estate

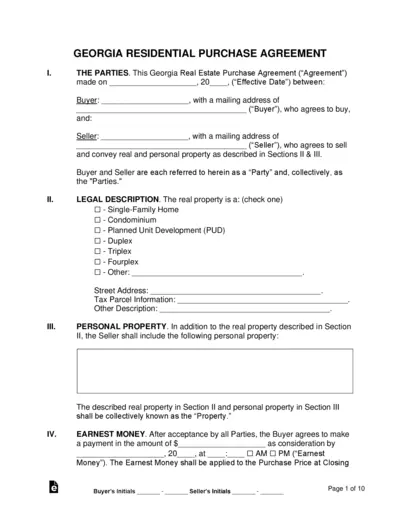

Georgia Residential Real Estate Purchase Agreement

This Georgia Residential Purchase Agreement outlines the terms and conditions for buying and selling real estate in Georgia. It includes essential details about the parties involved, legal description, and personal property included. Completing this form is crucial for a smooth real estate transaction.