Property Law Documents

Property Taxes

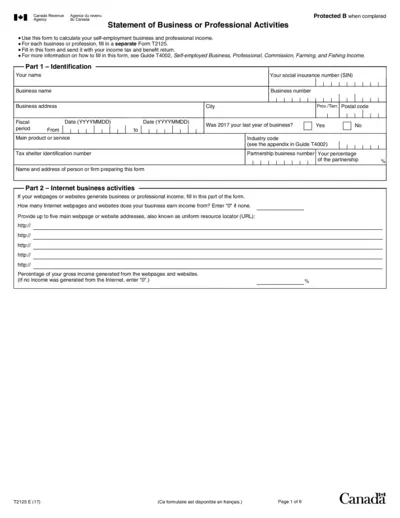

Statement of Business or Professional Activities Form T2125

This file is used to calculate self-employment business and professional income. It includes sections for business and professional income, internet activities, cost of goods sold, and net income before adjustments. Instructions, identification details, and various fields for entering financial data are provided.

Property Taxes

2023 Oregon Income Tax Form OR-40 Instructions

This file provides detailed instructions for filing the 2023 Oregon Income Tax Form OR-40 for full-year residents. It includes information on e-filing, tax credits, and various tax-related topics. Check out the content to ensure accurate and timely tax filing.

Property Taxes

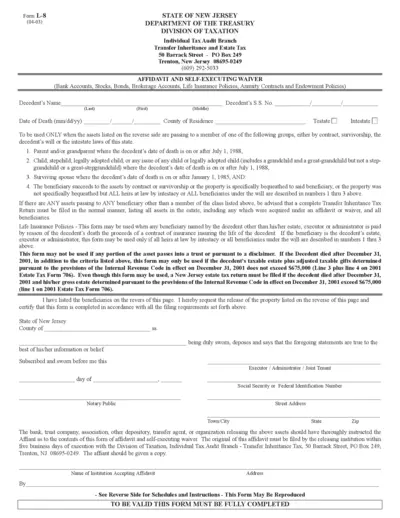

NJ Form L-8 Affidavit and Self-Executing Waiver

Form L-8 is for the release of certain assets without the need for a formal New Jersey inheritance tax waiver. It covers bank accounts, stocks, bonds, brokerage accounts, and life insurance policies. The form is used for beneficiaries including spouse, parents, grandparents, and children.

Property Taxes

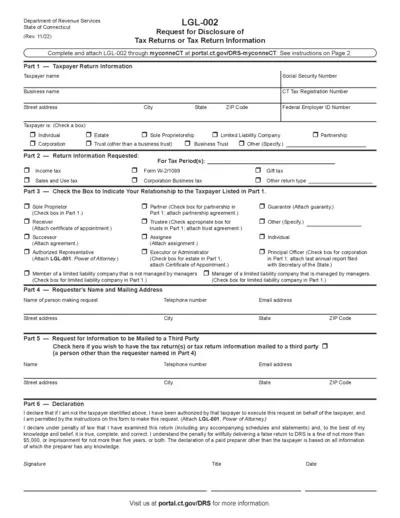

Connecticut Form LGL-002: Request for Disclosure of Tax Returns

This form, LGL-002, from the Department of Revenue Services in Connecticut is used to request tax returns or tax return information. It is applicable for various types of taxpayers including individuals, corporations, estates, and trusts. Follow the instructions provided on the second page to correctly fill out and submit the form.

Property Taxes

2021 IRS Form 8995 Instructions: Qualified Business Income Deduction

Form 8995 instructions help taxpayers calculate the Qualified Business Income Deduction for eligible businesses. It includes details on eligibility, calculating QBI, and aggregating trades or businesses.

Property Taxes

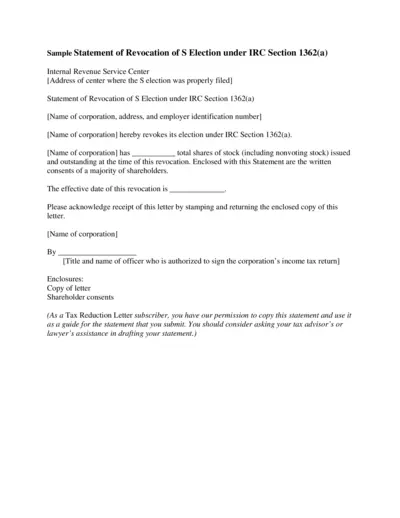

Revocation of S Election under IRC Section 1362(a)

This file contains a statement for revoking an S election under IRC Section 1362(a). It includes details such as the name of the corporation, address, and employer identification number. It also outlines the steps necessary to complete the revocation process and obtain shareholder consents.

Property Taxes

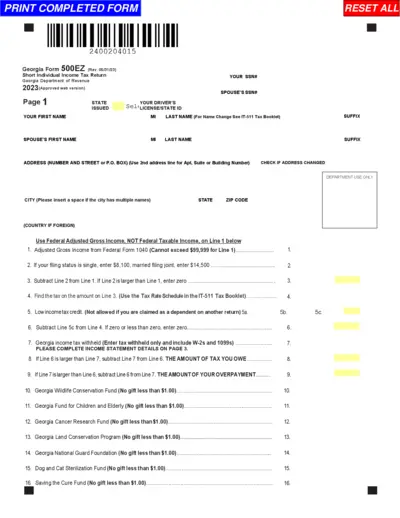

Georgia Form 500EZ - Short Individual Income Tax Return 2023

The Georgia Form 500EZ is a short individual income tax return form for state residents. It's meant for those who meet specific requirements such as having an income below $99,999 and not itemizing deductions. This form is used to calculate and report your state tax obligations for the year 2023.

Property Taxes

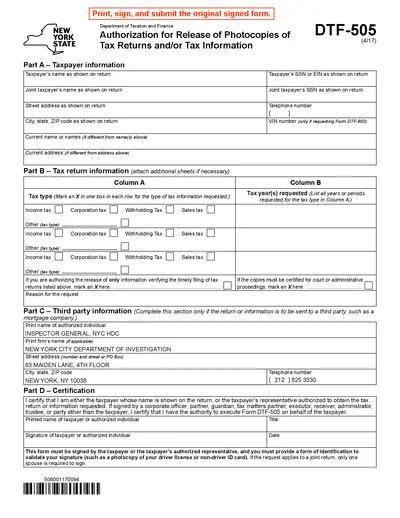

Authorization for Release of Tax Information - NY State

Authorization for Release of Photocopies of Tax Returns and/or Tax Information (DTF-505) from New York State. This form is used to request copies of e-filed or paper tax returns. Ensure to provide identification and processing fee.

Real Estate

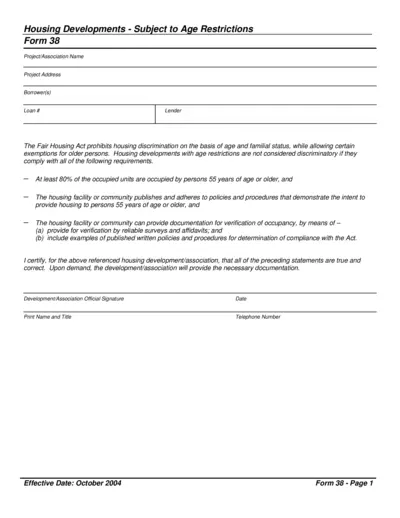

Age-Restricted Housing Developments Compliance Form

This form ensures that housing developments comply with legal age restrictions. It certifies occupancy by persons 55 years or older. Provides verification documentation.

Property Taxes

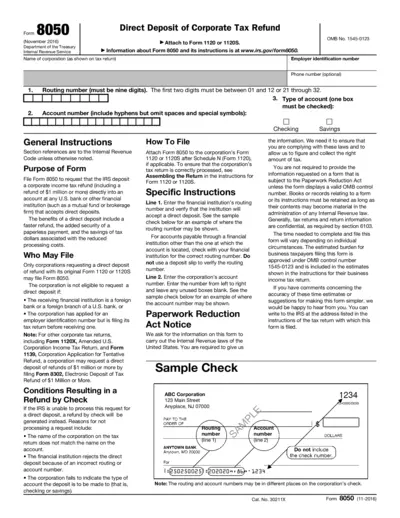

Direct Deposit of Corporate Tax Refund (Form 8050)

Form 8050 allows corporations to request a direct deposit of their corporate tax refund into any U.S. bank or financial institution. It provides instructions on how to complete the form and attach it to the corporate tax return. This form ensures a faster, more secure refund process.

Property Taxes

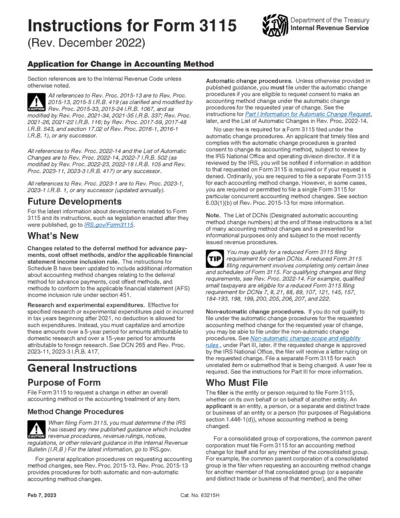

Instructions for Form 3115: Change in Accounting Method

This file provides detailed instructions for IRS Form 3115, which is used to request a change in accounting method. It includes guidance on the latest IRS regulations and procedures. Additionally, it offers specific steps for both automatic and non-automatic change requests.

Real Estate

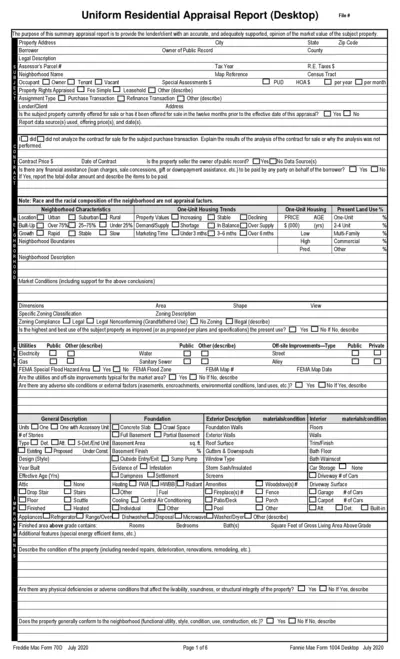

Uniform Residential Appraisal Report (Desktop)

The Uniform Residential Appraisal Report (Desktop) provides an accurate and adequately supported opinion of the market value of the subject property. This report is essential for lenders/clients needing a summary appraisal of a residential property. It includes details on property characteristics, neighborhood dynamics, and market trends.