Property Law Documents

Real Estate

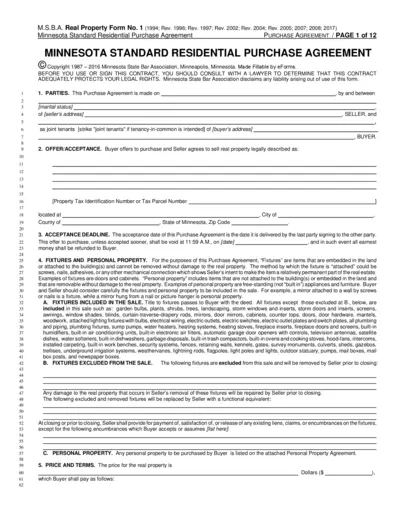

Minnesota Standard Residential Purchase Agreement

This document serves as a legally binding agreement between a buyer and seller for residential real estate transactions in Minnesota. It outlines the terms, conditions, and obligations of both parties involved in the purchase. Be sure to consult an attorney to ensure your rights are fully protected.

Property Taxes

New York State Nonobligated Spouse Allocation Form IT-280

The New York State Nonobligated Spouse Allocation Form IT-280 enables nonobligated spouses to allocate their income and tax withholdings correctly. This form helps protect your portion of a joint refund from being applied against debts solely owed by your spouse. It is essential for taxpayers looking to claim a refund while avoiding liability from their partner’s financial obligations.

Property Taxes

Tax Worksheet for Self-employed and Contractors

This tax worksheet is designed for self-employed individuals, independent contractors, and sole proprietors. It helps users accurately report their income and expenses to maximize deductions. Utilize this detailed guide to ensure every eligible expense is accounted for.

Property Taxes

Form 8936 Qualified Plug-in Electric Drive Vehicle Credit

Form 8936 is used to claim the Qualified Plug-in Electric Drive Motor Vehicle Credit. This form is essential for taxpayers who have purchased eligible electric vehicles. Ensure you follow the detailed instructions for accurate credit claims.

Property Taxes

Form 1042-T Instructions and Submission Guidelines

The Form 1042-T is used to transmit paper Forms 1042-S to the IRS. It provides essential guidelines to ensure accurate reporting of U.S. source income subject to withholding. This file is crucial for withholding agents managing tax responsibilities for foreign persons.

Property Taxes

Schedule K-3 Form 1065 Partner Information 2023

The Schedule K-3 is a tax form used by partnerships to report each partner's share of income, deductions, and credits. It is essential for partners to accurately reflect international tax information. This form facilitates compliance with tax regulations for the applicable tax year.

Property Taxes

West Virginia Sales and Use Tax Return Form

This file contains the West Virginia Sales and Use Tax Return form for individuals and businesses. It provides detailed instructions on how to report and remit sales tax. Ensure accurate completion to avoid issues with the State Tax Department.

Real Estate

Arizona General Warranty Deed for Real Property

The Arizona General Warranty Deed is a legal document that facilitates the transfer of property ownership. It provides a guarantee from the grantor to the grantee regarding clear title and rights. Essential for property transactions in Arizona.

Property Taxes

2022 California Form FTB 3586 Payment Voucher Instructions

The 2022 Instructions for Form FTB 3586 provide detailed guidelines for corporations and exempt organizations to remit payments. This form is essential for individuals with a tax balance due who have filed their tax return electronically. Familiarize yourself with the instructions to ensure correct completion and submission of the payment voucher.

Property Taxes

Form 1042 - Annual Withholding Tax Return IRS 2023

The Form 1042 is used to report and withhold taxes on U.S. source income paid to foreign persons. This annual return provides the IRS with the necessary information about withheld taxes. Ensure to follow the instructions provided to complete the form accurately.

Property Taxes

Instructions for Form 8023 Elections Under Section 338

Form 8023 is designed for corporations making qualified stock purchases to elect under Section 338. It outlines the procedures to follow and specifies who must file. Understanding the form's requirements is essential for compliance with IRS regulations.

Property Taxes

Form 8829 - Expenses for Business Use of Your Home

Form 8829 is used to calculate and deduct expenses for the business use of your home. This form is essential for self-employed individuals or those who run a business from home. Fill this out to maximize your tax deductions related to home office use.