Property Law Documents

Property Taxes

Instructions for Form 8829 Business Use of Home

This file provides comprehensive instructions on how to fill out Form 8829 for calculating expenses related to the business use of your home. It includes future developments, reminders about expired benefits, and specific guidelines for different types of users. Essential for business owners who want to maximize their tax deductions.

Real Estate

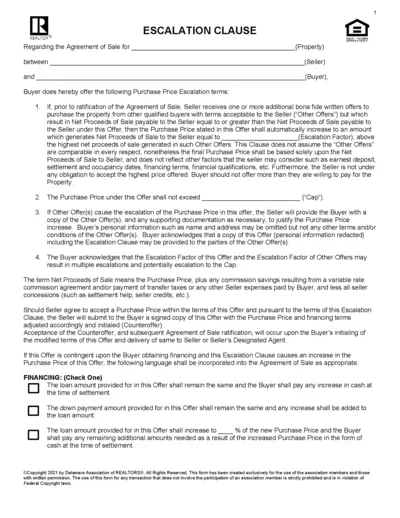

Agreement of Sale and Escalation Clause Template

This file contains an agreement of sale template with an escalation clause. It provides buyers and sellers with structured terms for real estate transactions. Utilize this customized document for seamless negotiations and professional transactions.

Real Estate

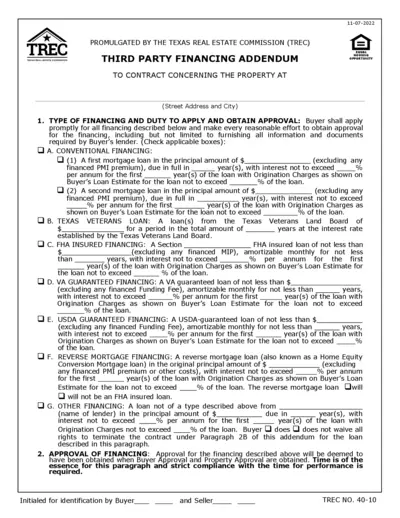

Texas Real Estate Commission Third Party Financing Addendum

This file contains important details and instructions for obtaining third party financing for real estate transactions in Texas. It outlines different financing options available to buyers, including conventional loans, FHA, VA, and USDA financing. The addendum ensures compliance with Texas real estate regulations and provides necessary buyer and seller approvals.

Property Taxes

New York State Nonresident Income Tax Return 2021

The New York State Nonresident and Part-Year Resident Income Tax Return IT-203 for the year 2021 provides essential instructions for filing. It assists nonresidents and part-year residents in accurately reporting their income and taxes owed. This form is critical for ensuring compliance with New York tax regulations.

Property Taxes

IRS Form 4562 Instructions for Depreciation and Amortization

This document provides comprehensive instructions for IRS Form 4562. It covers the necessary steps for depreciation and amortization claims. Essential for understanding recent updates and requirements for filing.

Property Taxes

VAT C4 Certificate for Input Tax Claims

This file is a VAT C4 certificate for input tax claims under the Haryana Value Added Tax Act. It is required to validate the tax paid on goods sold between VAT dealers. Properly filling out this form ensures compliance with tax regulations.

Property Taxes

2019 Estimated Tax for Individuals Form 1040-ES

The 2019 Form 1040-ES is used by individuals to calculate and pay estimated taxes. It is essential for those who have income not subject to withholding. This form helps taxpayers avoid penalties for underpayment of taxes.

Real Estate

Florida Land Trust and LLC's by Kevin Tacher

This file provides comprehensive insights on Florida Land Trusts and LLCs by best-selling author Kevin Tacher. Discover essential tips and legal considerations for real estate professionals and homeowners. Ensure informed real estate transactions and manage assets effectively.

Property Taxes

Form 2555 Instructions for Foreign Earned Income

Form 2555 helps U.S. citizens and resident aliens claim the foreign earned income exclusion. It provides guidelines for income taxes and identifies eligible taxpayers. Detailed instructions are included to assist in the filing process.

Property Taxes

Real Estate W-9 Instructions and Guidelines

This file provides essential instructions for filling out the W-9 form specifically for real estate transactions. Users will find steps to properly submit their completed forms along with guidelines on identification numbers. Essential for contractors, freelancers, and businesses to ensure compliance with IRS requirements.

Property Taxes

Form 6252 IRS Installment Sale Income Instructions

Form 6252 is used to report income from installment sales. This form is essential for taxpayers receiving payments after the sale year. Understand how to complete and submit it effectively.

Property Taxes

Kansas Partnership S Corporation Tax Form Instructions

This file provides essential information and instructions for filing the Kansas Statement of Partnership or S Corporation Tax. It outlines the required details for partnerships, S corporations, LLCs, and LLPs. Ensure accurate completion to avoid delays in processing.