Property Law Documents

Real Estate

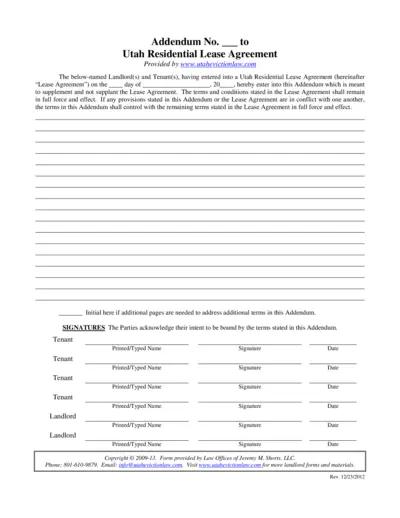

Utah Residential Lease Agreement Addendum

This addendum supplements the Utah Residential Lease Agreement between landlords and tenants. It outlines any additional terms or conditions agreed upon after the lease signing. Use this form to ensure compliance with lease modifications.

Property Taxes

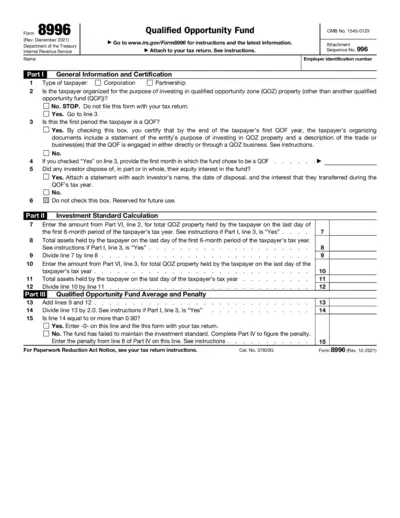

Form 8996 Instructions for Qualified Opportunity Fund

Form 8996 is used to certify a Qualified Opportunity Fund (QOF). Properly filled out, this form helps in tax benefits related to investments in Opportunity Zones. Ensure to follow the guidelines provided to maintain compliance.

Property Taxes

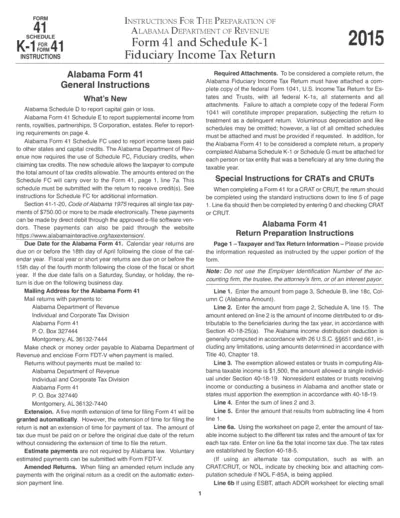

Alabama Form 41 Instructions and Schedule K-1 Details

This file provides comprehensive instructions for completing the Alabama Form 41 and its associated Schedules. It covers submission guidelines, important dates, and the necessary attachments required for a successful filing. Designed for fiduciaries and tax professionals, this guide aims to simplify the preparation process.

Real Estate

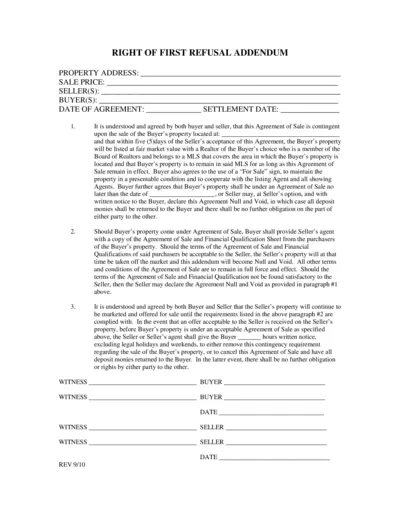

Right of First Refusal Agreement Instructions

This document outlines the Right of First Refusal Agreement between buyers and sellers. It details the contingency of sale based on another property's status. This file is essential for parties involved in property transactions requiring this agreement.

Real Estate

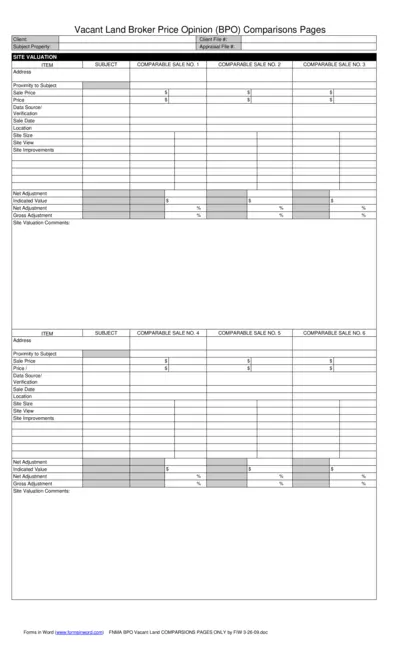

Vacant Land Broker Price Opinion Comparisons

This document provides detailed comparisons for vacant land broker price opinions. It includes essential information on comparable sales, adjustments, and valuation. Useful for real estate professionals and appraisers.

Property Taxes

Instructions for Form 8960 - Net Investment Income Tax

This document provides detailed instructions for completing Form 8960. It outlines the process for calculating Net Investment Income Tax for individuals, estates, and trusts. Users can find necessary definitions, filing requirements, and key updates within the document.

Property Taxes

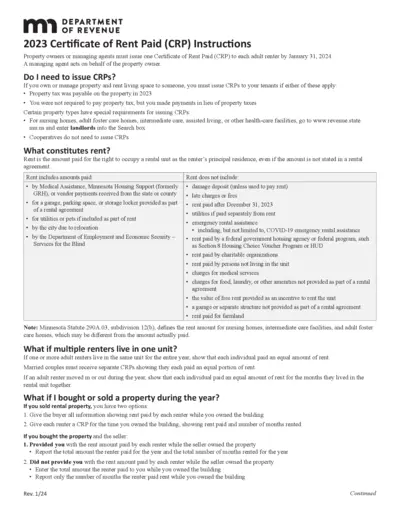

2023 Certificate of Rent Paid Instructions

The 2023 Certificate of Rent Paid (CRP) Instructions provide essential information for property owners and managers on issuing CRPs to tenants by January 31, 2024. It details the conditions under which CRPs are required and guidelines for filling them out accurately. This document is crucial for ensuring compliance with Minnesota state requirements regarding rental properties.

Property Taxes

IRS Form 2555-EZ Foreign Earned Income Exclusion

Form 2555-EZ allows U.S. citizens to exclude foreign earned income. This form helps in avoiding double taxation for individuals working abroad. Proper completion is essential for accurate tax reporting.

Property Taxes

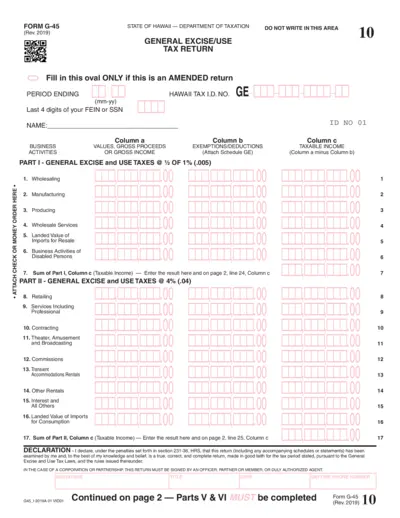

Hawaii Department of Taxation Form G-45 Instructions

This file contains important instructions and details for filling out Form G-45, which is the General Excise/Use Tax return for businesses in Hawaii. It provides guidelines for reporting gross income and calculating taxes owed. Users are encouraged to review this document carefully to ensure compliance with state tax requirements.

Property Taxes

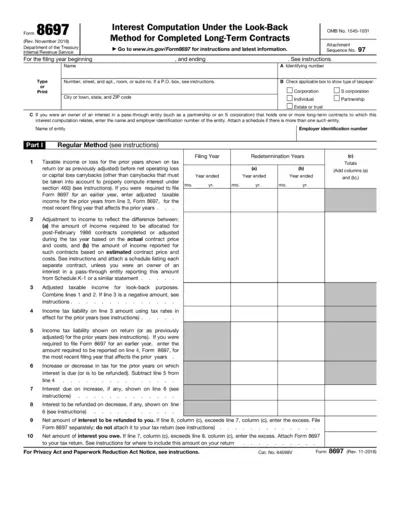

Interest Computation Look-Back Method for Contracts

Form 8697 is used for computing interest under the look-back method for completed long-term contracts. It is crucial for taxpayers involved in long-term contracts to accurately report their tax liability. This form ensures proper allocation of income and consideration of adjustments for the prior years.

Property Taxes

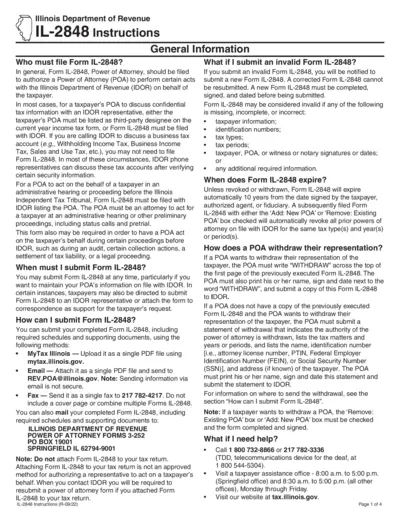

IL-2848 Power of Attorney Instructions for Illinois

Form IL-2848 provides guidance for taxpayers in Illinois to authorize a Power of Attorney. This form is essential for allowing your representative to act on your behalf for various tax matters. Proper submission ensures compliance and expedites communication with the Illinois Department of Revenue.

Property Taxes

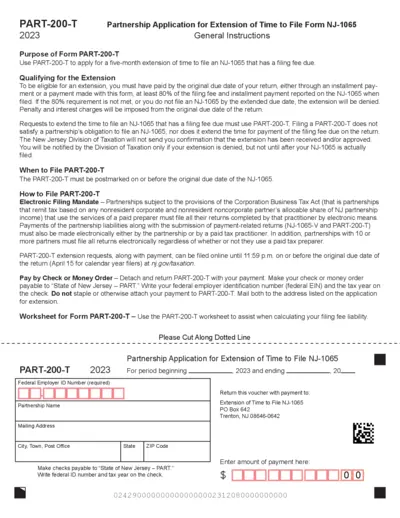

NJ Partnership Extension Application PART-200-T

The PART-200-T form is used for applying for a five-month extension to file the NJ-1065. This extension allows partnerships to submit their returns later while managing filing fees. Failure to meet specific requirements could lead to penalties.