Property Law Documents

Property Taxes

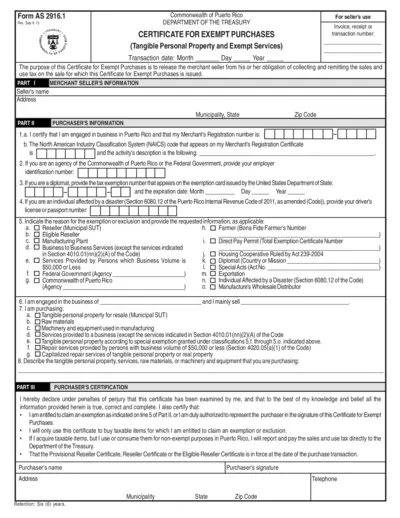

Puerto Rico Exempt Purchase Certificate

This file provides a Certificate for Exempt Purchases in Puerto Rico, allowing qualifying purchasers to exempt sales tax. Suitable for registered merchants and agencies, it details necessary information for tax exemption. Complete the form accurately to ensure compliance with Puerto Rican tax regulations.

Real Estate

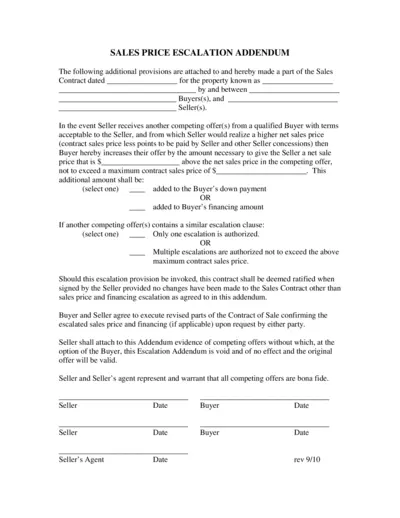

Sales Price Escalation Addendum for Real Estate

This Sales Price Escalation Addendum provides detailed provisions for buyers and sellers in real estate transactions. It allows buyers to increase their offers based on competing bids. Ideal for real estate professionals and buyers looking to enhance their offers.

Property Taxes

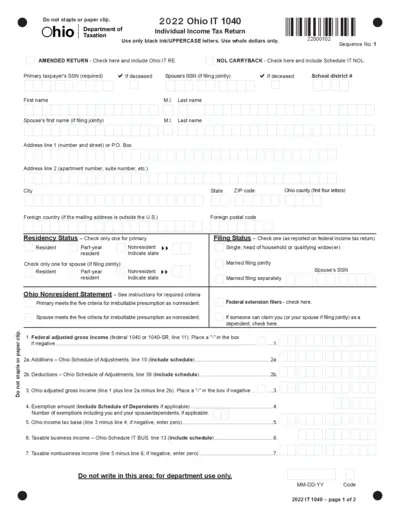

2022 Ohio IT 1040 Individual Income Tax Return

The 2022 Ohio IT 1040 is essential for residents filing their individual income taxes. It provides guidance on forms and instructions for various tax situations. Complete this form accurately to ensure compliance and avoid penalties.

Property Taxes

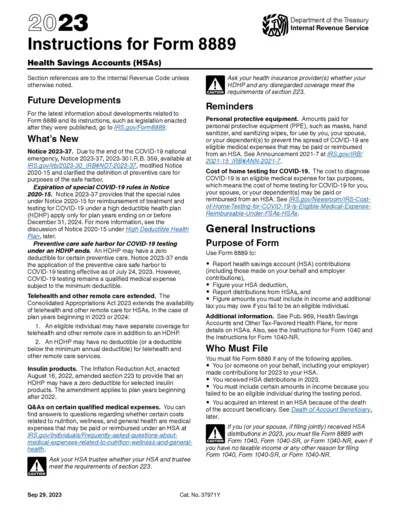

Instructions for Form 8889 Health Savings Accounts

This document provides vital instructions on filling out Form 8889, which is used for Health Savings Accounts (HSAs). It explains eligibility, contributions, and distribution reporting. This is essential for taxpayers managing their HSAs.

Property Taxes

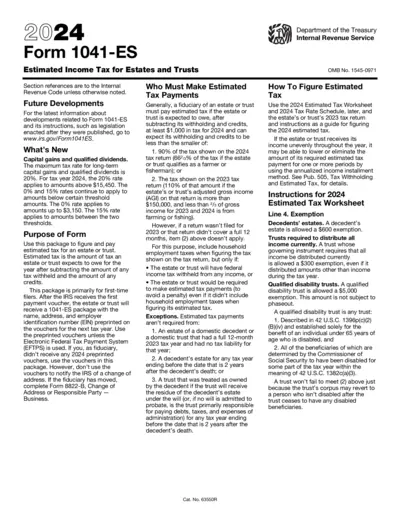

2024 Form 1041-ES Estimated Income Tax Instructions

This document provides essential instructions for filing Form 1041-ES, the Estimated Income Tax for Estates and Trusts for the year 2024. It details estimated tax payment requirements, filing deadlines, and important exemptions. Perfect for fiduciaries managing estates or trusts.

Property Taxes

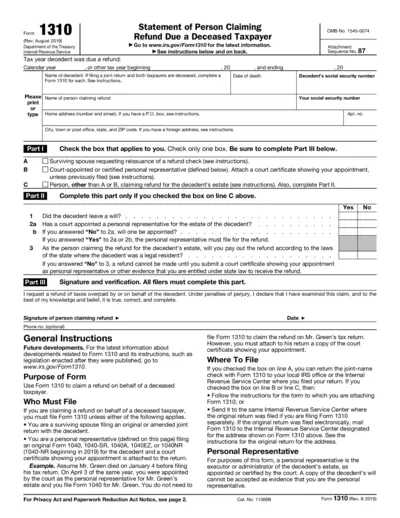

IRS Form 1310 Claim Refund Deceased Taxpayer

IRS Form 1310 allows individuals to claim a tax refund on behalf of a deceased taxpayer. It is essential for personal representatives and surviving spouses to ensure proper execution. This form is vital for managing estate taxes and refunds efficiently.

Real Estate

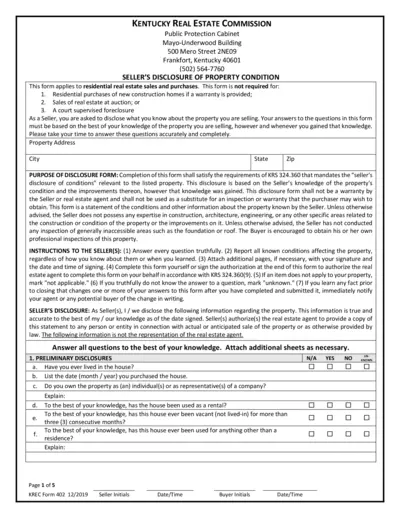

Kentucky Seller's Disclosure of Property Condition Form

This file is the Seller's Disclosure of Property Condition form for Kentucky real estate transactions. It provides important details about property conditions and seller disclosures. Accurate completion of this form helps facilitate the sale process and protects both buyers and sellers.

Real Estate

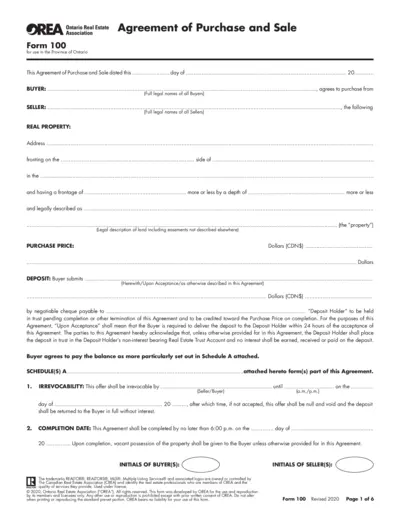

Ontario Real Estate Agreement of Purchase and Sale Form

This file provides the official Agreement of Purchase and Sale for real estate transactions in Ontario. It includes necessary details for buyers and sellers to ensure a legal and binding sale process. Essential for anyone involved in property transactions in Ontario, this form streamlines legal agreements.

Property Taxes

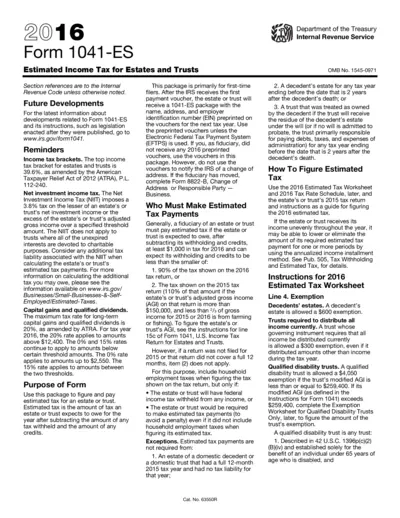

Form 1041-ES Estimated Income Tax for Estates

This file provides essential instructions and details on filing estimated tax payments for estates and trusts. It outlines the requirements and guidelines necessary for compliance. Users can benefit from understanding the payment schedules and exemptions applicable to their estates or trusts.

Property Taxes

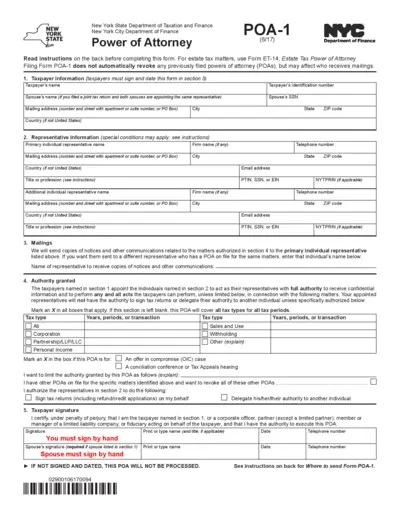

New York State Power of Attorney Form Instructions

This file provides detailed instructions on how to complete the New York State Power of Attorney Form POA-1. It includes information about the necessary taxpayer information, representative information, and filing instructions. Ensure compliance with tax obligations and authority granted.

Real Estate

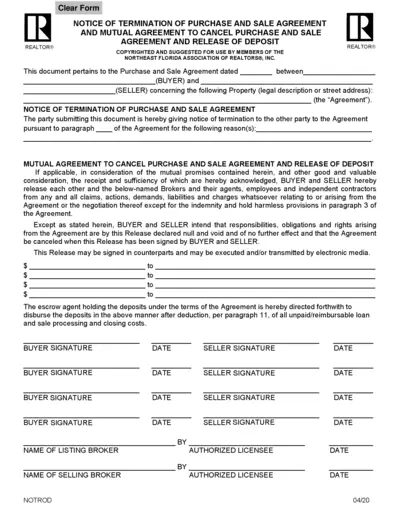

Notice of Termination of Purchase Agreement

This form serves as a formal notice for the termination of a purchase and sale agreement. It outlines the mutual agreement between the parties involved to release the deposit. Users can use this document to ensure that all parties acknowledge the cancellation properly.

Property Taxes

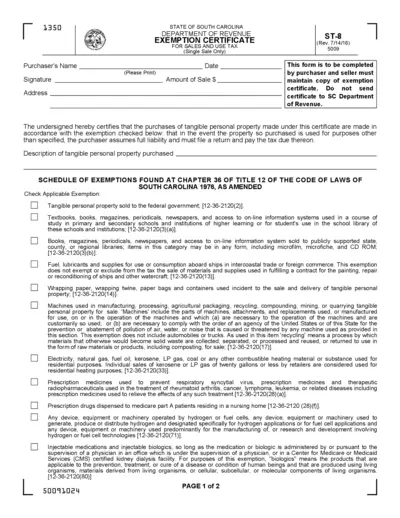

South Carolina Sales and Use Tax Exemption Certificate

The South Carolina Sales and Use Tax Exemption Certificate is essential for individuals and organizations to claim tax exemptions on purchases. This document outlines the necessary steps and exemptions applicable under South Carolina state law. Completing this certificate accurately ensures compliance and facilitates tax savings.