Property Law Documents

Property Taxes

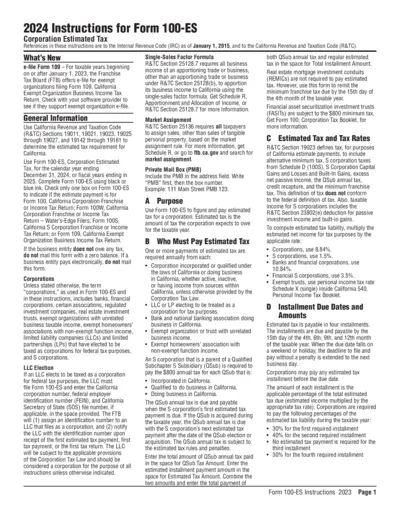

2024 Corporation Estimated Tax Instructions

This document provides essential instructions for corporations to calculate and submit estimated tax in California for 2024. It details requirements, payment methods, and important regulatory information. Businesses should use this guide to ensure compliance with state tax laws.

Zoning Regulations

USAREC Regulation 601-37 Army Medical Recruiting Program

This document outlines the USAREC Regulation 601-37, detailing policies and procedures for Army Medical Recruiting. It includes eligibility criteria and updates regarding various forms and requirements. Aimed at military personnel, it serves as a guideline for processing applications efficiently.

Real Estate

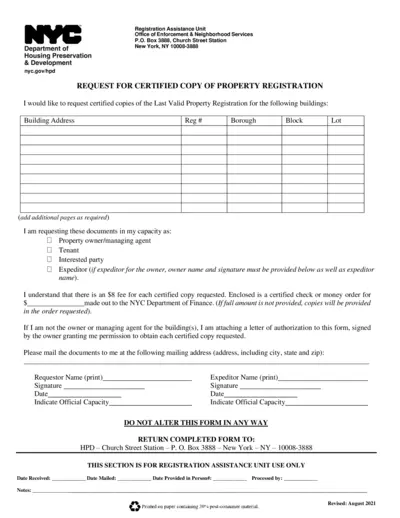

Request Certified Copy of NYC Property Registration

This form allows individuals to request certified copies of property registrations in New York City. It is essential for owners, tenants, and interested parties to obtain valid property documents. Ensure all information is accurately filled out to facilitate the request process.

Property Taxes

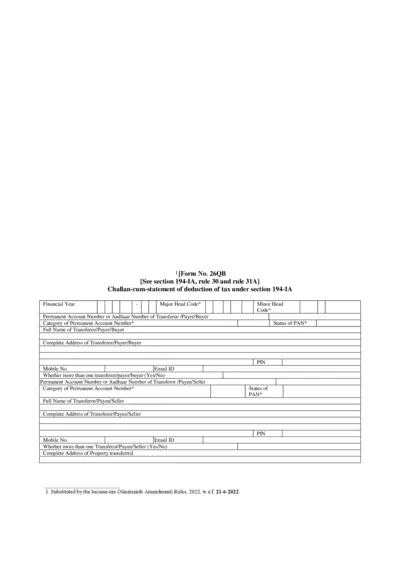

Form 26QB - Challan for Tax Deduction Under 194-IA

Form 26QB is a Challan-cum-statement for tax deduction under section 194-IA. It is crucial for individuals involved in real estate transactions for tax compliance. The form captures essential details regarding property transfer and tax deductions.

Real Estate

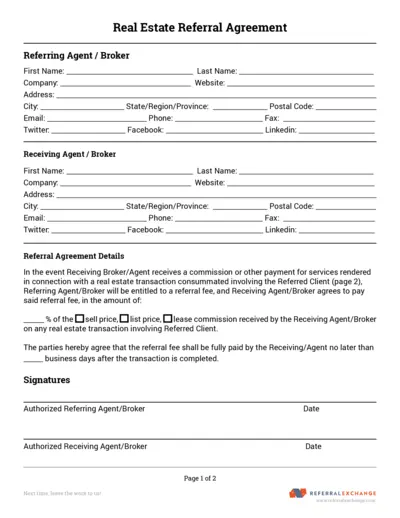

Real Estate Referral Agreement Form

The Real Estate Referral Agreement outlines the terms between agents and brokers for referrals. It includes sections for client information and details about the referral fee. This form is essential for real estate transactions involving referred clients.

Real Estate

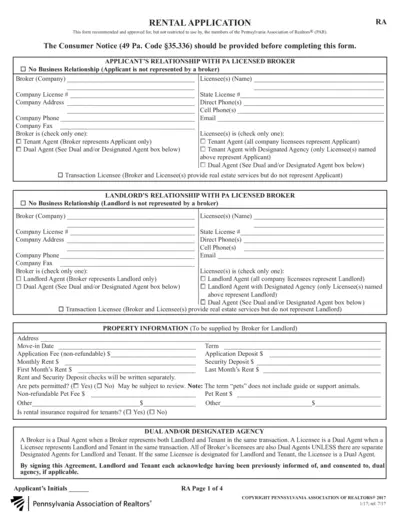

Rental Application Form for Pennsylvania Residents

This rental application form is designed for individuals applying to rent a property in Pennsylvania. It includes essential information such as applicant details, landlord information, and property specifics. Ensure that all sections are completed accurately for a smooth application process.

Real Estate

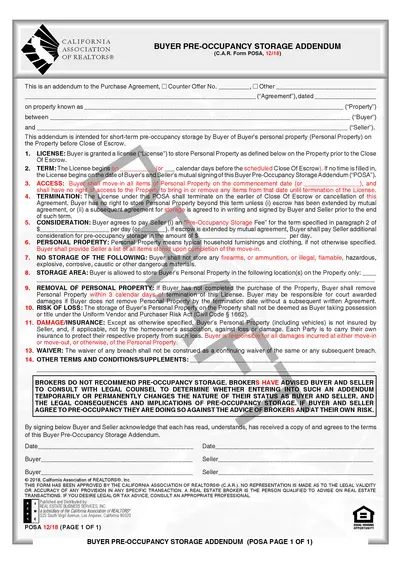

California REALTORS Buyer Pre-Occupancy Agreement

This form provides essential guidelines for buyers regarding pre-occupancy storage of personal property before closing. It outlines terms including license, access, and responsibilities of both parties. Ideal for buyers looking to store belongings safely before closing on a property.

Property Taxes

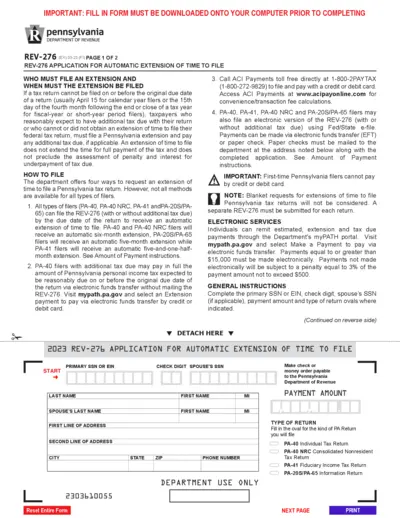

Application for Automatic Extension to File PA Tax

The REV-276 form is essential for taxpayers in Pennsylvania who need an extension to file their tax returns. This document outlines the necessary steps for filing and the associated deadlines. Ensure compliance with state regulations by completing and submitting this application.

Real Estate

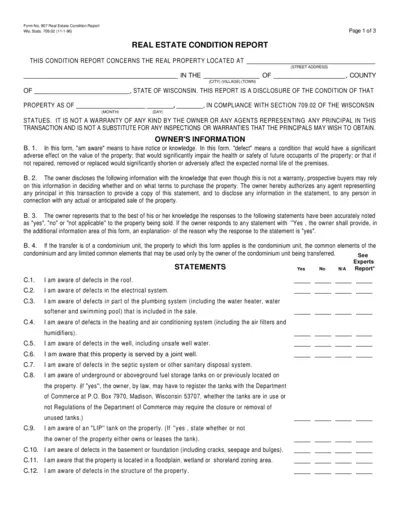

Wisconsin Real Estate Condition Report for Property

This document is the Wisconsin Real Estate Condition Report, providing essential information about the condition of a property. It is a legal disclosure that must be completed by the property owner. Understanding this report is critical for potential buyers to make informed decisions.

Real Estate

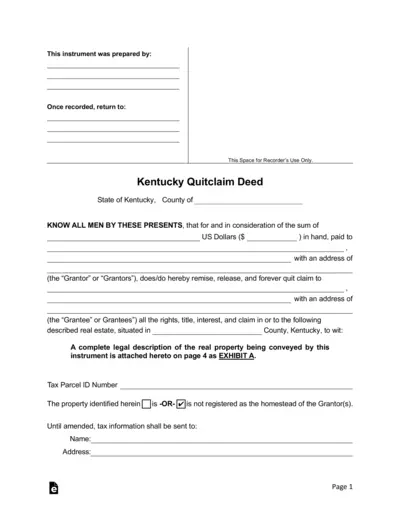

Kentucky Quitclaim Deed Document Overview

This quitclaim deed template is essential for transferring property ownership in Kentucky. It provides a straightforward format for grantors and grantees to complete the transaction securely. Use this reliable resource to ensure all legal requirements are met during property transfers.

Property Taxes

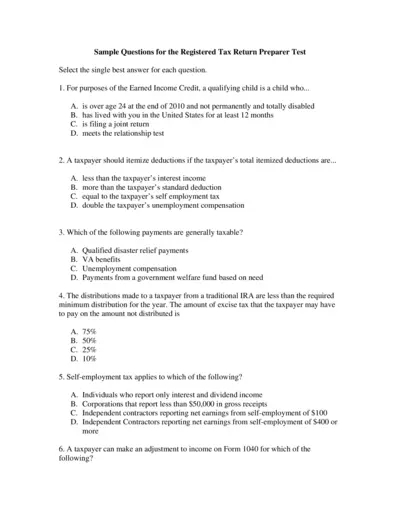

Tax Return Preparer Test Question Sample Guide

This file contains sample questions for the Registered Tax Return Preparer Test. It provides insights into the types of questions that may appear in the actual test, helping candidates prepare effectively. Utilize this resource to enhance your understanding of key tax concepts.

Property Taxes

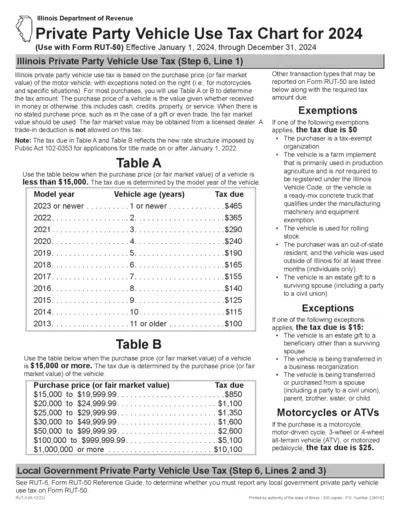

Illinois Vehicle Use Tax Chart for 2024

This document details the Illinois Private Party Vehicle Use Tax for 2024, outlining tax rates based on vehicle purchase prices. It provides guidance on filling out Form RUT-50. Essential for both consumers and businesses needing to understand vehicle use tax obligations.