Property Law Documents

Real Estate

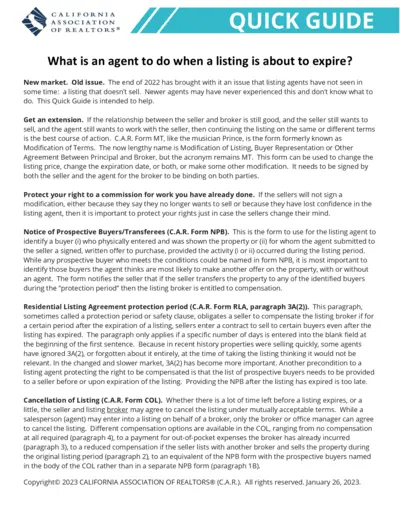

California REALTORS Quick Guide for Listing Agents

This guide provides essential instructions for listing agents on how to manage property listings effectively. It covers strategies to handle expiring listings and protect commission rights. Learn how to modify terms and utilize necessary forms to ensure a successful sale.

Real Estate

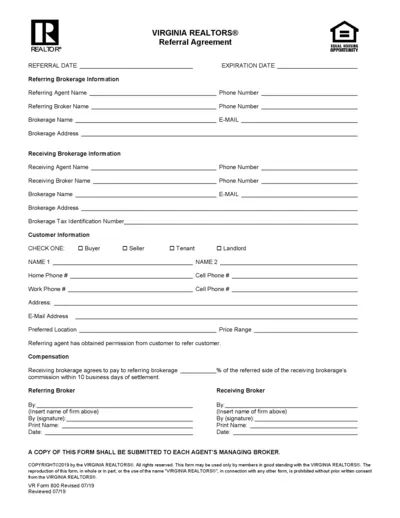

Virginia REALTORS® Referral Agreement Form

This is the official referral agreement form used by Virginia REALTORS®. It details responsibilities and compensation for referring agents. All parties involved in real estate transactions will benefit from this clear and organized agreement.

Property Taxes

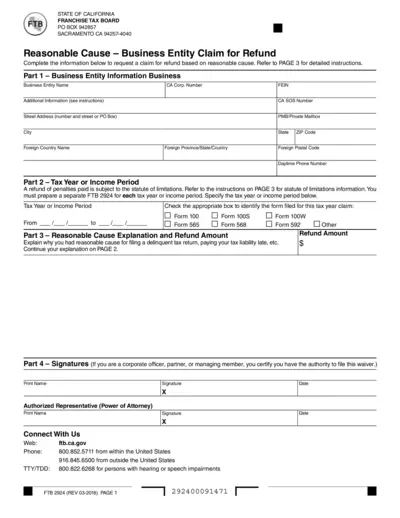

California Franchise Tax Board Refund Claim

This file offers a claim form for refund based on reasonable cause for business entities. It provides guidelines on filing and necessary details. Ensure to carefully follow the instructions for a successful submission.

Real Estate

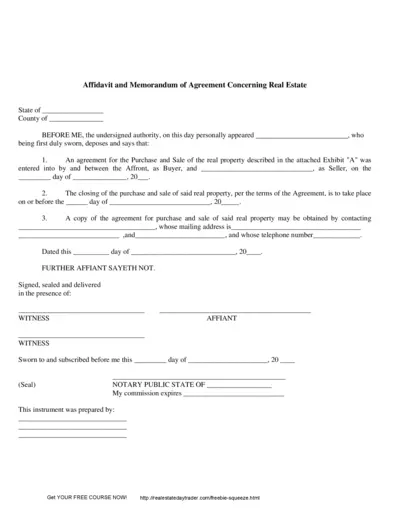

Affidavit and Memorandum of Agreement Concerning Real Estate

This document serves as an official record for an agreement regarding the purchase and sale of real estate. It outlines the key details and instructions necessary for both parties involved in the transaction. Ideal for buyers and sellers looking to formalize their property agreements.

Property Taxes

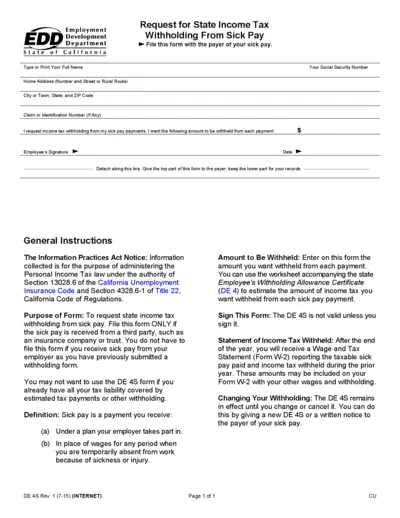

Request for State Income Tax Withholding from Sick Pay

This form allows individuals to request state income tax withholding from their sick pay. It is used in cases when sick pay is received from a third party, such as an insurance company. By submitting this request, you ensure the appropriate amount of tax is withheld from your payments.

Property Taxes

Instructions for Form IT-2105.9 Underpayment Tax

This file contains detailed instructions for individuals and fiduciaries on how to handle underpayment of estimated tax for New York State. It outlines important changes in tax rates and methods for calculating penalties. Users will find guidance on who must pay penalties and how to avoid them.

Zoning Regulations

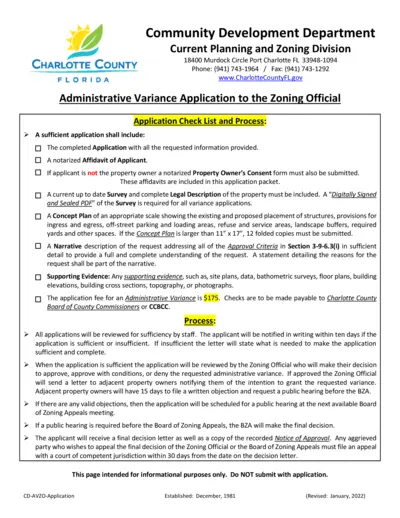

Charlotte County FL Administrative Variance Application

This file contains the Administrative Variance Application for Charlotte County, Florida. It provides detailed instructions for applicants, including necessary forms and criteria for approval. Ideal for property owners and agents seeking zoning variances.

Property Taxes

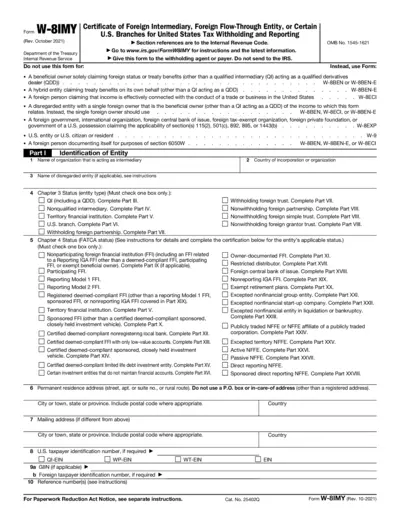

W-8IMY: Certificate of Foreign Intermediary Instructions

The W-8IMY form is used to certify the status of foreign intermediaries for U.S. tax withholding and reporting. It's crucial for entities acting on behalf of foreign owners to ensure proper tax treatment. This form must be submitted to the withholding agent, not to the IRS.

Property Taxes

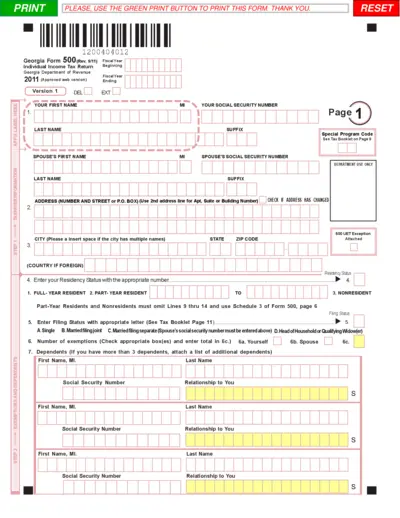

Georgia Individual Income Tax Return Form 500

The Georgia Form 500 is the state's official Individual Income Tax Return form for the fiscal year 2011. This form is essential for individual taxpayers to report their income and calculate their tax liability. It ensures compliance with Georgia tax regulations while maximizing eligible deductions.

Property Taxes

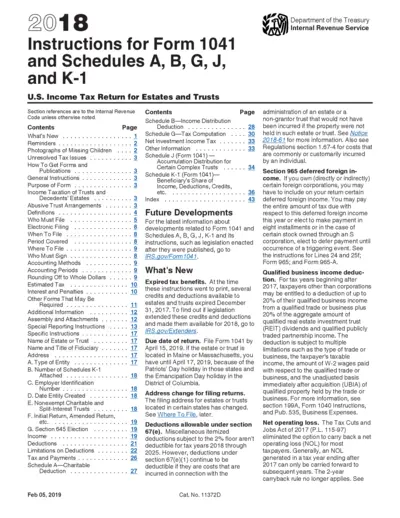

Instructions for Form 1041 and Related Schedules

This file provides essential instructions for filing Form 1041, U.S. Income Tax Return for Estates and Trusts. It covers important information regarding income, deductions, and necessary schedules. Users will benefit from a comprehensive guide to ensure accurate and timely submissions.

Property Taxes

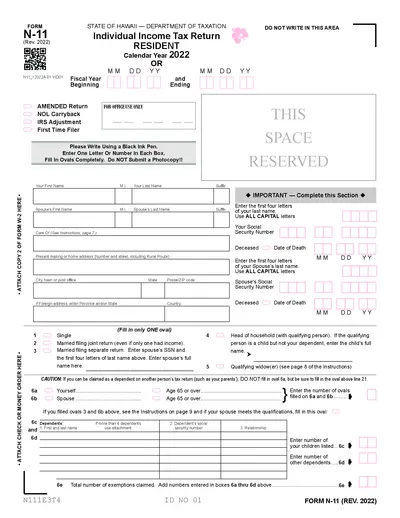

Hawaii Individual Income Tax Return N-11 Form 2022

The N-11 form is used for filing individual income taxes in Hawaii. It is essential for residents to accurately report their income for tax purposes. Ensure to complete the form fully to avoid penalties.

Property Taxes

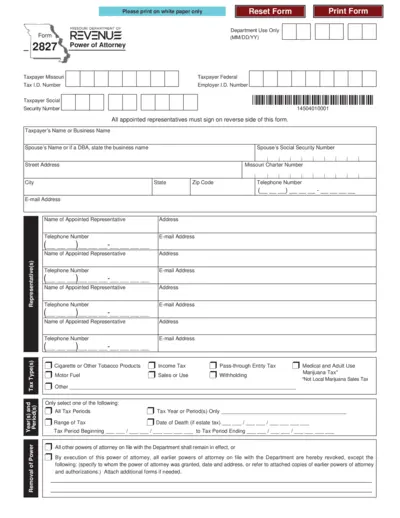

Missouri Power of Attorney Form 2827 Instructions

This file contains the Missouri Form 2827 for Power of Attorney. It is essential for taxpayers in Missouri to designate representatives for tax matters. Follow the detailed instructions provided to fill out and submit the form correctly.