Property Law Documents

Real Estate

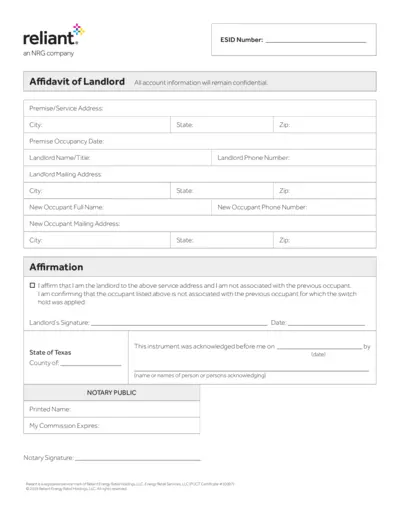

Affidavit of Landlord for Texas Residents

This form is an affidavit for landlords in Texas to affirm their relationship to tenants. It ensures that account information remains confidential. Landlords must provide all necessary details to complete the occupancy change.

Real Estate

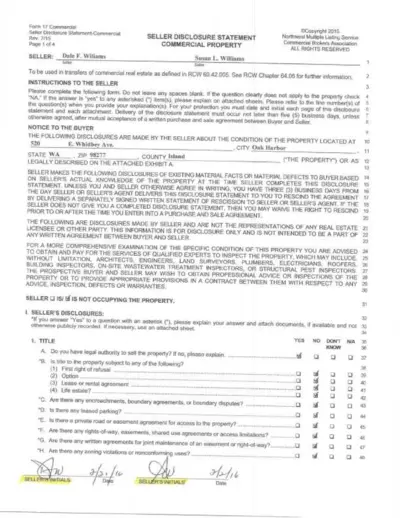

Seller Disclosure Statement for Commercial Property

This file is a Seller Disclosure Statement specifically for commercial properties. It contains essential information about the condition of the property that every prospective buyer should know. Proper completion of this form is crucial for both legal compliance and transparency in real estate transactions.

Property Taxes

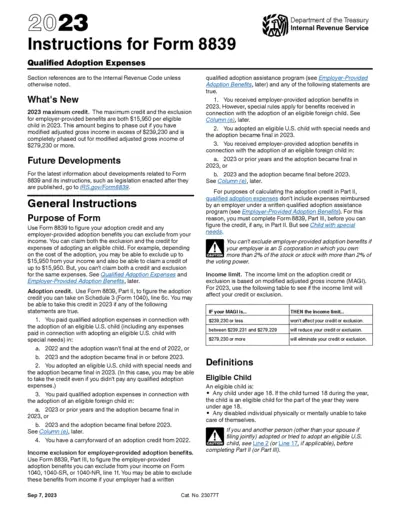

Instructions for Form 8839 on Qualified Adoption Expenses

This document provides comprehensive instructions for Form 8839, which is used to claim adoption credits and benefits. It outlines eligible expenses and income exclusion criteria, ensuring users understand the requirements for claiming credits. A crucial resource for individuals adopting an eligible child in 2023.

Real Estate

Sale by Offer and Acceptance in Western Australia

This brochure offers a comprehensive guide to the process of buying and selling properties in Western Australia. It outlines the essential steps involved in the offer and acceptance method of real estate transactions. Understanding this process is crucial for prospective buyers and sellers to navigate property transactions effectively.

Property Taxes

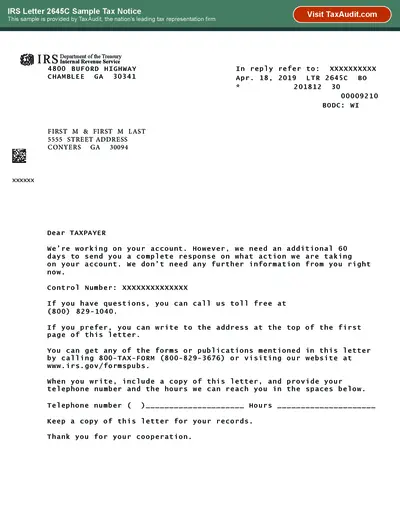

IRS Letter 2645C Sample Tax Notice for Tax Audit

This file contains a sample IRS Letter 2645C tax notice. It serves as a reference for individuals receiving similar notices from the IRS. The document includes important instructions and contact information relevant to tax inquiries.

Real Estate

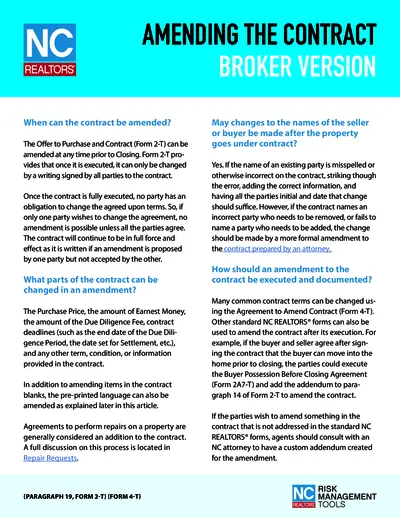

NC REALTORS Contract Amendments Guidelines

This document outlines how to amend contracts in real estate transactions in North Carolina. It provides essential information on executing amendments and possible changes to a contract. Ideal for real estate professionals needing to navigate contract modifications effectively.

Real Estate

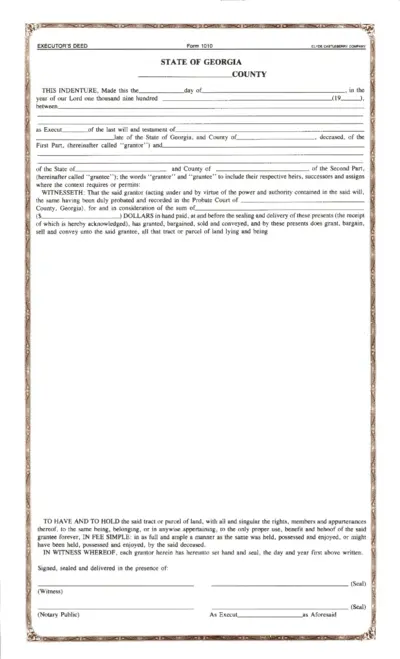

Executor's Deed Template Georgia Form 1010

This Executor's Deed, Form 1010 is a legal document used in Georgia for property transfer after a person's death. It ensures the proper conveyance of real estate from the deceased's estate to the heirs or named beneficiaries. This document is essential for executing the last will and testament of the deceased.

Property Taxes

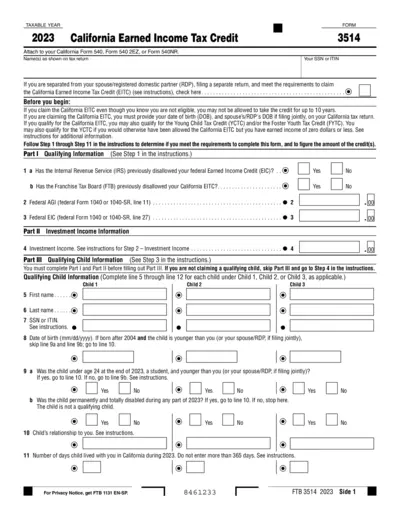

California Earned Income Tax Credit Form 3514 Guide

This document provides essential information about the California Earned Income Tax Credit for the year 2023. It includes instructions on eligibility and how to fill out the EITC application form. There are also guidelines for important tax credits related to children and foster youth.

Property Taxes

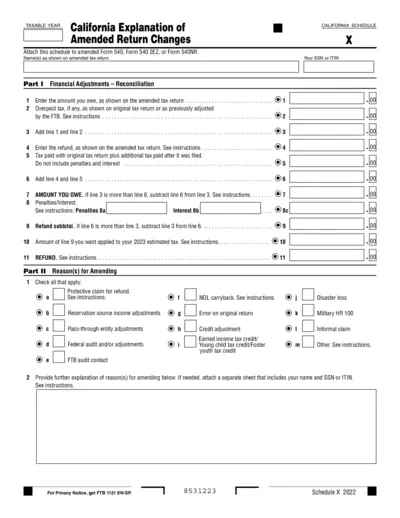

California Amended Tax Return Schedule 2022

This file contains the California Schedule for Amended Tax Returns. It provides detailed instructions for financial adjustments and reconciliation. Use this schedule when updating your tax returns.

Real Estate

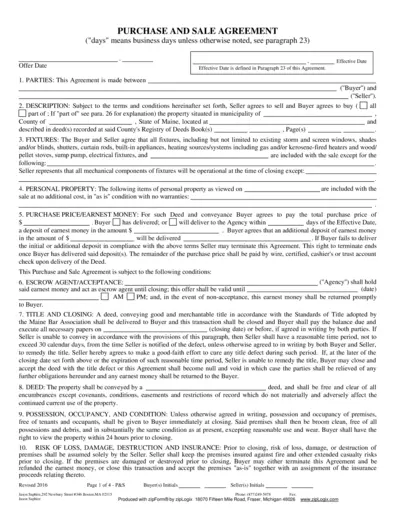

Purchase and Sale Agreement Template Maine

This Purchase and Sale Agreement template outlines the terms and conditions between a buyer and seller for a property transaction in Maine. It includes essential sections such as parties involved, purchase price, and conditions for sale. Users can utilize this file to ensure a clear and legally compliant agreement standard for real estate transactions.

Property Taxes

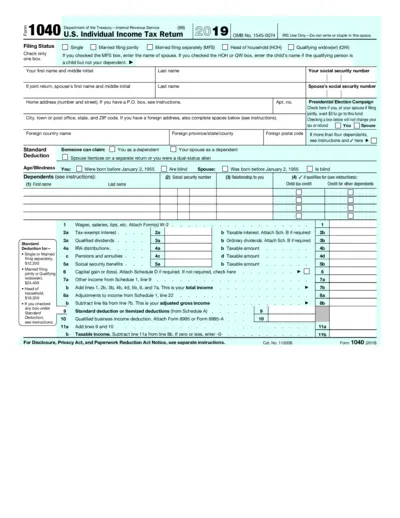

U.S. Individual Income Tax Return Form 1040 (2019)

The U.S. Individual Income Tax Return Form 1040 for 2019 is essential for individuals filing their annual income taxes. This IRS form requires personal information, income details, and deductions for accurate tax assessment. Use this guide to understand how to complete and submit the form effectively.

Property Taxes

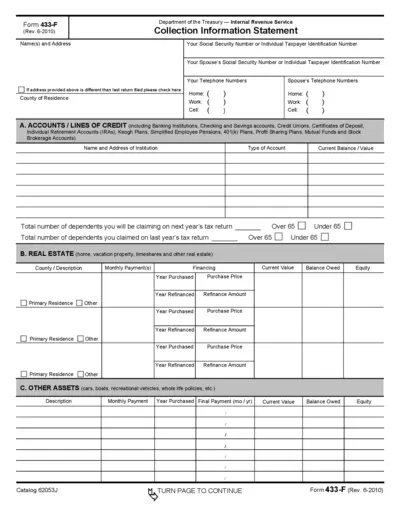

Form 433-F Collection Information Statement

Form 433-F is a crucial document for individuals seeking an installment agreement with the IRS. This form gathers financial information to assess payment capability. Complete the form accurately to facilitate your financial negotiations with the IRS.