Property Law Documents

Real Estate

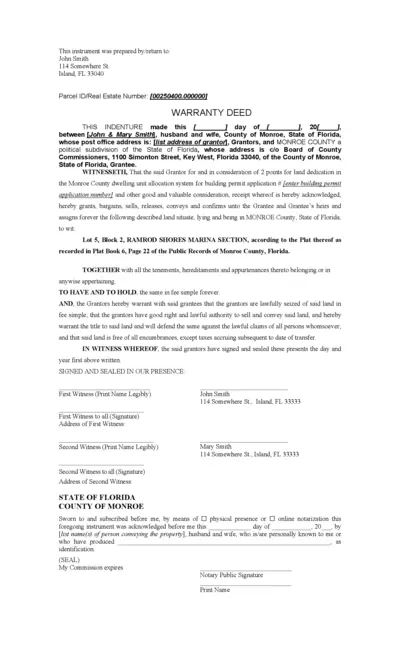

WARRANTY DEED FOR MONROE COUNTY FLORIDA PROPERTY

This warranty deed is a legal document recording the transfer of property ownership in Monroe County, Florida. It includes essential details such as grantor and grantee information, property description, and signatures. Ideal for those involved in real estate transactions in Florida.

Property Taxes

IRS Form 8829: Business Use of Your Home Instructions

This form provides instructions for calculating expenses related to the business use of your home. It is essential for self-employed individuals who want to deduct home office expenses. Complete this form alongside Schedule C (Form 1040) for accurate reporting.

Property Taxes

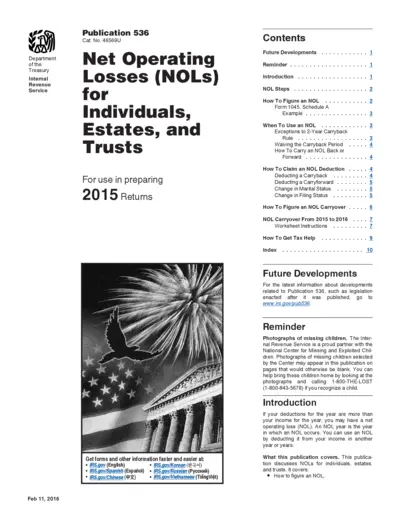

Net Operating Losses (NOLs) for Tax Years 2015

This document provides guidelines on net operating losses (NOLs) applicable to individuals, estates, and trusts. It offers detailed instructions on how to figure, claim, and carry over NOLs for tax purposes. Essential for understanding your tax obligations and maximizing deductions.

Property Taxes

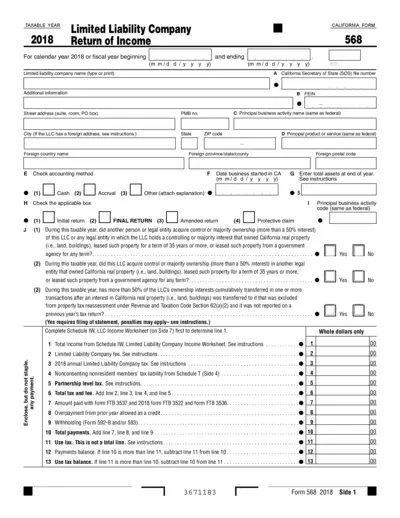

California LLC Tax Return Form 568 Instructions

The California Form 568 is the official return of income for Limited Liability Companies (LLCs). It provides essential information for tax filing for the taxable year 2018. The form includes details on income, assets, and tax liabilities.

Property Taxes

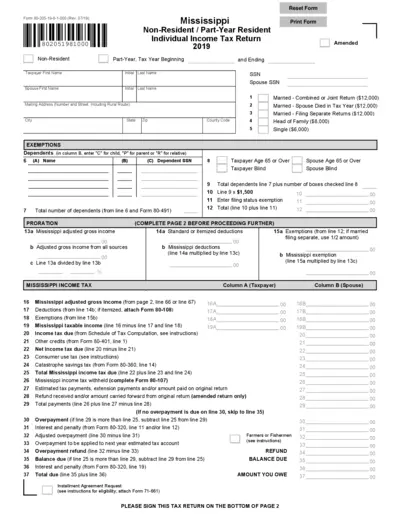

Mississippi Non-Resident Individual Income Tax Return

This file contains the form 80-205 for filing the Mississippi non-resident or part-year resident individual income tax return for 2019. It provides sections for reporting income, deductions, exemptions, and determining tax liabilities. Use this file to ensure compliance with state tax obligations.

Property Taxes

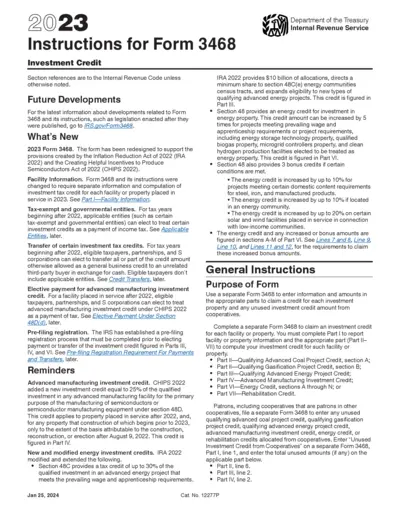

Instructions for Form 3468 Investment Credit

This document provides essential instructions and guidelines for taxpayers regarding Form 3468, which pertains to the Investment Credit. Users will find insights into eligibility, changes, and the claiming process for investment credits introduced by the Inflation Reduction Act and CHIPS Act. It's an invaluable resource for individuals and businesses looking to navigate the complexities of tax credits associated with investments.

Property Taxes

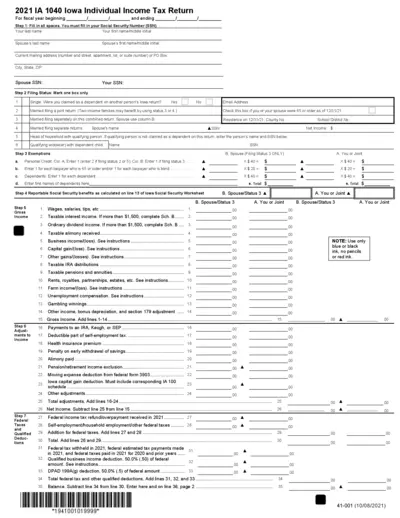

2021 Iowa Individual Income Tax Return Form IA 1040

The 2021 IA 1040 is the Iowa Individual Income Tax Return required for filing your state tax. This form is essential for residents of Iowa to report their income and calculate their tax liability. Follow the instructions to ensure accurate completion and submission.

Real Estate

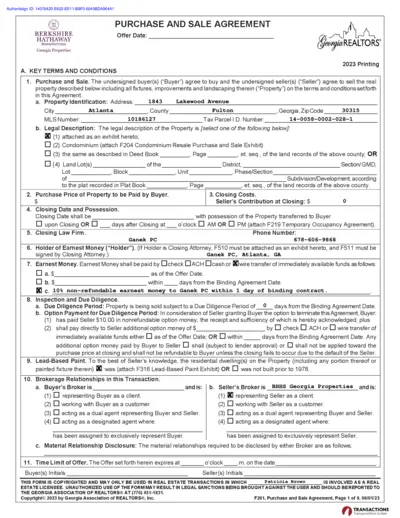

Georgia Purchase and Sale Agreement Document

This document outlines the purchase and sale agreement for real estate transactions in Georgia. It details key terms, conditions, and responsibilities for both buyers and sellers. Essential for anyone looking to engage in real estate transactions within the state.

Real Estate

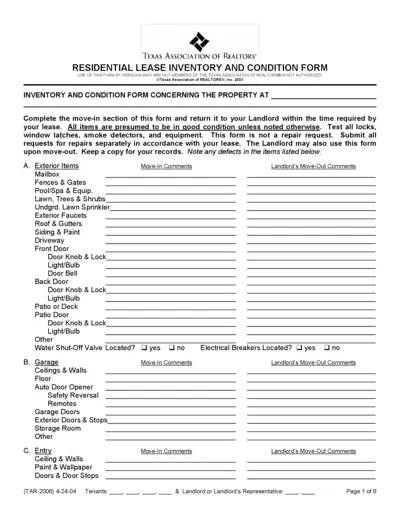

Texas Association of Realtors Residential Lease Form

This Residential Lease Inventory and Condition Form is essential for landlords and tenants in Texas. It helps document the condition of the property at move-in and move-out. Proper usage ensures smooth communication about repairs and maintenance.

Property Taxes

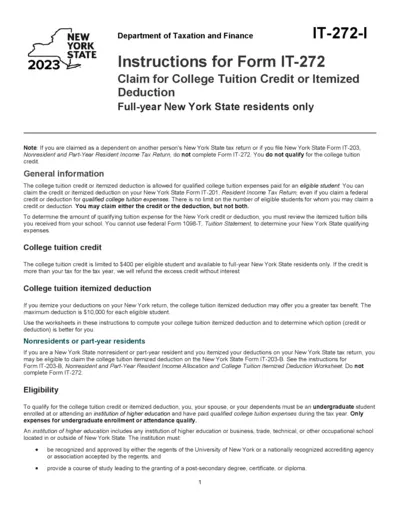

Instructions for New York College Tuition Credit

This document provides detailed instructions for New York State residents on claiming the College Tuition Credit or Itemized Deduction. It outlines eligibility criteria, required forms, and guidance for calculating the credit or deduction. Ensure you follow these guidelines precisely to maximize your tax benefits.

Real Estate

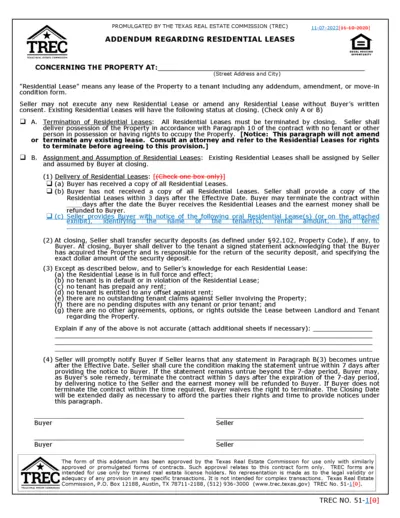

Texas Real Estate Commission Residential Lease Addendum

This document includes essential information about Residential Leases governed by the Texas Real Estate Commission. It provides instructions for buyers and sellers regarding the termination and assignment of existing leases. Ideal for anyone involved in real estate transactions in Texas.

Property Taxes

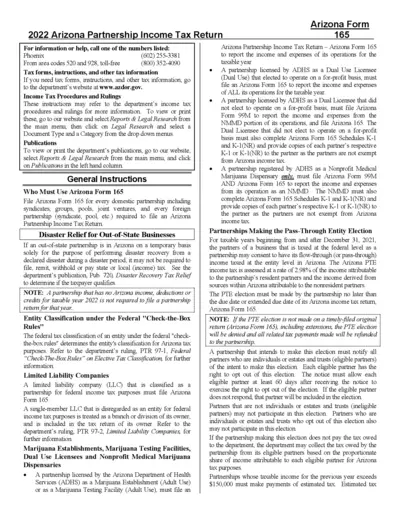

2022 Arizona Partnership Income Tax Return Form 165

The 2022 Arizona Partnership Income Tax Return Form 165 is essential for domestic partnerships to report their income. Properly filling this form ensures compliance with Arizona tax laws. Follow the guidelines closely to complete your submission.